That is tied to the dopamine levels in the pelvic wall. Women who rarely get their perineum in the sun suffer from this due to altered fiber type in the pelvic muscles as the video above show. This effect is mediated by dopamine changes in the muscles. Dopamine is made by aromatic amino acids which absorb solar energy in the UV range to deliver energy to optimize the function of muscles.

The dopamine system plays an integral role in motor physiology. Dopamine controls movement by modulation of higher-order motor centers (e.g., basal ganglia) but is now now known to also regulate movement by directly controlling motoneuron function. Even though dopamine cells synapse onto motoneurons, which themselves express dopamine receptors, it is unknown whether dopamine modulates skeletal muscle activity. More on that below.

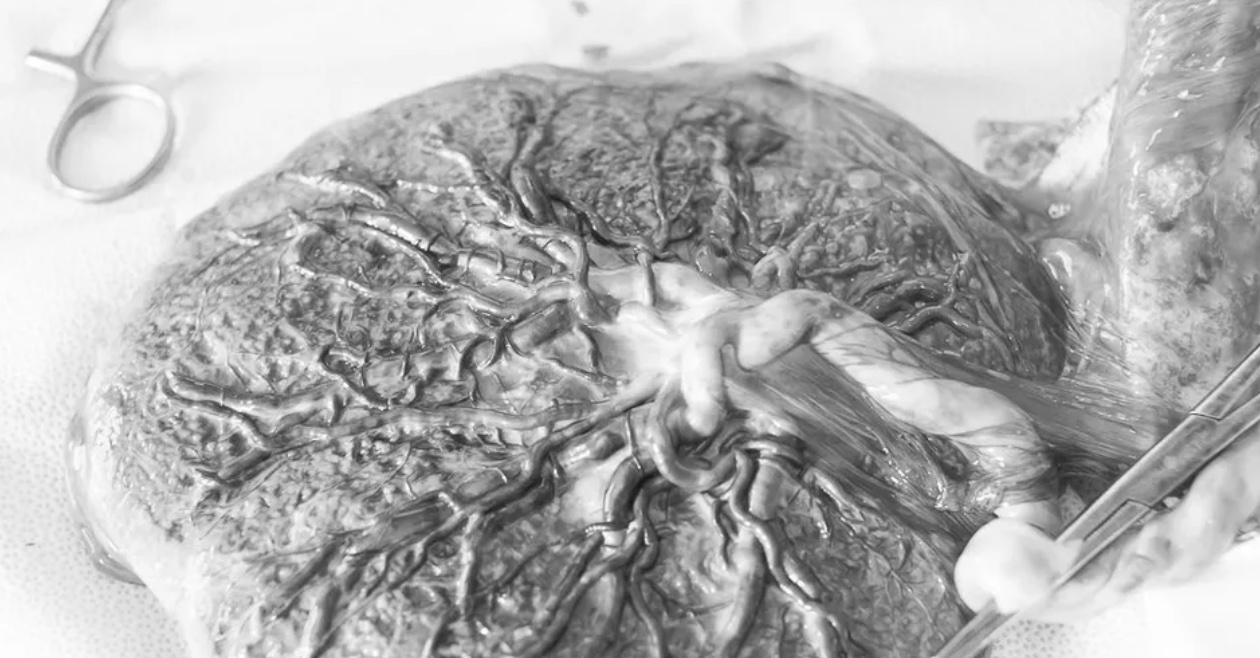

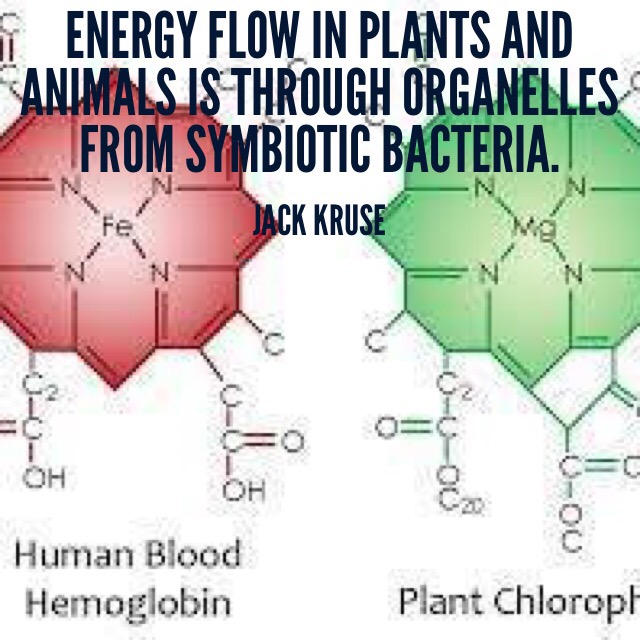

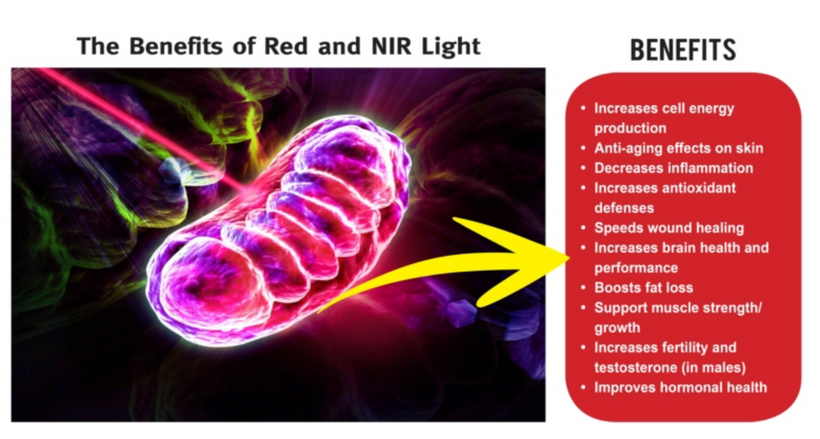

Many women with this condition will also have poor hemoglobin and hematocrit levels and this tells us they deliver poor levels of oxygen to their pelvic floor muscles. What are those implication for these women’s pelvic floor colony of mitochondria?

Mitochondrial cristae density is a better predictor of maximal #oxygen uptake than mitochondrial volume. Nielsen et al. 2017 lays out these mitochondrial effects and your doctor should know why anemia is a symptom that foretells cristae collapse in the muscles of your pelvis to affect sexual dysfunction and bowel and bladder incontinence.

WHAT ARE THE PELVIC FLOOR MUSCLES?

The pelvic floor is a group of muscles that stretch like a hammock from the pubic bone at the front, to the coccyx (tailbone) at the back and from one ischial tuberosity (sitting bone) to the other (side to side).

A female’s pelvic floor muscles support her bladder, bowel and uterus (womb). The openings from these organs (the urethra from the bladder, the vagina from the uterus and the rectum from the bowel) pass through the pelvic floor. The pelvic floor muscles wrap firmly around these passages to help keep them shut.

When the pelvic floor muscles are strong they help prevent:

- the leaking of urine (wee) and feces (poo)

- prolapse.

The pelvic floor muscles also help with sexual sensation during orgasm and function.

Continence issues can affect the bladder, bowel or both. In countries with poor UV light from the sun the amount of women with this disease skyrockets. Different cultures who make it perineal health using natural light taboo also have female populations of with a higher incidents of pelvic wall weakness. For example, incontinence is prevalent in the solar poor UK, with an estimated 14 million adults experiencing urinary incontinence (NHS England, 2018; NHS England, 2015) and over 6.5 million having bowel control problems (Yates, 2017; NHS England, 2015). In women, the most prevalent types of continence problems are:

- Stress urinary incontinence, which affects 10-39% of women;

- Mixed urinary incontinence, which affects 7.5-25% of women;

- Urge incontinence, which affects 1-7% of women (Abrams et al, 2017).

Approximately 10% of all adult women experience urinary leakage at least once weekly and 25-45% experience occasional leakage (Abrams et al, 2017).

How to do pelvic floor muscle exercise using sunlight or PBM

Once you can feel your pelvic floor muscles working, you can start exercising them in the light:

- Pelvic floor muscle exercises can be done anywhere – while sitting, standing or lying down in the sun.

- Squeeze and draw in the muscles around your anus (back passage) and vagina at the same time. Lift them UP inside. You should have a sense of “lift” each time you squeeze your pelvic floor muscles. Try to hold them strong and tight as you count to 8. Now, let them go and relax. You should have a distinct feeling of “letting go”. If you can’t hold for 8, just hold for as long as you can.

- Repeat “squeeze and lift” and let go. It is best to rest for about 8 seconds in between each lift up of the muscles.

- Repeat this “squeeze and lift” as many times as you can, up to a limit of 8 to 10 squeezes. This equals one set.

- Try to do three sets of 8 to 10 squeezes each day.

- I just got a new light unit built that is large enough where one can do this in any environment

While doing pelvic floor muscle training:

- keep breathing

- only squeeze and lift

- do NOT tighten your buttocks

- keep your thighs relaxed.

Pelvic floor exercises are most effective when individually tailored and monitored. If you are not sure that you are doing the squeezes right, or if you do not see a change in symptoms after three months, ask for help from your family doctor, a Women’s, Men’s and Pelvic Health Physiotherapist or Nurse Continence Specialist. Doing this in sunlight works faster than it does with PBM.

The Workout You Won’t Want to Miss

Another thing to consider is pelvic floor training with sex. Two musts for a powerful orgasm; a strong, healthy pelvic floor is key and getting the right stimulation along the entire length of the clitoris. Why?

This part of a women releases large electric currents that can help change the fiber type of the pelvic floor muscles.

Women automatically think about the small external portion on top of the vault which is known as the glans—a pleasure zone of nearly 8,000 nerves. That small area loaded with nerves also has the power to spread that oh-so-good feeling to over 15,000 other nerves throughout the pelvis that innervate the muscles of the pelvic floor. The more we can engage those nerve the stronger those muscles get. Let’s just think about the implications of this reality for a moment.

The glans is simply the external portion of the clitoris, but many people don’t know the clitoris extends internally and then splits similarly to a wishbone around the vaginal canal. This means the more of the clitoris we engage the more the muscles of the pelvic floor can become hypertrophied.

If you do not want to do this with your partner consider using medically adapted vibrator for muscle training when you’re alone. Use sunlight or PBM when you do this as outlined above.

Pelvic floor health isn’t all fun and games. Many vibrators were created from a formal medical device. The device above came from a pelvic EMG for nerve damage during birth trauma. These nerve injuries were some of the most difficult I had to deal with as a peripheral nerve neurosurgeon. We had some custom devices we used to help with these injuries but several entrepenurial women came up with the idea to make something they could use at home. This is one example but these days there are a myriad of choices to use to help this problem. It is an example of an intimate health product available that combines pelvic floor toning with training of the muscles, while giving you a workout you’ll look forward to.

The pelvic floor is a group of muscles that surround the vagina and support other structures in the pelvis. Strong pelvic floor muscles provide improved intimacy, sensation and stronger orgasm, along with better bladder control. So yes, orgasms and pelvic floor health are linked ladies by your fiber type, and muscle fiber type is traiable. Both of them can be optimized when you know how to train these muscles.

A general consensus exists among scientists who actually work in this area regarding human skeletal muscle fiber type changes with exercise:

- All fiber types change with training, and it happens quickly.

- Most sedentary (sexercise) people have ~20-40% of their fibers at hybrids. Active people are usually in the 10-20% range. Very highly trained athletes may have little to no hybrids. So guess what, the amount of sexercise you get matters to your pelvic floor!

- Typically hybrids convert to pure types (i.e., MHC IIa/IIx convert to MHC IIa, and MHC I/IIa convert to MHC I or MHC IIa – depending on training style) when any type of training occurs, particularly the MHC IIa/IIx fibers. The reverse happens with disuse = atrophy = incontinence = lack of strong orgasm.

- Extremely plasticity exists (i.e., it’s easy to change) between all fiber types, though pure MHC I appear more rigid (but they still do change).

- The amount of change is controlled by exposure time and intensity; training more often = more change.

The scientific evidence indicates females have more slow-twitch fibers than men (cite 1 below), and single fiber contractile force and velocity adaptations vary between men and women in a fiber type-dependent and MHC-specific manner (cite 2 below). This all seemingly indicates a need for development of fiber type and gender-specific training programs. This is why I wrote the blog for my tribe of ladies.

SUMMARY

Muscle stimulation provides the “mind muscle connection”, as Intensity automatically strengthens your pelvic floor muscles, it teaches you how an effective, properly performed Kegel exercise should feel—allowing you to learn proper technique. It is no different than lifting in the gym. If your technique is off you will not get the desired muscle strength. With added inflation, Intensity’s vibration activates more nerves, meaning your body is learning to experience more sensation and muscle strength with every training session.

If you find yourself delaying toileting too long, try to make a conscious effort not to. A normal voiding schedule is every two to four hours.

They call it a restroom for reason!

Nature programs in us builds endless optimism in the face of repeated failures. Do not let incontinence or diminished orgasm stop you. In this way Mother Nature forces us to move to act to learn about our world and our body. You have to “open up” to the world and learn optimism to get regeneration. In Nature, you always collect failures on your way to success.

Consider photography in Nature. Not every one is Ansel Adams when they begin. Few learn immediately that the widest, most open, most accepting aperture, the one providing the narrowest, most demanding depth of field is what you need to take a great picture. The same idea cab used to train your pelvic floor. The mechanics of image-making as it related to a women’s pelvic muscles is not an analogy one often finds but it works. For example, using vibration and light simultaneously can be optimized as you can do with a camera. Stopping down the fixed 35mm lens’s diaphragm- which is elegantly composed of nine leaf-shutter blades-to a tight focal length of f/16 would be the equivalent of executing a Kegel pelvic floor exercise. It tightens while gives the most depth of sensation that a muscle needs to train.

CITES

Norman B, Esbjornsson M, Rundqvist H, Osterlund T, von Walden F, Tesch PA. Strength, power, fiber types, and mRNA expression in trained men and women with different ACTN3 R577X genotypes. J Appl Physiol (1985). 2009;106(3):959-65.

Miller MS, Callahan DM, Tourville TW et al. Moderate-Intensity Resistance Exercise Alters Skeletal Muscle Molecular and Cellular Structure and Function in Inactive, Older Adults with Knee Osteoarthritis. J Appl Physiol (1985). 2017:jap 00830 2016.

Williamson DL, Gallagher PM, Carroll CC, Raue U, Trappe SW. Reduction in hybrid single muscle fiber proportions with resistance training in humans. J Appl Physiol (1985). 2001;91(5):1955-61.

Guth L, Yellin H. The dynamic nature of the so-called “fiber types” of nammalian skeletal muscle. Exp Neurol. 1971;31(2):227-300.

https://pubmed.ncbi.nlm.nih.gov/21653722/

Yates A (2019) Female pelvic floor 1: anatomy and pathophysiology. Nursing Times [online]; 115: 5, 18-21.

Dopamine triggers skeletal muscle tone by activating D-1-like receptors on somatic motoneurons. June 2011 Journal of Neurophysiology 106(3):1299-309 DOI:10.1152/jn.00230.2011

https://www.physio-pedia.com/Muscle