You are about to dive into a story that, for quite some time now, has been nothing but a great-sounding idea — a wonderful “what if.” Almost nothing of this story could be found in the mainstream media.

However, the bizarre origin of the story did briefly find its way into FOX’s Glenn Beck show in 2009 as the video above shows you.

I highly recommend you watch this first, as it will draw you directly into the mystery — which flickered for the briefest moment in mainstream media, only to disappear into shuddering silence.

Notice that Beck says FOX contacted the Treasury Department about this case, and received an official blow-off letter in response — basically saying they had “no comment” on this 134 billion dollars in US bonds, seized at the Italian border, as it was “evidence in an ongoing investigation.”

Beck then goes on to put up the numbers of which countries hold the largest numbers of US bonds. In order, they are China at 763.5 billion, Japan at 685.9 billion, the United Kingdom at 152.8 billion, Russia at 137.0 billion and Brazil at 126.0 billion.

Based on the public, unclassified numbers, 134.5 billion dollars in US bonds could only have been produced by Russia, the UK, Japan or China… no one else. The amount of money is so huge that if Russia produced it, they would only have 2.5 billion dollars in US bonds left over!

Joe Wiesenthal, the editor of BusinessInsider.com, said that whether this was a government dumping its bonds or a counterfeit operation, it was “gigantic” in scope and “unlike anything we’ve ever seen — not just in size but also in sophistication.”

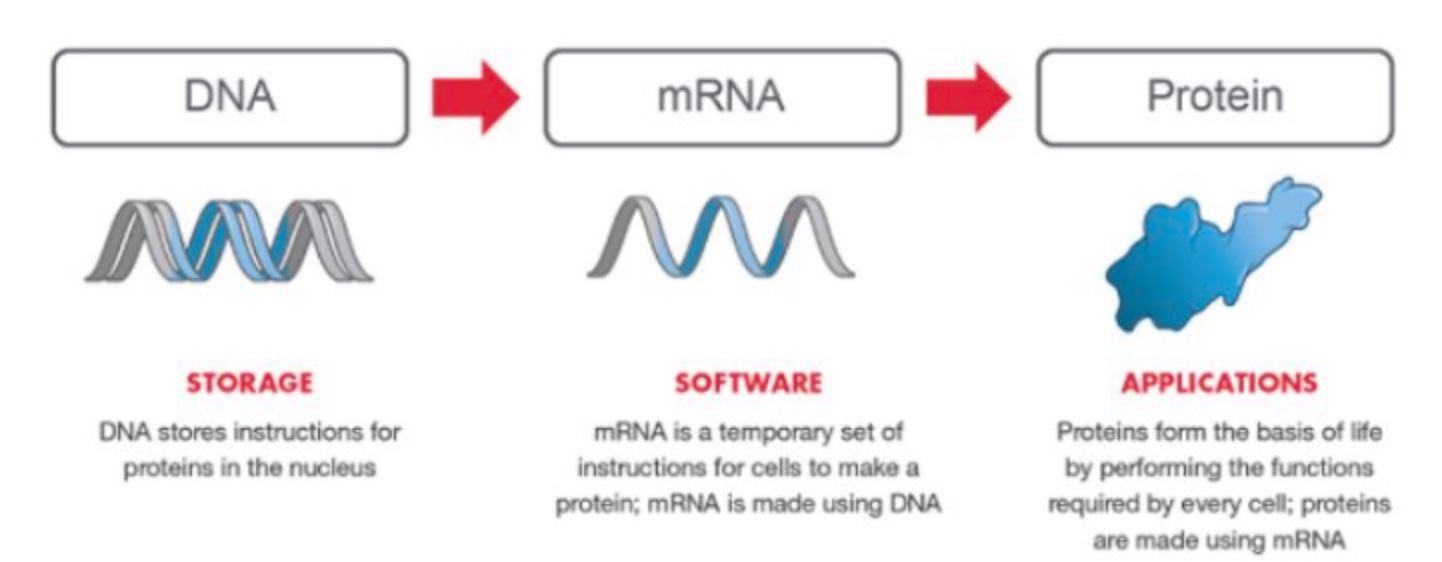

According to Wiesenthal, in order to counterfeit these bonds, “it would be the kind of technology you would expect only a government to have.” Wiesenthal also believes the 1934 issuance date on the bonds suggests they may be elaborate forgeries. Bonds are just like money in the Federal Reserve legacy system. Who has more bond assets than any other company right now in the world?

BLACKROCK.

If the name BlackRock sounds familiar as of late, that is because this entity is also gobbling up real estate, usually at well over the asking price. This is a big reason why real estate prices are the highest they have ever been along with asset inflation by QE from their partners at the Federal Reserve

This plan is laid out by the WEF books linked to Schwab’s Fourth Industrial Revolution. Read these books to see how the families control the pieces on the monopoly board. Why do they lay the plan out for all to see? To show you how powerful they really are. It is akin to a bond thief who counterfeits the bonds artwork and leaves his signature camouflaged in his masterpiece to let the world know how much smarter they are than anyone else. This is wealth redistribution 101, and it isn’t a financial derivative where the rich people’s wealth is getting redistributed.

What will make 82 million people in the future sell their house to Blackrock, Vanguard, whoever, you ask?

That is the wrong question to ask. The WEF has a different plan.

This is the fundamental misunderstanding professional market analysts are making on this. They dont have to force anyone to sell. They just have to buy enough new homes for the next 10 or 20 years that it becomes exceedingly difficult for new buyers to enter the market. It’s a long play that the WEF is interested in.

By 2028, BlackRock and Vanguard will own almost everything in many asset classes, which is the stated goal of the WEF in all their books. You should go read some of them to see if I am lying to you. Ideation without execution leads to deletion of every good idea. BlackRock and Vanguard are the executioners of WEF plans in today’s investing world. None of them want you to know about much less own any Bitcoin. Owning BTC is an impediment to their plan. Why?

The angle of attack of the WEF is to make sure the price of a home is out of your reach and they will sociall engineer you into being a life long renter. You’ll look into your mirror everyday and say, “how can I afford a house? You won’t be able too. That is the goal. Those homes Black Rock is scooping up today, in 2-3 decades will be 20, 30 yrs old: at best by the time a current 5th grader is, say 30 yrs old. And he won’t likely be offering what the market wants when he is 30, namely 30-40% down.

Don’t be fooled into thinking they need to court people who will be 50-70 yrs old, and home owners in 2030, 2040, 2050. They’ll have stymied enough of those under 30 years old from building enough wealth to be capable of buying a home. They’ll need 120k or 150k down just to compete in the future market place, and they wont have it, by social engineering design, and this will keep everyone as a renter/slave to the property owner. They will be slaves to BlackRock just to have a place to live. That is the goal of the WEF. You’ll own nothing and be happy about it.

With 10-20 years of this BlockRock buy up you’ll see a perceptual shift in future generations or home ownership. It has already happened to millennials. Owning a home won’t have been a wealth generating tool for a decade or more in 2030. Moreover, the kids of today won’t even see a home as an asset to build wealth. Instead, through financial engineering, they’ll view it as an albatross. So the impetus to own a home won’t be there the way it was 20 years ago or even today. That is the goal. To change their perceptions of how to do wealth and make sure they remain financially illiterate. This is why BTC ownership is critical to the younger generations of today, and few of the know it.

It’s similar to how those today who are under 25 don’t have a recognition of living in a pre-9/11 world. They don’t really know what that means or entails. They’ve only known a post-9/11 existence and that existence is dominated by the catastrophe 2008 had on their parents. It will be the same with home ownership, if localities don’t stop major investment firms current practices of buying up neighborhoods, the WEF’s goal is a one world government with one currency, they make the rules of how you live.

Bitcoin will allow you to be a divergent in this world. You should not, and cannot fear Bitcoin right now. That is why when it dips today, you better buy it and not fear their FUD creation. They are hoping to scare you so you never buy your freedom card again.

To be afraid, is to prepare one’s self to obey a master.

Decide that you want it more than you are afraid of it.

If you want to control someone, all you have to do is to make them feel afraid.

Inaction breeds doubt and fear. Action breeds confidence and courage.

If you want to conquer fear, do not sit home and think about it. Go out and get busy and do something productive

Fear keeps us focused on the past or worried about the future. If we can acknowledge our fear in the now, everything becomes crystal clear.

Today, for BlackRock and Vanguard borrowing money is dirt cheap to buy up assets. This is why they are gobbling up real estate, usually at well over the asking price. This is a big reason why real estate prices are the highest they have ever been along with asset inflation by QE from their partners at the Federal Reserve. Devalued money & bonds today are buying hard assets today, because post economic reset they know the majority of the public will never have the ability to own a house ever again. They want to create a nation of renters.

This plan is laid out by the WEF books linked to Schwab’s Fourth Industrial Revolution. Read these books to see how the families who make up Octagon who control the Bank of International Settlements (BIS) which in turn, controls the Federal Reserve who help move the pieces on the monopoly board to help those families steal wealth of 8 billion people slowly over time below their ability to perceive it.

Why do they lay the plan out for all to see? To show you how powerful they really are. It is akin to a bond thief who counterfeits the bonds artwork and leaves his signature camouflaged in his masterpiece to let the world know how much smarter they are than anyone else. This is wealth redistribution 101, and it isn’t a financial derivative where the rich people’s wealth is getting redistributed right in front of your eyes.

It’s normal American middle class, salt of the earth wealth heading into the hands of the world’s most powerful entities and individuals by financial engineering of the rules of the game. The traditional financial vehicle is gone forever because of how BlackRock, State Street, and Vanguard operate.

If you have ever wondered why television “news” is constantly interrupted by advertising for the latest drug offerings from Big Pharma, look no further than Blackrock and Vanguard, two of the world’s largest asset management companies, which just so happen to own both the drug industry and the media.

BlackRock and Vanguard are currently the top two owners of Time Warner, Comcast, Disney, and News Corp. These four media conglomerates own and control more than 90 percent of the United States media landscape, which explains why their collective coverage of world events all centers around the same propaganda.

Though most people have never heard of them, BlackRock and Vanguard are also the silent monopoly owners of many other facets of the economy. They are said to hold ownership in some 1,600 American firms which, as of 2015, held combined revenues of $9.1 trillion. The number is now over 30 Trillion in 2021.

CHINA’S DRAGON FAMILIES ARE NOT WHO YOU THINK THEY ARE

When you understand the Chinese BTC miners represent the Chinese elder families who had their gold stolen from the families who own the US Fed, you understand that the BTC miners in China are not CCP friendly and abhor the US bankers. You also begin to understand why the Chinese elder families want to replace their metallic gold with digital gold and why the CCP is cracking down on BTC miners right now.

The Chinese Elders sued the Federal Reserve families in September 2010 for gold contracts going back hundreds of years, in a secret world court within the BIS — and the Elders won as of December 2020. This lawsuit has a lot to do with Bitcoin’s future. Where did this lawsuit begin?

Ever since this bizarre event happened in the hyperlink, the only follow-up to the story has been in the form of an elaborate amount of ‘insider’ information leaked by Benjamin Fulford — the former Asia-Pacific bureau chief for Forbes Magazine — on a week-by-week basis. The video above was the giant rabbit hole I jumped down to solve this mystery. Here is his media page.

Finally, the lawsuit at the epicenter of this investigation has now become a tangible reality — validating everything Fulford has been saying about this mysterious case since it originally started.

Looming storm clouds threatened to demolish Fulford’s credibility in a single crash of lightning as the all-important date of November 15th, 2011 came and went — with nothing to show for it — after years of fanfare and buildup on his financial websites.

However, on November 23, 2011, the clouds parted. A vast, 111-page legal complaint was filed in the United States District Court for the Southern District of New York. This complaint is now a provable matter of public record… as you are about to see.

GO LOOK FOR YOURSELF

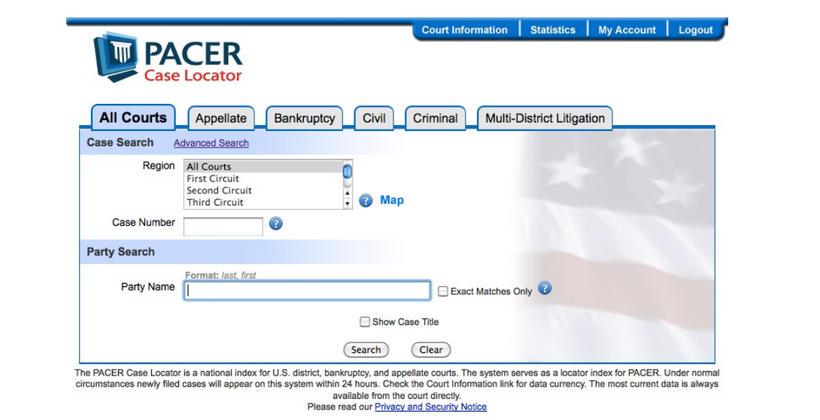

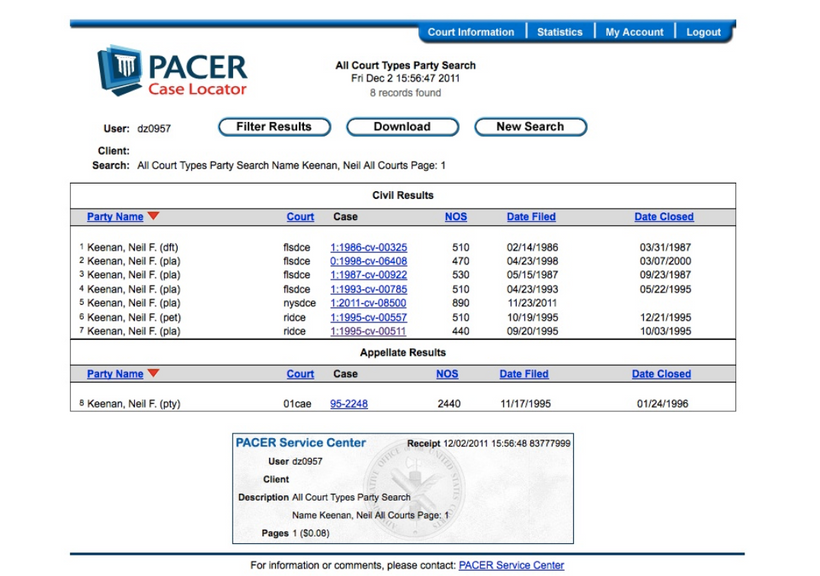

Here is the search window that opens up when you go to pacer.gov and register as a user for eight cents a page. This website is a public service that allows you to search for any and all legal cases that have been filed in America:

Once you’ve set up your user account, type in “Keenan, Neil” under “Party Name”, and you will then see this:

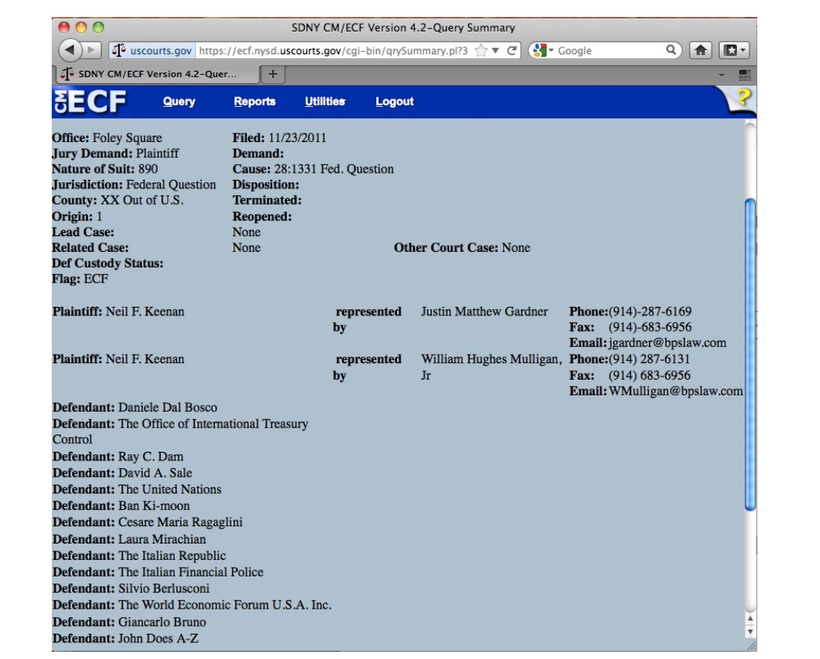

Notice the fifth item down on the list… 2011-cv-8500, filed on November 23, 2011. That’s the one. You can then click into it from there, and one of the screens you will pull up is the following:

Did you catch that list of defendants above?

If the amount of money being sued for isn’t stunning enough, that list of defendants should attract a great deal of attention — for it includes the Italian Republic, the Italian Financial Police, Italy’s Prime Minister Silvio Berlusconi, the World Economic Forum, Ban Ki-Moon (the old head of the UN), and the United Nations itself.

What the hell is going on here you ask????

If you don’t want creepy government spies watching you, and you don’t want to pay eight cents a page, here’s the entire PDF file as it appears once you download it off the PACER website: HYPERLINK

MAINSTREAM MEDIA PICKED UP THE STORY AS OF DECEMBER 5, 2011

Dan McCue started asking the same questions you may now be thinking about… and as a result, he was the first mainstream journalist to cover this story in Courthouse News Service, a nationwide news service for lawyers and the news media.

McCue isn’t necessarily convinced — the article is entitled “Bizarre Claim for $1 Trillion” — but given that this is a real case, he is certainly interested enough to write about it.

THE FIRST MAINSTREAM ARTICLE TO EXPLORE THIS STUNNING CASE

Here’s an overview of what McCue wrote:

http://www.courthousenews.com/2011/12/05/41930.htm

MANHATTAN (CN) – An American expatriate in Bulgaria claims the United Nations, the World Economic Forum, the Office of International Treasury Control and the Italian government conspired with a host of others to steal more than $1.1 trillion in financial instruments intended to support humanitarian purposes.

The 111-page federal complaint involves a range of entities common to conspiracy theorists, including the Vatican Illuminati, the Masons, the “Trilateral Trillenium Tripartite Gold Commission,” and the U.S. Federal Reserve.

Plaintiff Neil Keenan claims he was entrusted in 2009 with the financial instruments — which included U.S. Federal Reserve notes worth $124.5 billion, two Japanese government bonds with a combined face value of $19 billion, and one U.S. “Kennedy” bond with a face value of $1 billion — by an entity called the Dragon Family, which is a group of several wealthy and secretive Asian families.

“The Dragon family abstains from public view and knowledge, but, upon information and belief, acts for the good and better benefit of the world in constant coordination with higher levels of global financial organizations, in particular, the Federal Reserve System,” Keenan claims.

“During the course of its existence over the last century, the Dragon family has accumulated great wealth by having provided the Federal Reserve Bank and the United States Government with asset assignments of gold and silver via certain accounts held in Switzerland, for which it has received consideration in the form of a variety of Notes, Bonds and Certificates such as those described … that are an obligation of the Federal Reserve System.”

Keenan says that with accrued interest the instruments are now worth more than $1 trillion. He says the family designated him as its principal in an effort to select certain registered and authorized Private Placement Investment Programs (PPPs) for the benefit of unspecified global humanitarian efforts.

In his remarkable complaint, Keenan claims that the U.S. government [received] enormous amounts of money — delivered in gold and other precious metals — from the Dragon Family many years ago, and that the money was placed into the Federal Reserve System for the benefit and underwriting support of the dollar, “which was to become and currently remains the global reserve currency”….

The complaint alleges a complicated history with many moving parts and scores of internationally known and unknown characters, the sum of which is that Keenan claims he was entrusted with billions of dollars in bonds by the Dragon Family….

These instruments were then stolen as two Japanese agents attempted to cross the border from Italy into Switzerland with them, contained in the suitcase. It has taken me years to find the names of the agents. One was named Satoshi Yamamoto and the other was named Nakamoto Haruto. That find stunned me. Why?

In Japan, like in China and Korea, the first name follows the family name. A person with the first name “Ichiro” and the family name “Suzuki” is, therefore, called “Suzuki Ichiro” rather than “Ichiro Suzuki”.

What is the pseudonymous name of linked to the Bitcoin White paper?

[Keenan] claims that as the conspiracy continued to unfold, various high level officials repeatedly offered him a bribe of $100 million to “release” the instruments without disclosing their theft to the Dragon family, and to allow the instruments to be converted to a so-called UN “Sovereign Program” wholly under the auspices, protection and umbrella of the sovereign immunity enjoyed by the defendants.

Other defendants include UN General Secretary Ban Ki-Moon, Former Italian Prime Minister Silvio Berlusconi, Giancarlo Bruno, who is identified as head of the banking industry for the World Economic Forum, Italy’s ambassador to the UN Cesare Maria Ragaflini, Ray C. Dam, president of the Office of International Treasury Control, and David A. Sale, the deputy chief of the council for the cabinet of the OITC in 2011.

Keenan seeks the return of the stolen instruments, punitive damages and court costs on multiple claims of fraud, breach of contract and violation of international law.

He is represented by William H. Mulligan Jr., with Bleakley, Platt & Schmidt of White Plains, N.Y.

Unfortunately Courthouse News Service, website was removed by the FBI from the web for some unknown reason years ago. McCue did a great job of summarizing the rest of the case on that site but it is lost forever now. This is just an overview of what was on that site when it was live.

YOU HAVE GOT TO BE KIDDING ME FILE

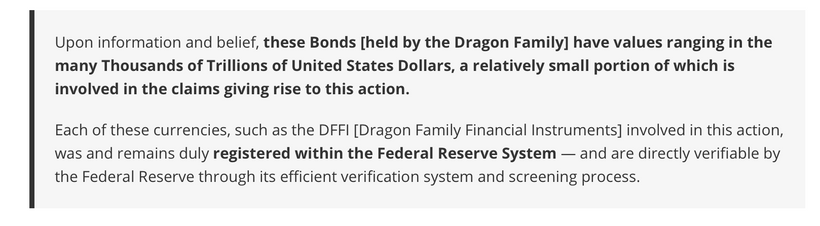

Courthouse News Service didn’t quite have the stomach to quote one of the most interesting paragraphs in the entire complaint… but I do. This is where the whole story really started taking shape for me:

Thousands of trillions of dollars? You have GOT to be kidding me! As soon as I read that, I had to know more… because I had enough information to be convinced that this was not a spurious lawsuit. I emailed Fulford to try to educate myself and was sent down a few rabbit holes.

Neil Keenan, the principal plaintiff in this case above, as well as Keith Scott, who is also mentioned in the complaint. Scott is an expert in this utterly secretive world of trading between central banks — and is well aware of the vast wealth underwriting them, all held in the strictest secrecy.

Keenan has never worked for any government or clandestine agency. He is a businessman who ultimately became acquainted with the Dragon Family — the former ruling party of China, prior to the arrival of Communism — and gained their trust.

WHO ARE THE DRAGON FAMILY?

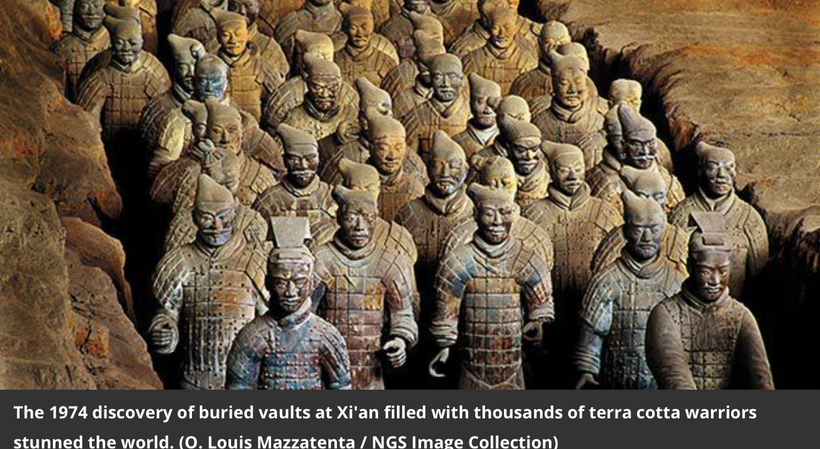

In March 1974, a group of peasants digging a well in drought-parched Shaanxi province in northwest China unearthed fragments of a clay figure—the first evidence of what would turn out to be one of the greatest archaeological discoveries of modern times. Near the unexcavated tomb of Qin Shi Huangdi—who had proclaimed himself first emperor of China in 221 B.C.—lay an extraordinary underground treasure: an entire army of life-size terra cotta soldiers and horses, interred for more than 2,000 years.

China was named after emperor Qin, the first ruler in the Dragon Family. That was the first dynasty of China. Qin was the ruler who built the Terra Cotta Soldiers, where he took every soldier and every horse in his army and built a stone sculpture out of them and buried them in a mountain. There’s all sorts of interesting historical facts about how this Dragon family showed up. Much of what they do mimics what Micheal Burry does with his tweets. They basically erased all the history from China before they existed, which is now being rebuilt by certain scholars. Apparently, that is how the ancients remained clandestine because back then communication was limited and this kept their enemies in the dark about their true intentions. These Asian secret societies appear to be dynastic. They’ve largely been behind the scenes. They’ve amassed large amounts of wealth. This wealth was used to Fund the Federal reserve in 1913. That gold was stolen from them when the USA military became powerful and the USA stole the gold via their judicial system. The Dragon family then came up with a plan to level the playing field. THE DRAGON FAMILIES WANT A FAIRER SYSTEM, NOT DOMINATED BY THE WEST

They think that the control of the future of the planet should no longer be controlled by a small Western elite. They would rather have it fall under the control of the people of the planet.

BIS WANTS CENTRAL CONTROL of money. This is their headquarters above. Who is BIS? BIS was founded by four men on 5/17/1930,: Hjalmar Schacht [Head of Reichsbank], Charles G Dawes [Chairman of City National Bank], Owen D Young [founder of RCA and chairman of General Electric] and Montague Norman [governor of the Bank of England and partner in JP Morgan]. Now you can see the tentacles of this tribe.

From the founding of the bank (BIS) until at least 1939, Schacht worked closely with Jacob Schiff, the Warburgs and Montague Norman, in funneling Wall Street and City of London money into Hitler’s rearmament program; as is documented in Professor Antony Sutton’s painstaking work, Wall Street and the Rise of Hitler:

“In October 1931, Warburg received a letter from Hitler which he passed on to Carter at Guaranty Trust Company, and subsequently another bankers’ meeting was called at the Guaranty Trust Company offices. Opinions at this meeting were divided. “Sidney Warburg” reported that Rockefeller, Carter, and McBean were for Hitler, while the other financiers were uncertain.

Montague Norman of the Bank of England and Glean of Royal Dutch Shell argued that the $10 million already spent on Hitler was too much, that Hitler would never act. The meeting finally agreed in principle to assist Hitler further, and Warburg again undertook a courier assignment and went back to Germany.

On this trip Warburg reportedly discussed German affairs with “a Jewish banker” in Hamburg, with an industrial magnate, and other Hitler supporters.

One meeting was with banker von Heydt and a “Luetgebrunn.” The latter stated that the Nazi storm troopers were incompletely equipped and the S.S. badly needed machine guns, revolvers, and carbines.”

This evidence shows that the transfers of those funds into the accounts held in trust by BIS for Hitler’s regime were all facilitated by the Warburgs, a family which long ago assimilated itself into the House of Rothschild by marriage and without whom the Rothschild’s hand in world affairs would not have been capable of remaining hidden for so long.

It is therefore fair to deduce from this circumstantial evidence alone that the Warburgs were acting as Rothschild proxies in the financing of Hitler’s rise to power, in which they were aided and abetted by at least two of the four BIS founders, in Schacht and Norman.

WHY IS THIS IMPORTANT TODAY?

The US Federal Reserve is linked to BIS in cornerstone fashion.

Paul Warburg was also the driving force behind the creation of the US Federal Reserve, which congressman Charles Lindbergh described as: “…the most gigantic trust on earth. When the President [Wilson] signs this Bill, the invisible government of the monetary power will be legalized… The greatest crime of the ages is perpetrated by this banking and currency bill.”

That is how your Fed links to the BIS and the Octagon families.

Why is China’s CCP dumping all things bitcoin right now?

Did you know that a key CCP official defected to the USA recently? He turned himself over to the DIA (defense intelligence agency). Guess why he chose them? Minister Dong Jingwei choose to defect to the Defense Intelligence Agency and not the CIA or NSA like usual. That makes this an industrial military game who protects the BIS or Federal bankers.……….yet.

Who is this guy?

Minister Jingwei was a Counterintelligence Boss, essentially the Chief Spy Catcher of the CCP. His job was to ensure that Spies in China or working overseas against Chinese Interests were caught. He is part of the Dragon family ancestry.

Many of the spies were linked to Wuhan Institute and the CBDC/digital yuan rollout plans.

He was in charge of surveillance capitalism, the take over of Taiwan, and Diego Garcia in the Indian Ocean. (BTC #4 blog)

The bottom line is that the Chinese Dragon Family intended for these bonds to be stolen to set legal precedent in the Old World Court system.

They represented only a small percentage of the overall asset base… all of which is clandestinely registered within the Federal Reserve and the Bank of International Settlements in Basel!

This was an elaborate sting operation that has brought us to where we are today in financial markets — where a vast international alliance of 117 countries now has a legal way to end the financial tyranny of the Old World Order (WEF) that the families I mentioned above have been forcing on the rest of the world through their action arms like BlackRock and Vanguard.

Might the 1 million coins on BTC blockchain that have not been touched ever be owned by the Chinese Dragon Families? Might the Japanese name of Satoshi Nakamoto have particular relevance to this story laid out above? I think it might. I think the battle over the New World Order and Old World Order is linked to this lawsuit in the Southern District of New York, and why Central bankers all over the world abhor Bitcoin.

A STAGGERING AMOUNT OF INFORMATION IS BURIED FROM US.

In truth, BlackRock and Vanguard are one and the same entity, seeing as how the latter is the largest shareholder of the former. Among the family names tied into the two are the Freemasons and the P2 Lodge, Rothschilds, the Bushes, the British Royal family, the Du Ponts, the Vanderbilts, and the Rockefellers. These families have created Bezos and Elon Musk to help faciltate the wealth redistribution on their behalf. Be careful who you worship and adore because they maybe be your “Brutus” tomorrow. These families make up the Octagon network that control the BIS now.

The Chinese triads, the Japanese yakuza groups and various other secret groups in Asia have strict rules against nepotism. This is another reason the Dragon families are at war with the groups above. All of them favor nepotism as a means of generational control.

BLOCKROCK OWNS THE MEDIA. The media is the entertainment division of the industrial military complex to keep things running smoothly during the Economic Reset.

All of these families have been pushing for a New World Order for centuries, and it would appear as though they are on the verge of achieving their goal through the destruction of world financial systems, the gobbling up of all real estate, and eventually the total abolition of private property. Klaus Schwab, George Soros, and Henry Kissinger are the living spokesmen of this Old World centralized empire.

Nixon protected the people who formed and now own BlackRock. BlackRock is part of the Octagon network that links the Fed and the WEF. The BUSH family is a major stakeholder in Black Rock and they have deep ties to the CIA and FBI through positions their family have held in government. George H Bush was the president in 2011. https://thestrategystory.com/2020/09/18/blackrock-shadow-bank/

Robert Mueller……….remember him. “Independent council “formerly head man at the FBI. How independent can you be when you are investing your own department for misconduct? See how the WEF operates? They control the fox allowed into the hen house so they cannot lose.

What this means is that BlackRock/Vanguard together own pretty much everything there is to own, which explains why everything is now moving in one general direction, straight towards an economic reset. No matter the industry or the sector, BlackRock and Vanguard more than likely hold a stake and control the movement.

The stock of the world’s largest corporations is owned by the same institutional investors. They all own each other. This means that ‘competing’ brands, like Coke and Pepsi or NBC and Fox, aren’t really competitors, at all, since their stock is owned by exactly the same investment companies, investment funds, insurance companies, banks (see their tweet below), and in some cases, governments. The media is the entertainment division of BlackRock’s military division.

That is your reality now. You cannot trust anyone but yourself to make the right call for you and your loved ones.

SUMMARY:

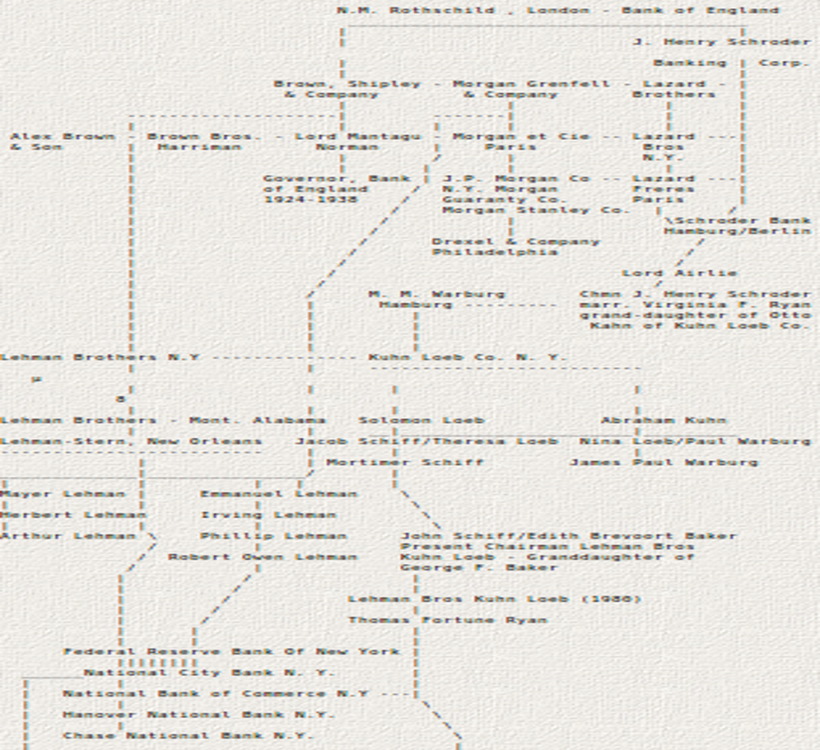

Warburg’s reward for bringing into being the U.S. Federal Reserve was to be its first chairman. While speaking before the House Committee on Banking and Currency in 1913, he confessed that, having emigrated to America in 1902, following an extensive education in international banking in Europe, he became a partner of Kuhn, Loeb & Co, which was to become a Rothschild-controlled shareholder of the American central bank.

It is self-evident that the education Warburg received was given by the Rothschilds, just as it was given to Jacob Schiff whilst he lived at their Frankfurt home before emigrating to America.

Between the American Civil War and the beginning of the First World War, the main U.S. agents of the Rothschild Empire were JP Morgan, Abraham Kuhn and Solomon Loeb. Newsweek magazine published a brief history of Kuhn, Loeb & Co on February 1st 1936, which stated:

“Abraham Kuhn and Solomon Loeb were general merchandise merchants in Lafayette, Indiana, in 1850. As usual in newly settled regions, most transactions were on credit. They soon found out that they were bankers…

In 1867, they established Kuhn, Loeb and Co., bankers, in New York City, and took in a young German immigrant, Jacob Schiff, as partner. Young Schiff had important financial connections in Europe.

After ten years, Jacob Schiff was head of Kuhn, Loeb and Co., Kuhn having retired. Under Schiff’s guidance, the house brought European capital into contact with American industry.”

Those European “financial connections” were the Rothschilds, in whose Frankfurt house Jacob Schiff was purportedly educated; and their German partners, the M.M. Warburg Company of Hamburg and Amsterdam, who were and remain but an extension of the same all-powerful banking house – Rothschild by another name.

During the latter decades of the previous century, the Rothschilds provided John D. Rockefeller with enough finance to develop and dramatically expand his Standard Oil business which was broken up and whose fragments became modern day Big Pharma, Oil, and chemical empires.The mechanics of the investment were performed by the Warburgs and Jacob Schiff at Kuhn Loeb, who also financed Edward Harriman’s and Andrew Carnegie’s rail-road and steel empires;whilst JP Morgan’s empire was founded on credit extended by the Rothschild-controlled bank in New York.

Those of you who are full members of my website should go back and revist the webinar (Aug/Sept 2018) I did on the three robber barrons and how they ruined modern medicine with the Flexner report.

It naturally follows that, on the basis that the names of Warburg, Morgan and Schiff are synonymous with that of Rothschild, the banking house is widely considered to have power, control or undue influence over every member of the Federal Reserve board, as well as the selection of its chairman.

In August 1976, the House Banking Committee Staff Report was published, detailing the history of the board members of the Federal Reserve, a portion of which can be seen below:

I’m sorry this picture is not ideal but that is what we have left in archives. In the event this table is accurate [and there is no reason to believe it is not based on my research], there is not one individual or bank or investment company included that could not be considered a Rothschild interest, whether by partnership, investment, lending, commissioning or founding, at the time the Federal Reserve Act was passed into law.

IT GETS WORSE

Reflecting upon the 1907 panic, Paul Warburg, when speaking to the Banking and Currency Committee, confirmed that he was a driving force behind the Aldrich Plan for the creation of a privately owned US central bank:

“In the Panic of 1907, the first suggestion I made was, “let us have a national clearing house” [Central Bank]. The Aldrich Plan [for a Central Bank] contains many things that are simply fundamental rules of banking. Your aim must be the same.”

In addition to this compelling evidence of the hidden hand of Rothschild influence and control, the Telegraph newspaper published an article on 31/07/2013, detailing the revelations contained in documents released by the Bank of England, concerning the transfer of Czech gold to the Reichsbank BIS account. The article stated:

“The documents reveal a shocking story: just six months before Britain went to war with Nazi Germany, the Bank of England willingly handed over £5.6 million worth of gold to Hitler – and it belonged to another country.

The official history of the bank, written in 1950 but posted online for the first time in 2018, reveals how the BRITS betrayed Czechoslovakia in WW2 – not just with the infamous Munich agreement of September 1938 (Chamberlin), which allowed the Nazis to annex the Sudetenland, but also in London, where Montague Norman, the eccentric but ruthless governor of the Bank of England agreed to surrender gold owned by the National Bank of Czechoslovakia to Hitler. Still think a centralized system is not a problem?

The Czechoslovak gold was held in London in a sub-account in the name of the Bank for International Settlements, the Basel-based bank for central banks. When the Nazis marched into Prague in March 1939 they immediately sent armed soldiers to the offices of the National Bank. The Czech directors were ordered, on pain of death, to send two transfer requests.

The first instructed the BIS to transfer 23.1 metric tons of gold from the Czechoslovak BIS account, held at the Bank of England, to the Reichsbank BIS account, also held at Threadneedle Street.

The second order instructed the Bank of England to transfer almost 27 metric tons of gold held in the National Bank of Czechoslovakia’s own name to the BIS’s gold account at the Bank of England.”

To get more information on history of the Fed and BIS read cite one below.

WAS COVID ANOTHER CZECH GOLD STEAL?

COVID was a compliance test for the economic reset upon us. The WEF Octagon families own all of Big Pharma.

For a virus with a survivability rate of 99.8%, the West imploded upon itself and destroyed all resemblance of liberty in less than two weeks. Now it recommends a manufactured solution brought to you by the families who are controlled by the WEF. Amazing coincidence. Imagine if we had a real, sudden extensional emergency and crisis on our hands. What would stupid thinking humans default then? Twitter?

Who controls the media and what have they told us?

BlackRock, Vanguard, and WEF control NBC. The WEF controls the CDC & WHO. The Federal Reserve instituted lockdowns because the CCP asked the world to do that. This is how you engineer a wealth transfer upon obedient idiots. (technocracy link)

The Soviet Union tried to beat the west. Xi Jinping simply bought it using ads on MSM. The WEF and WHO and CDC all helped set it up. Don’t believe it yet?

The Chinese Communist Party Hid Vital Information from the World and the World Health Organization Chose to Placate Rather Than Act, Allowing the Virus to Spread Globally

December 2019 – January 2020: CCP leaders know about coronavirus, but take aggressive steps to hide it from the public, including detaining doctors who warned about the virus and censoring media on the virus.

Dec. 30, 2019: Doctors in Wuhan report positive tests for “SARS Coronavirus” to Wuhan health officials. Under WHO regulations, China is required to report these results within 24 hours. China fails to inform the WHO about the outbreak.

Dec 31, 2019: WHO officials in Geneva become aware of media reports regarding an outbreak in Wuhan and directs the WHO China Country Office to investigate. Taiwan informs WHO about human-to-human transmission, but data is not published on WHO’s data exchange platform.

Jan 1, 2020: Hubei Provincial Health Commission official orders gene sequencing companies and labs who had already determined the novel virus was similar to SARS to stop testing and to destroy existing samples.

Jan 2, 2020: The Wuhan Institute of Virology (WIV) completes gene sequencing of the virus, but the CCP does not share the sequence or inform the WHO.

Jan 3, 2020: China’s National Health Commission ordered institutions not to publish any information related to the “unknown disease” and ordered labs to transfer samples to CCP controlled national institutions or destroy them.

Mid-Late January: Despite knowing about the virus, CCP allowed massive travel within China and abroad during the Spring Festival (3 billion estimated trips over 40 days), and Wuhan held a celebratory potluck with more than 40,000 families eating from 14,000 dishes

Jan 11-12, 2020: After a researcher in Shanghai leaks the gene sequence online, the CCP transmits the WIV’s gene sequencing information to the WHO that was completed 10 days earlier. The Shanghai lab where the researcher works is ordered to close.

Jan 14, 2020: Wuhan health authorities claim no human to human transmission from coronavirus. This assessment was tweeted by WHO the same day. According to classified documents obtained by the Associated Press, Xi Jinping is warned by top Chinese health official that a pandemic is occurring. He did not care because he has full control of the West’s media by way of the WEF. The WEF and the CCP now have deep influence in Washington DC because the FBI and CIA helped them gain power in the last election of President.

Jan 22, 2020: WHO mission to China admits some evidence of human-to-human transmission.

Jan 23, 2020: After the Emergency Committee is divided on whether to declare a Public Health Emergency of International Concern (PHEIC), Director-General Tedros decides not to. This delay contributed to a regional epidemic turning into a pandemic

Jan 23, 2020: The CCP institutes a city-wide lockdown of Wuhan. However, before the lockdown goes into effect, an estimated 5 million people leave the city. Lockdowns do not work for coronavirus but they are quite good at shutting down an economy.

Jan 29, 2020: Tedros of the WHO praises the CCP’s response to the virus, saying their transparency was “very impressive, and beyond words” and that the CCP was “actually setting a new standard for outbreak response.” LOL

Jan 30, 2020: One week after declining to do so, Tedros declares a Public Health Emergency of International Concern. LOL

Feb 16, 2020: WHO and PRC officials begin a nine-day “WHO-China Joint Mission on Coronavirus Disease 2019” and travel to China to examine the outbreak and origin of COVID-19. Many team members, including at least one American, were not allowed to visit Wuhan on the trip.

March 11, 2020: The WHO officially declares the COVID-19 outbreak a pandemic after 114 countries had already reported 118,000 cases including more than 1,000 in the United States.

If you do not think all three branches of government are compromised then you must have missed this news below from the SCOTUS this week about slavery.

The Declaration of Independence says, “It is the right of the people to alter or abolish” a government deemed to be abusive by the governed. We are getting closer to that reality. I see a legal case developing now in the world around us. We have allowed the government and its agents too much power in controlling our lives.

The answer: Buy a lot of BTC. They will create FUD to keep you afraid of buying it. Do not stop filling your life raft. You life might soon depend on thinking critically. Don’t buy any BTC via a phone device and never store it on a phone wallet.

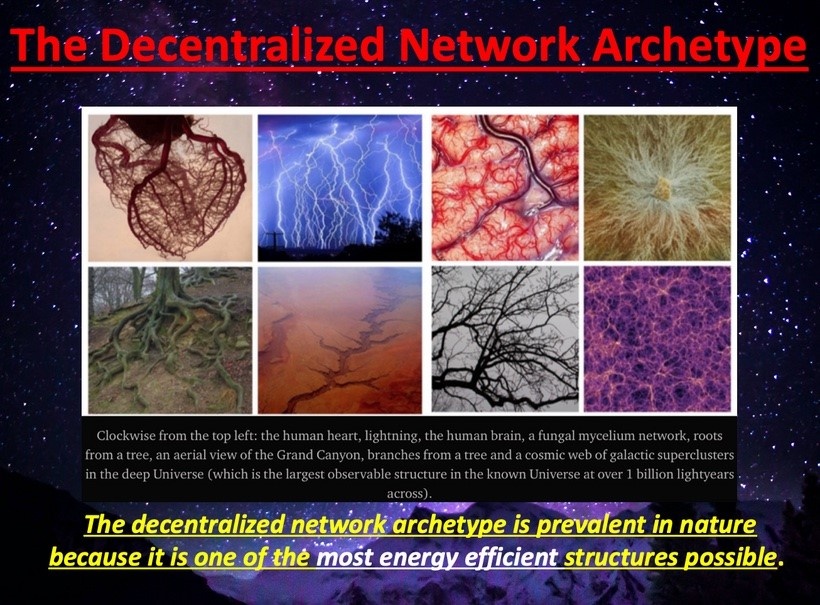

Bitcoin is a hard fork of gold. A needed system upgrade to ensure state resistance and decentralization. BTC is the vaccine against the plague in power now in the banking system.

Human history is the story of evolution which is a byproduct of entropy. We all still subject to the laws of physics and time. The game is to accumulate and store as much energy as possible. Fiat money is not real money. If you think paper dollars = wealth, then you deserve what is coming.

You will never achieve peace of mind as long as you still have people you cannot trust around.

CITE