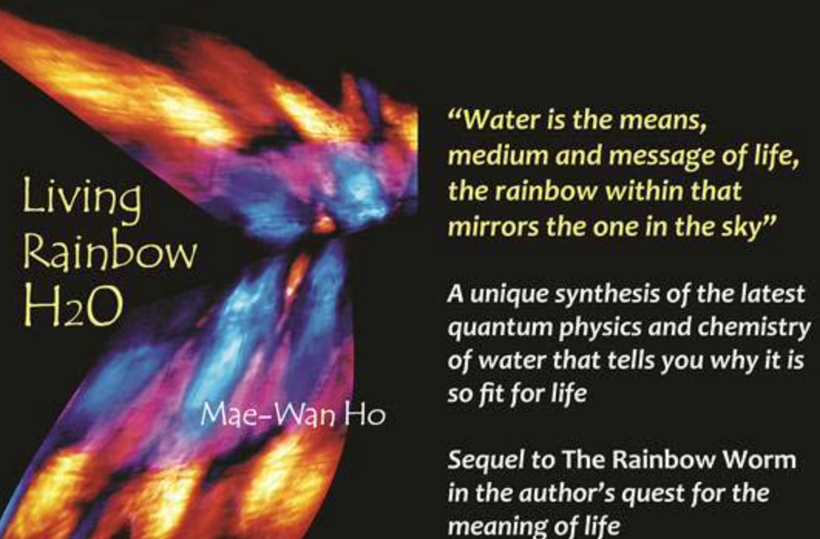

Life requires the optimization of light, water, and magnetism. How did magnetic forces begin to sculpt life on Earth? Where might the energy in our dynamo come from that creates the Earth’s magnetic field?

Earth and Mercury are the only planets in our system whose magnetic fields are generated by the movement of liquid metal at their cores. Mercury’s magnetic field is 100 times weaker than Earth’s. It’s billions of years old and recently discovered data suggests that it was at one point as strong as Earth’s. Of all of these natural magnets, the Earth’s magnetic field is the most important to the existence of all things living. If Earth didn’t have a magnetic field, all living things would be in trouble. The magnetic field protects us from harmful radiation from the Sun and helps keep our atmosphere from leaking into space.

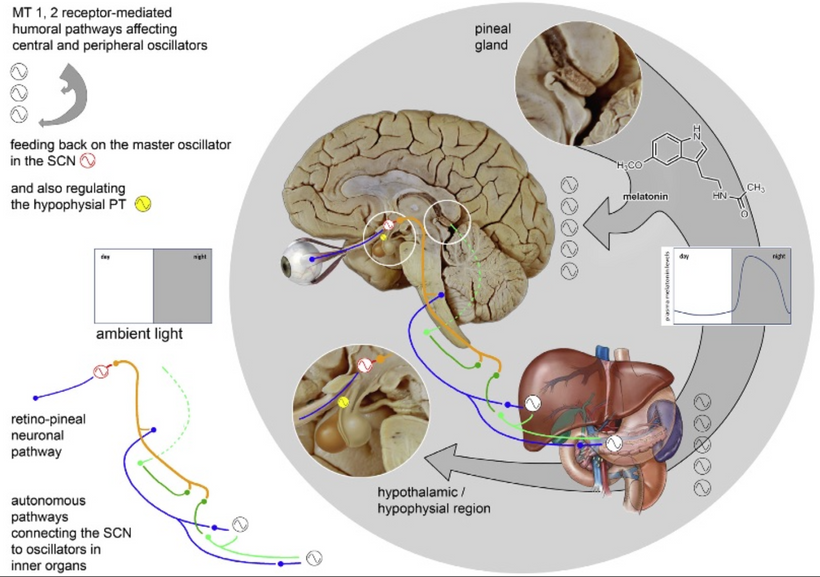

The Earth behaves like a gigantic electric circuit in our solar system. The moon is the Earth’s metrnome. The Earth’s electromagnetic field surrounds and protects all living things with a natural frequency pulsation of 7.83 hertz on average. Schumann predicted it mathematically in 1952. That frequency is critical controlling the periodicity of clocks in living things.

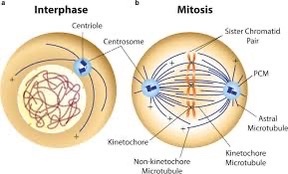

How do you create the concept of a singular time if your system spans the galaxy? How do you measure time in a timeless realm? This is a question that life had to ask nature in order to exist. What was her answer to this vexing question? The physics of organisms creates time for cells. The cellular organization of atoms in the SCN creates time using sunlight from the environment. All life on Earth gets all its energy and information from the sun. Sunlight or the photons that make up the light that falls to Earth are timeless. Light photons never experience time. They begin to experience time when magnetism enters the fray of life. A clock is a thermal machine that creates the illusion of time. Magnetism in the core drives the thermal machine that create time. The exhaust of the thermal machine is critical to see to understand the process.

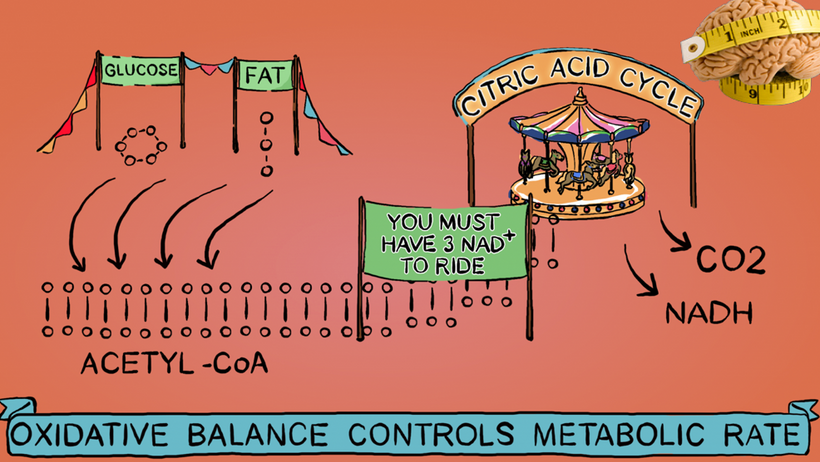

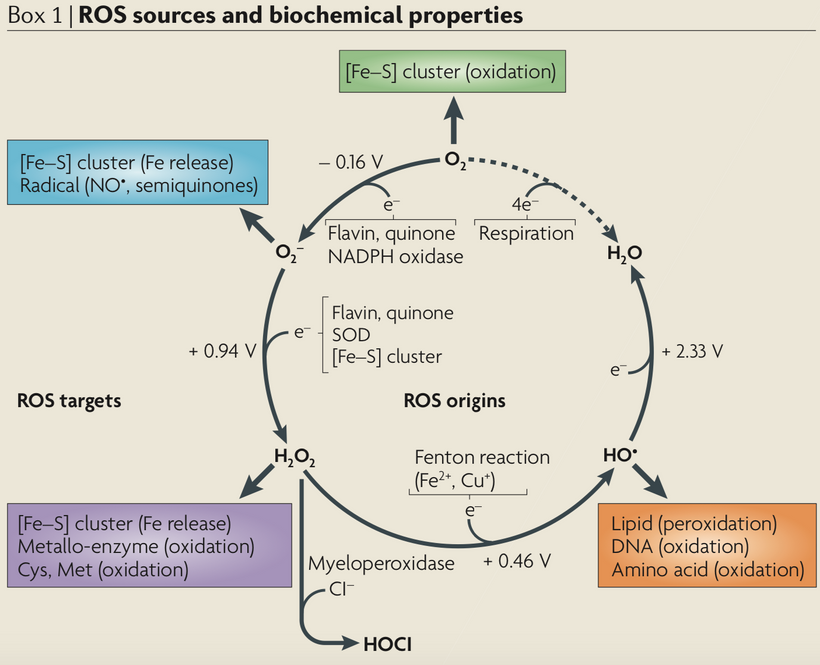

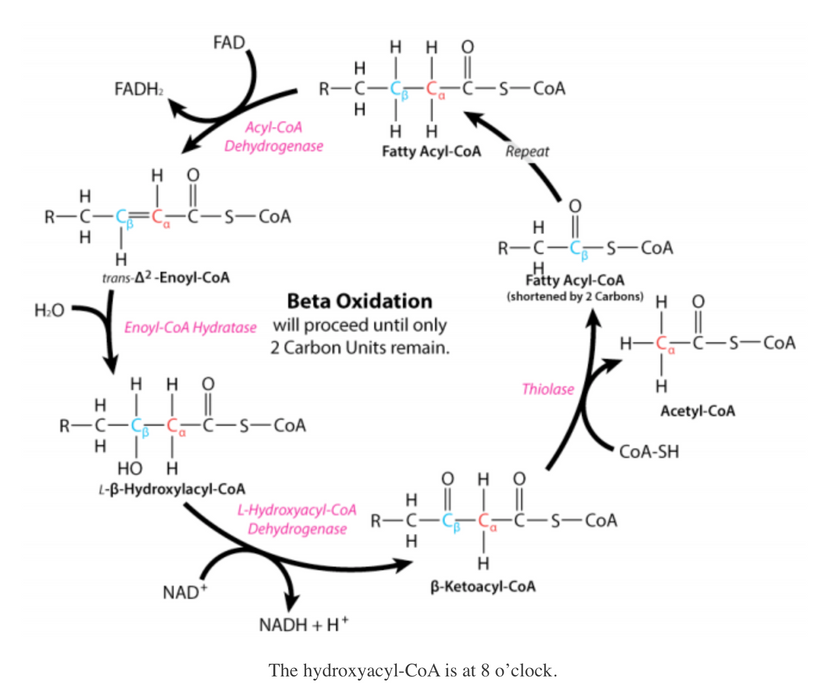

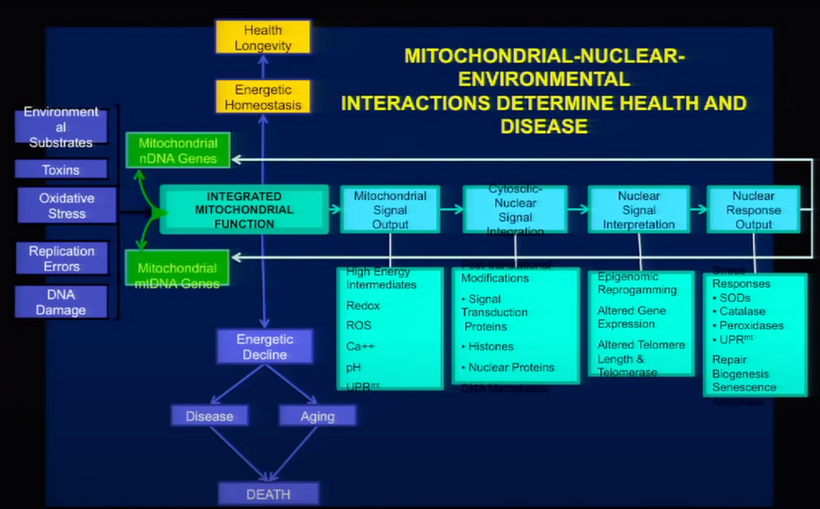

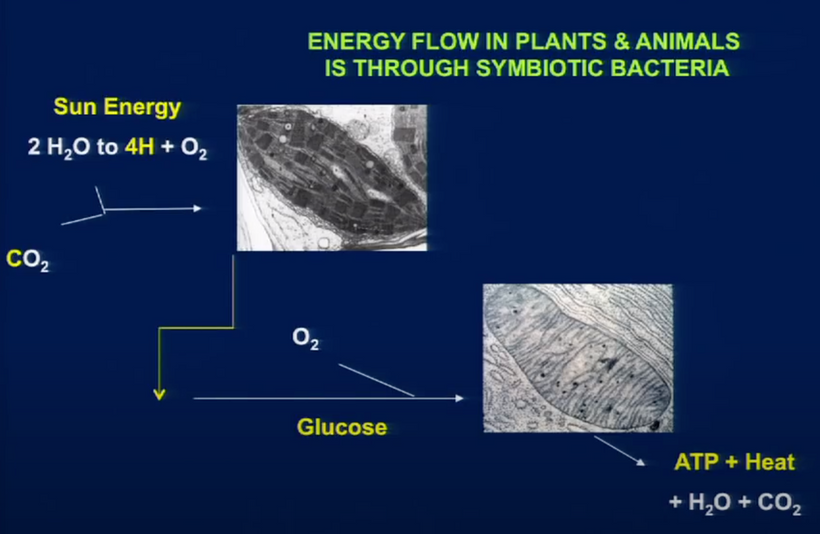

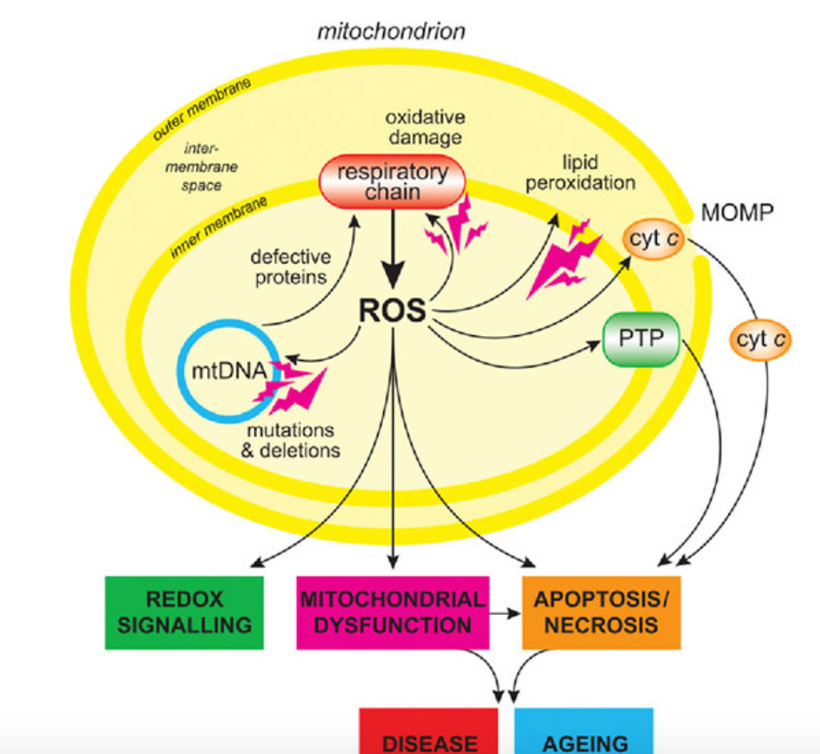

Like an engine, a clock harnesses the flow of energy to do work, producing exhaust in the process. Engines use this energy to propel; and clocks use it to tick. The exhaust in living cells is codified in the CO2 and water appears via transformed atoms by mitochondrial components with the amount of heat generated. Entropy, in the form of energy or information — is the quantity whose incessant rise in the universe is closely associated with the created arrow of time. Free radicals are the exhaust in mitochondria that drive the arrow of time in your thermal machines, called cells. There is a deep reason mitochondria create their own magnetic field. That field is entangled to the one in the core of the Earth to maintain life’s periodicity. Periodicity = time accuracy. QED requires precision to maintain coherence.

A clock is anything that undergoes irreversible changes: changes in which energy spreads out among more particles or into a broader area. Energy tends to dissipate — and entropy, a measure of its dissipation, tends to increase — simply because there are far, far more ways for energy to be spread out than for it to be highly concentrated.

With this perspective, life cannot exist without a magnetic field because it limits the spectrum of the solar wind to something tolerable and it creates the conditions of existence to create a resonance cavity that envelops the planet and all living things so they connect to all the power sources the solar system supplies to Earth. Life taps all of these sources.

SO HOW MIGHT IT HAPPEN?

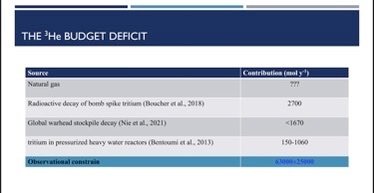

The isotope 4He is produced by radioactive decay in the Earth’s crust and accumulates in the same reservoirs as fossil fuels (mostly natural gas)

Helium-4 (4^He) is a stable isotope of the element helium. It is by far the more abundant of the two naturally occurring isotopes of helium, making up about 99.99986% of the helium on Earth. Its nucleus is identical to an alpha particle and consists of two protons and two neutrons.

Alpha decay of heavy elements in the Earth’s crust is the source of most naturally occurring helium-4 on Earth, produced after the planet cooled and solidified. While it is also produced by nuclear fusion in stars, most helium-4 in the Sun and in the universe is thought to have been produced by the Big Bang, and is referred to as “primordial helium”. However, primordial helium-4 is largely absent from the Earth, having escaped during the high-temperature phase of Earth’s formation.

Helium-4 makes up about one-quarter of the ordinary matter in the universe by mass, with almost all of the rest being hydrogen.

The CNO cycle (for carbon-nitrogen–oxygen) is one of the two presently known sets of fusion reactions by which stars convert hydrogen to helium, the other being the proton-proton chain reaction (p-p cycle), which is more efficient at the Sun’s core temperature. The CNO cycle is hypothesized to be dominant in stars that are more than 1.3 times as massive as the Sun.

I have a sense in the future we will discover that p-p fusion can happen on lower mass objects like planets. Planets have a lower mass and likely contain an unknown mechanism to operate fusion reactions of hydrogen and helium at lower temperatures.

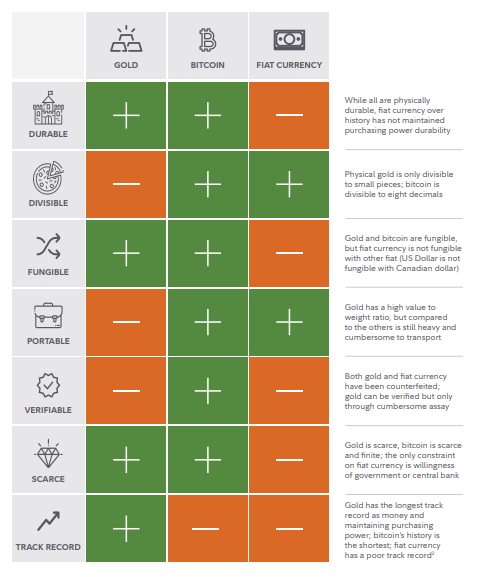

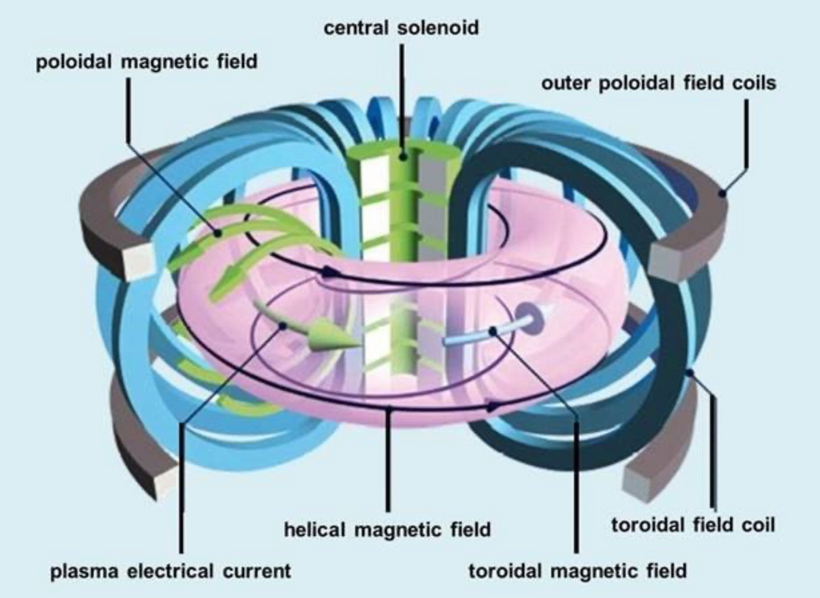

I believe the energy that creates the Earth’s dynamo comes from energy production by magnetic confinement fusion. I got this idea from reading about manufactured fusion at Princeton University long ago. Below is a picture of how magnetic confinement fusion happens. The Dept. of Energy has been working on this a long time.

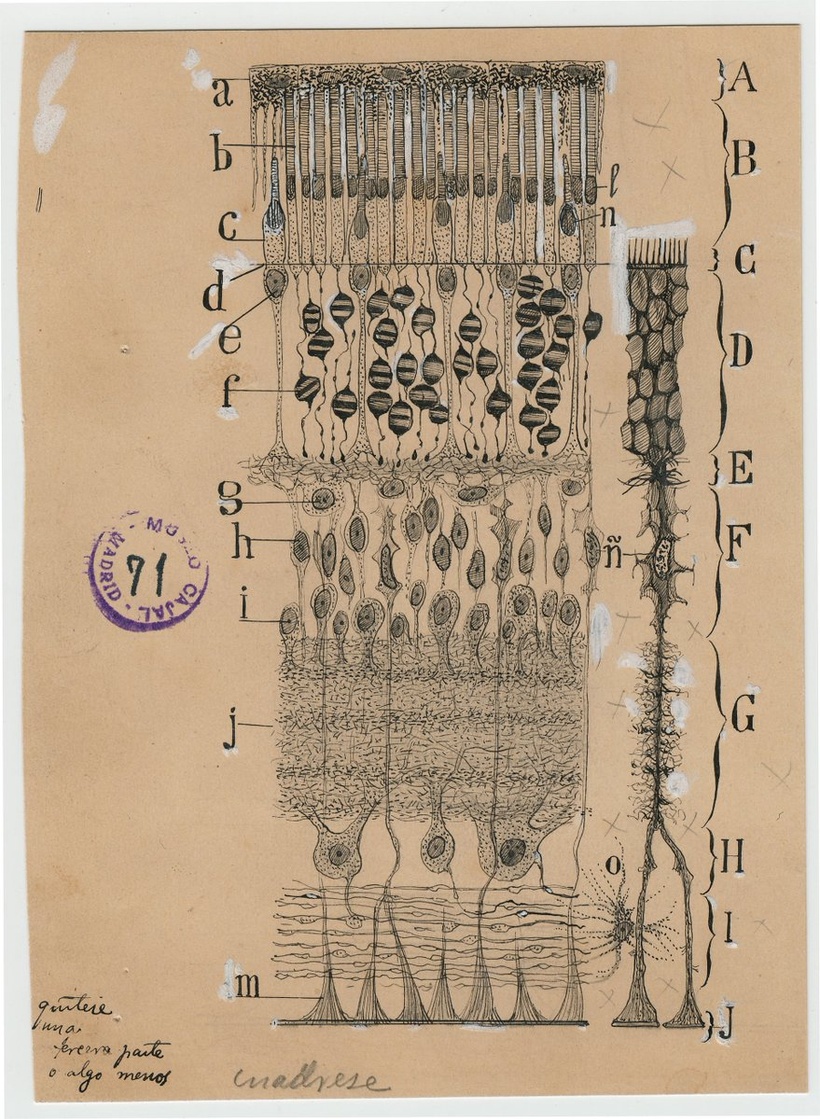

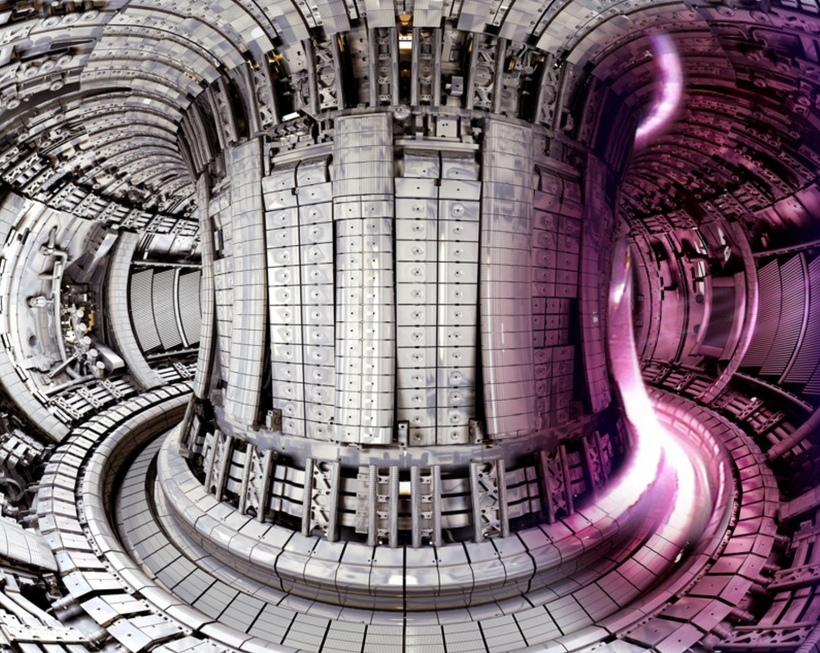

The most well-known of the nuclear fusion test reactors is the Tokamak Fusion Test Reactor(TFTR) at Princeton. It is a magnetic confinement reactor using the toroidal geometry of the tokamak, a device first developed in the USSR. It operated at Princeton from 1982 to 1997 and made many contributions to the study of nuclear fusion. It uses a combination of two magnetic fields to confine and control the plasma. One is provided by the doughnut-shaped set of external coils which provides a magnetic field along the axis of the toroid (called the toroidal field). The other is generated by the large heating current along the toroid which heats the plasma; it is called a poloidal field. This heating current is induced by changing magnetic fields in central induction coils and exceeds a million amperes. In addition to the plasma heating by this axial current, the plasma is heated by intense beams of neutral atoms which are injected into the plasma. Below is a picture inside of the Tokamuck.

I think the collisions of two planets might have created similar conditions suitable to overcome the Coulomb force of protons to ignite a dynamo inside the planet hit. This process would be temperature and pressure dependent fusion surrounded by a complex magnetic field of colliding toroids.

To test this hypothesis the number of neutrinos released in the reaction will be key to solving it. Why do I say this?

Neutrino production is extremely sensitive to the temperature of the fusion reaction. The proton-proton chain is more prominent in stars the mass of the Sun or less. This pp-chain reaction starts at temperatures around 4×10^6 K = 4 megakelvins = 3,999,726.85 Celcius = 7,199,540.33 F. Could the collision of two planets provide the spark that lit the dynamo inside of Earth? I think so. Planetary collision fueled fusion will emit far less neutrinos than the sun.

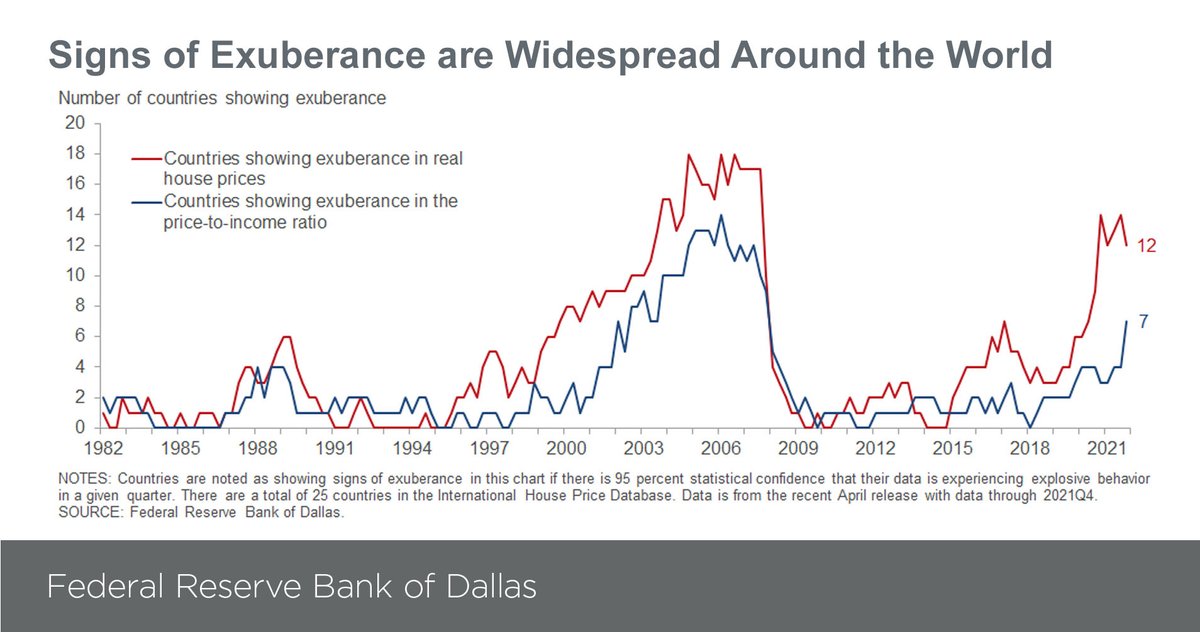

Above = Logarithm of the relative energy output (ε) of proton-proton (p-p), CNO, and triple-α fusion processes at different temperatures (T). Note how the green line continues downway below the sun’s temperatures and still allows for proton-proton fusion. This is the region where I think the Earth core operates. The dashed line shows the combined energy generation of the p-p and CNO processes within a star. This is the part of the curve where fusion has to be stellar and not planetary.

A self-maintaining CNO chain starts at approximately 15×10^6 K, but its energy output rises much more rapidly with increasing temperatures so that it becomes the dominant source of energy at approximately 17×10^6 K.

The Sun has a core temperature of around 15.7×10^6 Kelvin and only 1.7% of

Helium 4 nuclei produced in the Sun are born in the CNO cycle.

The first reports of the experimental detection of the neutrinos produced by the CNO cycle in the Sun were published in 2020. This shows you how recent this development is. This was also the first experimental confirmation that the Sun might use the CNO cycle.

IS HELIUM THE KEY TO THE PUZZLE? DOES THE MOON HOLD THE KEY?

Helium-3 (3He) is a light, stable isotope of helium with two protons and one neutron (the most common isotope, helium-4, has two protons and two neutrons in contrast). Other than protium (ordinary hydrogen), helium-3 is the only stable isotope of any element with more protons than neutrons. Helium-3 was discovered in 1939.

Helium-3 occurs as a primordial nuclide, escaping from Earth’s crust into its atmosphere and into outer space over millions of years. Helium-3 is also thought to be a natural nucleogenic and cosmogenic nuclide, one produced when lithium is bombarded by natural neutrons, which can be released by spontaneous fission and by nuclear reactions with cosmic rays. Some of the helium-3 found in the terrestrial atmosphere is also an artifact of atmospheric and underwater nuclear weapons testing.

Much speculation has been made over the possibility of helium-3 as a future energy source.Unlike most nuclear fusion reactions, the fusion of helium-3 atoms releases large amounts of energy without causing the surrounding material to become radioactive. However, the temperatures required to achieve helium-3 fusion reactions are much higher than in traditional fusion reactions

The magnetic dynamo on our planet cannot be explained by our planet’s mass. If it could the Earth, should be a dead red desert like Mars, but it remains viable and has optimized light, water, and magnetism to sustain life here for 3.8 billion years so far.

Life needs energy to remain viable. Much speculation has been made over the possibility of helium-3 as an ideal future energy source. Unlike most nuclear fusion reactions, the fusion of helium-3 atoms releases large amounts of energy without causing the surrounding material to become radioactive. Funny, life on Earth can tolerate some radiation just not a lot. This makes helium 3 something I am interested in.

Helium 3 is scarce on Earth because the planet’s atmosphere and magnetic field largely deflect the brunt of the solar wind, but the moon is far less protected. The only thing that’s close to the sun that has neither an atmosphere nor a magnetic field is the moon. People forget that moon and Earth have a complicated entangled history. The video above shows that at the 4:11 mark.

HOW DID MANKIND’S LARGEST STEP HELP US UNDERSTAND THIS 4 BILLION YEAR OLD MYSTERY?

The samples from the Apollo program show elevated levels of the lighter isotope of helium 3 compared to the puny amounts available on Earth. Researchers estimate that there are a million metric tons of helium 3 embedded in the outermost layer of the moon’s crust.

The small isotope difference in Helium on the moon is also found in oxygen isotopes as well. The Earth and Moon are believed to have been created in a collision that gave both an identical chemical footprint. We believed this until 2022. It turns out their profiles aren’t identical after all because of recent studies on atmospheric Helium concentrations and fossil fuel use.

What is more, the difference increases when you look at rocks from the Moon’s mantle, which is a layer below the surface or crust – having more lighter oxygen and helium isotopes than the Earth. This is an important lesson. The crust is where mixed debris would have ended up, whereas the deep interior would have more bits of the planet that hit us called, Theia.

Because of gravity, one should expect slightly more of the heavier isotopes closer to the Sun. Compared to Earth, Theia must have had more of the lighter oxygen isotopes, which suggests that it would have formed further away from the Sun than the Earth.

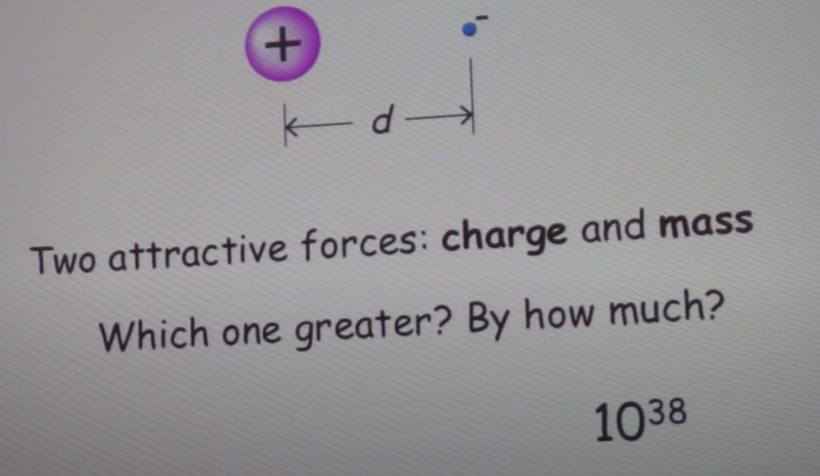

Normally, fusion is not possible on Earth because the strongly repulsive electrostatic forces between the positively charged nuclei would prevent them from getting close enough together to collide and for p-p fusion to occur. This is called the Coulomb force.

I have a sense that belief will be proven false some day in our future. I have a sense within the core of Earth due to our collision with Theia, there resides a real small, but strong Tesla magnetic field using a high-temperature superconducting electromagnet that powers the flow of molten metals in our core.

What might create that in Nature? How about a massive collision between planets 4.5 billion years ago that hit the right temperature?

THE MAGNETIC FIELD CONNECTS YOU TO THE SUN IN WAYS YOU DO NOT SENSE

The moon was created by a collision of two planets. That is the most widely accepted theory. It is called the giant-impact theory. It proposes that the Moon formed during a collision between the Earth and another small planet, about the size of Mars. The debris from this impact collected in an orbit around Earth to form the Moon. This is why its orbit is circular and not an ellipse.

There is no uncertainty at all that there are huge quantities of long-lived radioactive atoms in the deep Earth. The neutrino flux from the uranium and thorium chains has been measured (by Borexino and KamLAND) as totaling around 24 TW thermal energy (out of a total of around 44 TW). Potassium radioactivity is an unmeasured but significant source. These same measurements have caused many scientists to rule out a central reactor model of the Earth, but I have a sense their calculations are dead wrong because they are missing key data. What is that data? The reactor inside of us is shielded by this strong magnetic field ruining the measurement ability we have today. This is the same reason we do not know a lot about what really happens in the core of the sun right now. I think the key to the story will be found in neutrino production by the dynamo.

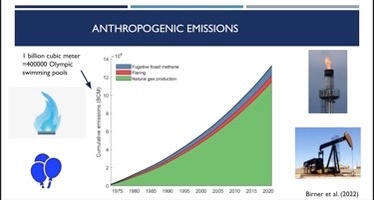

What is the clue that leads me to this conclusion? Since 1974 the globe has been poking holes into the crust and mantle looking for hydrocarbons. If there was a hydrogen/helium magnetic fusion device on the Earth for 4.5 billion years, poking holes in it should release a ton of helium-4 into the atmosphere when humans look for oil. Is there any evidence for this conjecture I am laying out in this blog? Take a look at Birner et al. 2022 paper cited below.

Levels of helium-4 in the Earth’s atmosphere have been increasing since at least 1974. Remember Helium is one of the rarest elements on the Earth.

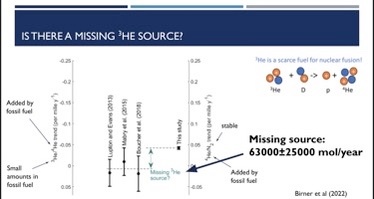

What was the most interesting part of Birner’s work to me? The very rare Helium 3 isotope is also increasing with helium 4 in our atmosphere.

That tells me there is a large source of hydrogen and helium deep in our planet for some unknown reason. Birner is blaming anthropogenic emissions as the missing piece of the helium story. I don’t think it is the burning of fossil fuels. I think it is evidence of a natural source of magnetically confined fusion.

WHAT ELSE?

Furthermore, the natural radioactivity of the Earth typically contributes roughly one-quarter of the basic background radiation dose that we are all getting all the time (mean is about 1 millirem per day). Potassium 40 is common in many building materials and in high potassium food such as bananas, carbon 14 is ubiquitous in the biosphere, and radon outgassing can contribute more than cosmic rays in an improperly vented structure over granite formation (which can be so deep the residents aren’t aware of them).

Inside the Sun, this process begins with protons (which are simply a lone hydrogen nucleus) and through a series of steps, these protons fuse together and are turned into helium. This fusion process occurs inside the core of the Sun, and the transformation results in a release of energy that keeps the sun hot.

It is important to note that the core is the only part of the Sun that produces any significant amount of heat through fusion (it contributes about 99%). The rest of the Sun is heated by energy transferred outward from the core.

The overall process of proton-proton fusion within the Sun can be broken down into several simple steps. A visual representation of this process is shown in Figure 1 below. I believe our core inside of Earth is running proton-proton fusion at low temperatures and it is magnetically confined because of our collision with Theia.

Now you know why there is a space race to the South Pole of the moon by China and the USA. Now you know why Musk is favored by our government. Now you know why we need to build a moon base like the one pictured above.

The steps are as follows:

Two protons within the Sun fuse. Most of the time the pair breaks apart again, but sometimes one of the protons transforms into a neutron via the weak nuclear force. Along with the transformation into a neutron, a positron and neutrino are formed. This resulting proton-neutron pair that forms sometimes is known as deuterium. Deuterium is the heavier isotope of hydrogen.

A third proton collides with the formed deuterium. This collision results in the formation of a helium-3 nucleus and a gamma-ray. These gamma rays work their way out from the core of the Sun and are released as sunlight. On Earth, I believe these are confined by the magnetic confinement of our flowing molten core and are being used to drive the core. I think helium is leaking slowly over billions of years into the hydrocarbon basins created by extinct life over billions of years that make up oil basins. Humans are the first species that evolved on Earth and can tap the Earth to get to the two helium isotopes made in the core.

Two helium-3 nuclei collide, creating a helium-4 nucleus plus two extra protons that escape as two hydrogens. Technically, beryllium-6 nuclei form first but are unstable and thus disintegrate into the helium-4 nucleus. I am not sure that this step happens in the core of Earth because of our lower temperature barrier. I think this is why the Earth is leeching slow amounts of Helium 3 and 4 into the mantle. In fact, I would bet our planet’s core has a massive amount of beryllium in its flowing magma that would be a fingerprint for the fusion event I am describing to you.

THE SUN PROCESS WILL BE DIFFERENT THAN OUR CORE PROCESS

The final helium-4 atom has less mass than the original 4 protons that came together (see E=mc^2). Because of this, their combination results in an excess of energy being released in the form of heat and light that exits the Sun, given by the mass-energy equivalence. To exit the Sun, this energy must travel through many layers to the photosphere before it can actually emerge into space as sunlight. Magnetic confinement in the Earth’s core would keep the energy confined to keep the core molten to drive the tectonic plate movements on the surface.

If you want to understand the power of helium fusion consider this:

Assume that the average continental crust weighs in at about 10 cubic feet to the ton. If a ton equals 2000 pounds, this means that each cubic foot of continental crust weighs about 200 pounds. How big is North America?

Since we’re just trying to get an “order of magnitude” number here, let’s assume that on average it’s approximately 2500 miles from east to west, 5000 miles from north to south, and 35 miles thick. Let’s see here now: converting to feet that make 1.3 X 10^7 feet times 2.6 X 10^7 feet times 35 feet which equals 1.2 X 10^16 cubic feet, times 200 pounds equals 2.4 X 10^18 pounds. In normal numbers this is the same as 2,400,000,000,000,000,000 pounds (2.4 quintillion). What power source can do this?

With this much mass, we can start to rule out some possibilities. The gravitational attraction of the moon just doesn’t do the job. Nor does the attraction of the sun. The centrifugal force from the rotation of the earth probably can’t get it done. What does it leave?

Probably the most logical place to look is inside the earth. We already know that it’s pretty hot down there, and we also know that heat and density are related to physics. The short version is that when something is heated up, there is a corresponding decrease in density, and the material rises to where hydrocarbons would be in extinct carbon basins. This is the reason hot air balloons work, why the cold water is near the bottom of the lake and not on top, and why helium 3 and 4 are in hydrocarbon basins.

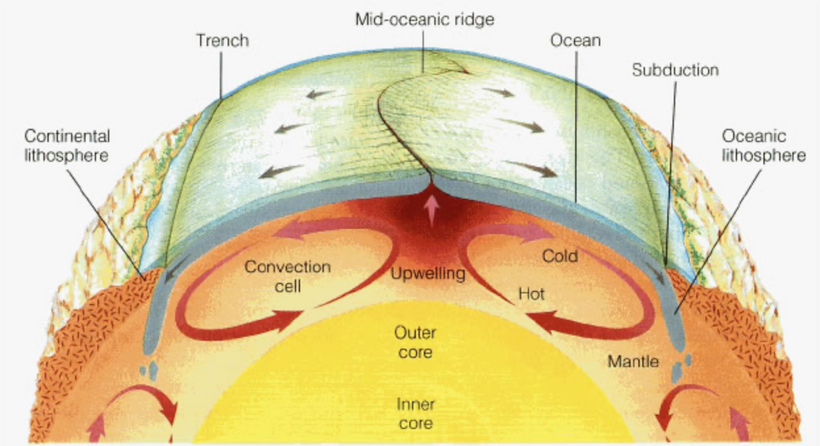

This process also drives the major wind patterns. Rock is no different, and when heated it lowers in density and wants to go up. So far so good. The problem is that if it rises it’s going to leave a void where it was, and we sure can’t have that. Just like in the lake (or the atmosphere), water, air, helium isotopes, or in this case rock, moves in from the side to fill the hole. But that just leaves another hole, so something has to move in to fill that one, and so on and so on until the stuff which moved in the first place do the filling and the circle is complete.

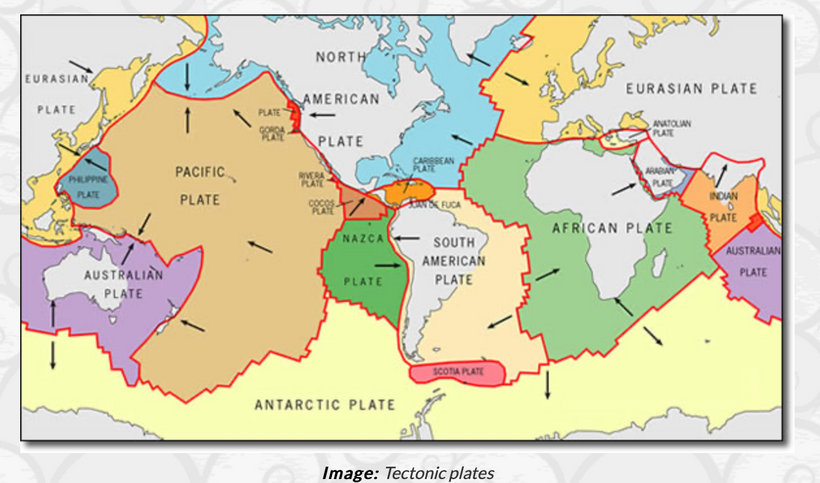

We call this circular pattern of density-driven material a “convection cell,” and as I said it’s this convection that powers the major global wind patterns, affects the ocean currents… and likely drives the tectonic plates on our planet. Deep beneath the crust the rock is VERY hot, and while there is probably too much pressure for it to be a liquid, it’s still somewhat mobile, and individual atoms like Helium and such can kinda/sorta ooze about, setting up convection cells which may carry the plates along where they rub up against the surface crust. This is how helium isotopes move too.

Most geologists accept convection currents as the most likely mechanism for plate motions. One of the biggest questions now relates to how deep within the mantle the convection cells extend.

Birner doesn’t seem to see the connections I do. I just entangled with him on Clubhouse a few days ago to give him a clue to look deeper before pointing to climate change. I did this in a group called Quantum Photonics. If you are crafty enough you probably can find the replay there. Or maybe, he reads this post because someone sent it to him.

Since this proton-proton chain happens frequently – 9.2 x 10^37 times per second – there is a significant release of energy. The core will run at far lower temperatures. Of all of the mass that undergoes this fusion process, only about 0.7% of it is turned into energy. Although this seems like a small amount of mass in the sun, this is equal to 4.26 million metric tonnes of matter being converted to energy per second. In Earth, this conversion means our core should burn 22 billion years moving the tectonic plates above. In other words, the core will be here longer than the sun will. The sun is expected to become a red giant and swallow Earth in about 10-12 billion years. In the sun, using the mass-energy equivalence, we find that this 4.26 million metric tonnes of the matter are equal to about 3.8 x 10^26 joules of energy released per second!

IS ANYONE TESTING THIS?

ITER (initially the International Thermonuclear Experimental Reactor, iter meaning “the way” or “the path” in Latin) is international nuclear fusion research and engineering megaproject aimed at replicating the fusion processes of the Sun to create energy on the Earth.

SUMMARY

How does this story of the creation of our magnetic field scale to your life right now? Your worldview has to be structured in principle on some specific doctrine that shapes how you function and view humanity. Embracing Quantum Electrodynamic theory in biology is akin to wearing steel-toed boots in a ballet-slipper world. Understanding that life is bigger than your set of challenges will help you overcome obstacles that will come your way from time to time.

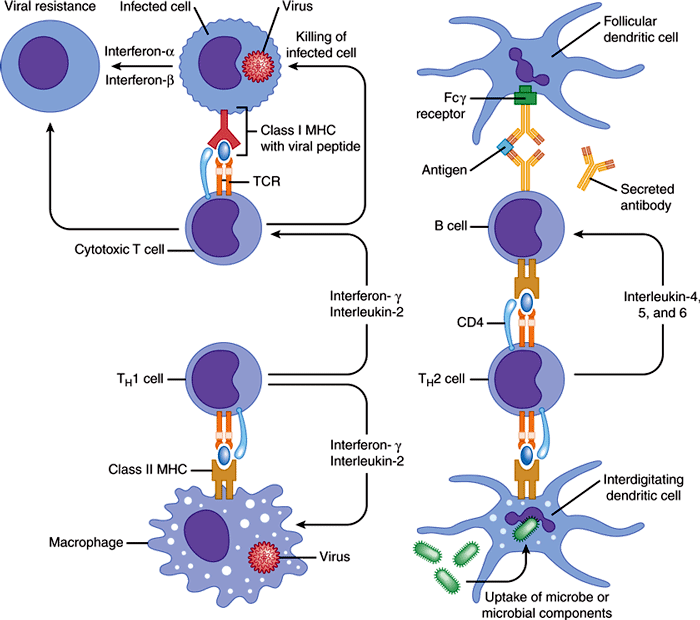

How does all this fancy physics begin to make sense in your biology?

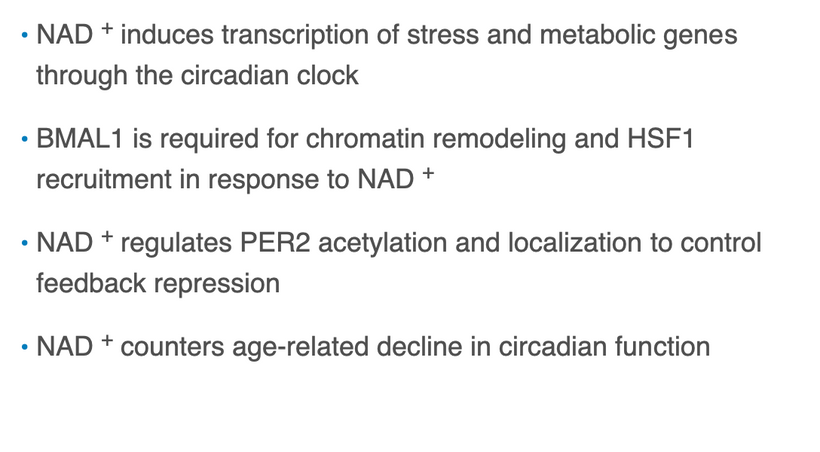

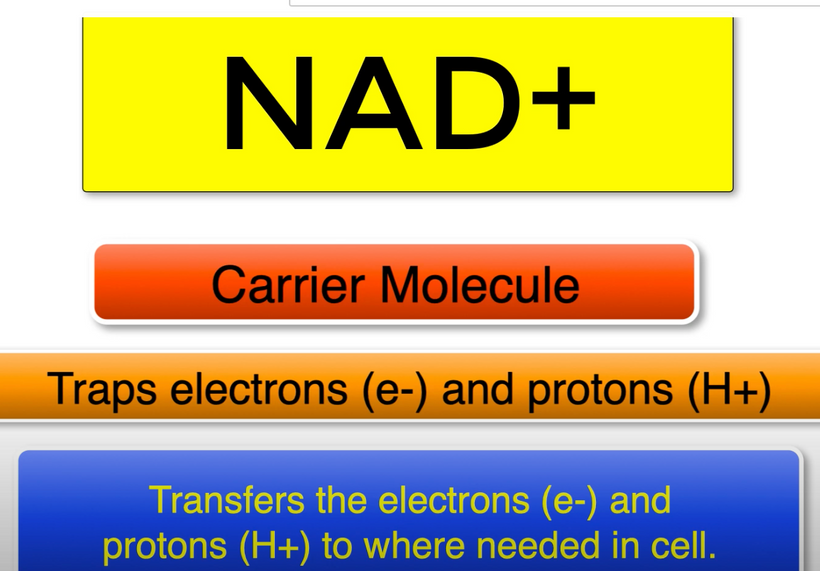

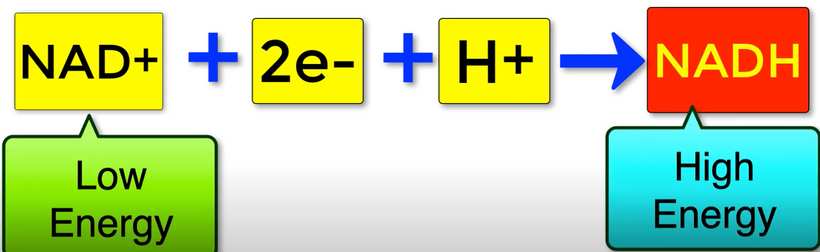

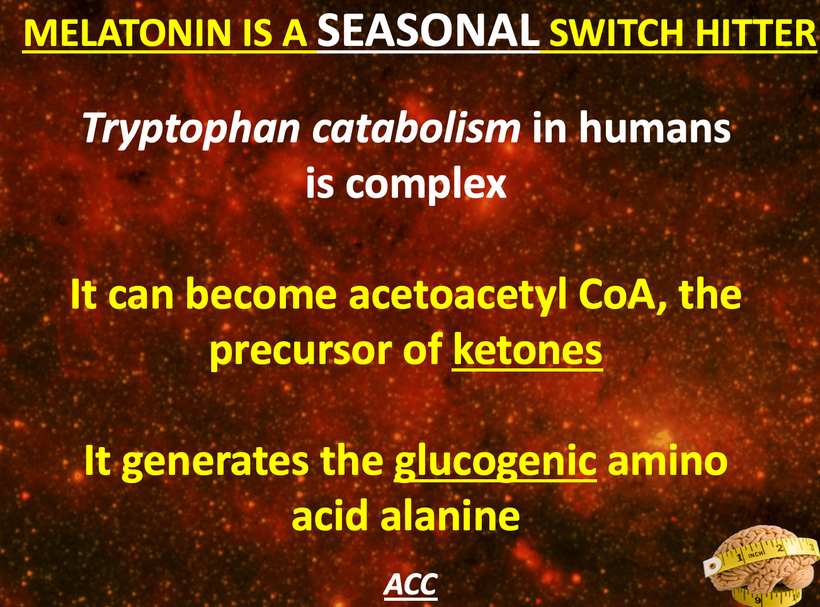

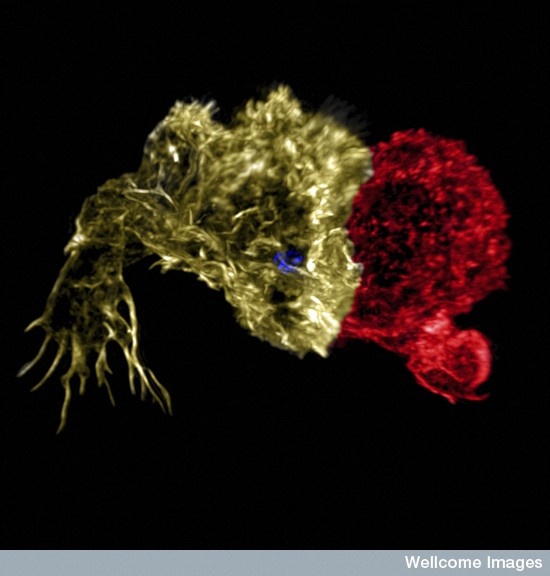

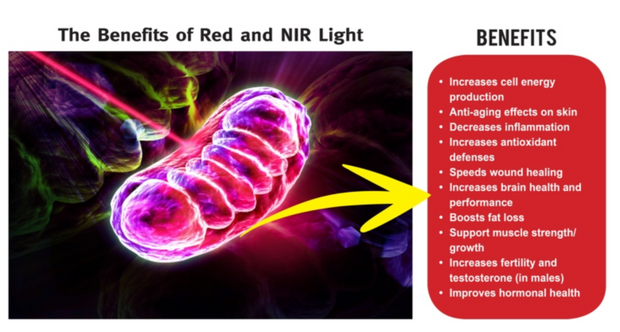

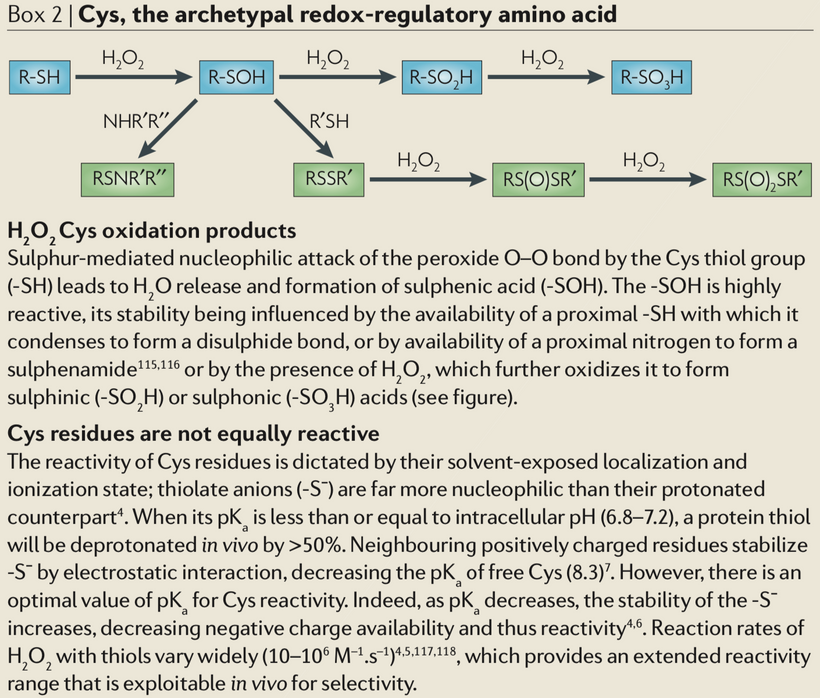

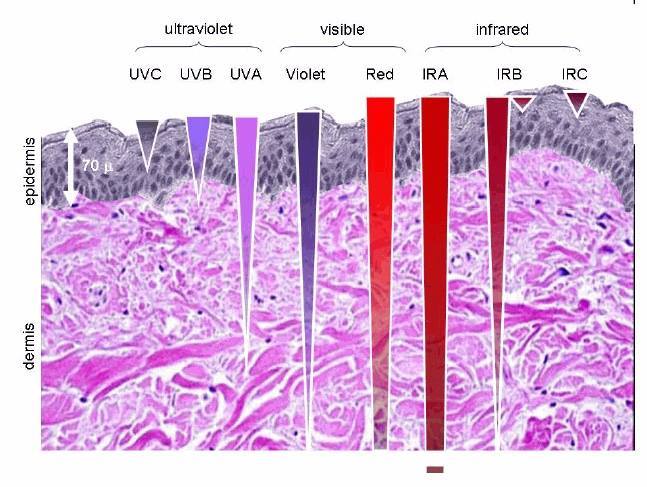

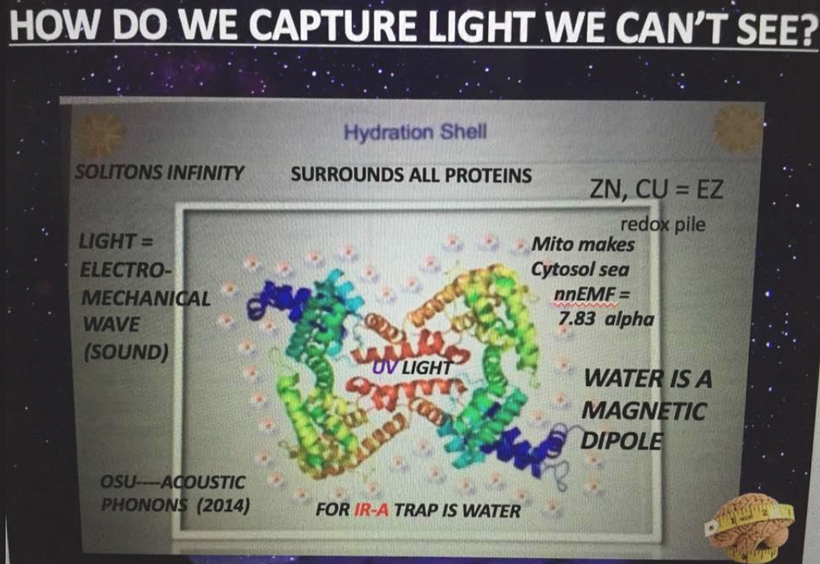

Protein modification is of major interest to a quantum biologist. All proteins are hydrated and their chemical structures act as light antennae for incident solar EMFs. When different incident light waves are present, post-translational modifications are induced or become necessary to maintain physiologic functioning. Recall that the incident light wave is electromagnetic. When it is absorbed by a protein or its side change it is changed into a specific type of electro-mechanical wave that is used by the hydration shell in the cell to signal a variety of different events.

Here is a list of some of those events and what they do for a cell. Indeed, many intra- and extracellular events depend on an occurrence of a specific chemical change that drives the change in both protein structure and function. These chemical modifications are commonly referred to as posttranslational modifications (PTM’s), as they occur after the protein biosynthesis step, i.e., the translation. PTMs and proteins involved in mediating their incorporation into target proteins add additional layers to functional properties and diversities in the proteome and are the key to a number of crucial biological processes. For example, prior to degradation, proteins are often modified several times, leading to profound variation in their behavior.

In general, the incorporation of PTMs takes advantage of the chemical reactivity of the amino acid side chains and leads to specific functional outcomes. Upon phosphorylation (addition of a phosphate group to the side chain hydroxyl group of a serine, threonine, and tyrosine residue), conformational switches (de)activate protein-protein interactions and downstream events; upon farnesylation (addition of a farnesyl group to the side chain thio group of a cysteine residue), proteins get translocated to the membrane; and upon ubiquitination (addition of a small protein, ubiquitin, to the side chain amino group of a lysine residue), proteins are recruited by the 26S proteasome for degradation. I have an entire blog series on this one process because it is a critically important step in oncogenesis. Proteins can also undergo glycosylation, the addition of saccharide units; acetylation, the addition of acetyl groups to the side chain amino group of a lysine residue; formylation, in which a formyl group is added to the N terminus of a protein; amidation, in which a formyl group is added at the protein C terminus; sumoylation, the addition of a small protein, SUMO, to the side chain amino group of a lysine residue; and biotinylation, the addition of a biotin molecule, to mention only a few.

Light from our native environment programs the things inside a cell to do all these amazing post-translational modifications. The magnetic field of the Earth assists light in this process by getting Nature’s recipes perfected. It helps craft the Schumann resonance which increases the periodicity of the molecular clocks in cells to coordinate all these modifications. The higher periodicity of a clock correlates to its accuracy. QED requires precision to maintain coherence in the living state. It has been done using a quantum mechanical method of chronic testing done over 4 billion years inside of every cell in your body. It has done this in ever cell that has ever existed on this planet.

Overall, it’s fair to say that selective modification of proteins is a key step in most biological processes. Nature uses a covalent modification of proteins to modulate their function. We call this process “evolution”. I call it “change without much changing”, except light frequencies. As such, many natural products, originating from millions of years of evolution, have adapted their structure for covalent binding to proteins. Light is what sculpts the semiconductors of life, in my humble opinion. Proteins are those semiconductors. The evolutionary process toward life all began with a planetary collision. Now you can see just how important magnetism is to all of us. (Drahl et al., 2005; Pucheault, 2008).

CITES:

https://www.energy.gov/science/doe-explainstokamaks

https://physicsworld.com/a/atmospheric-helium-levels-are-on-the-rise/