Life is a show. It’s up to you how to make your own story, do your own show and how to live your show you are on. You choose who you need to meet, where you should have your scenes, or which scenes you want to do. How awesome your mind can do right? Get to it now…….in 2022.

Here are my wishes for my TRIBE

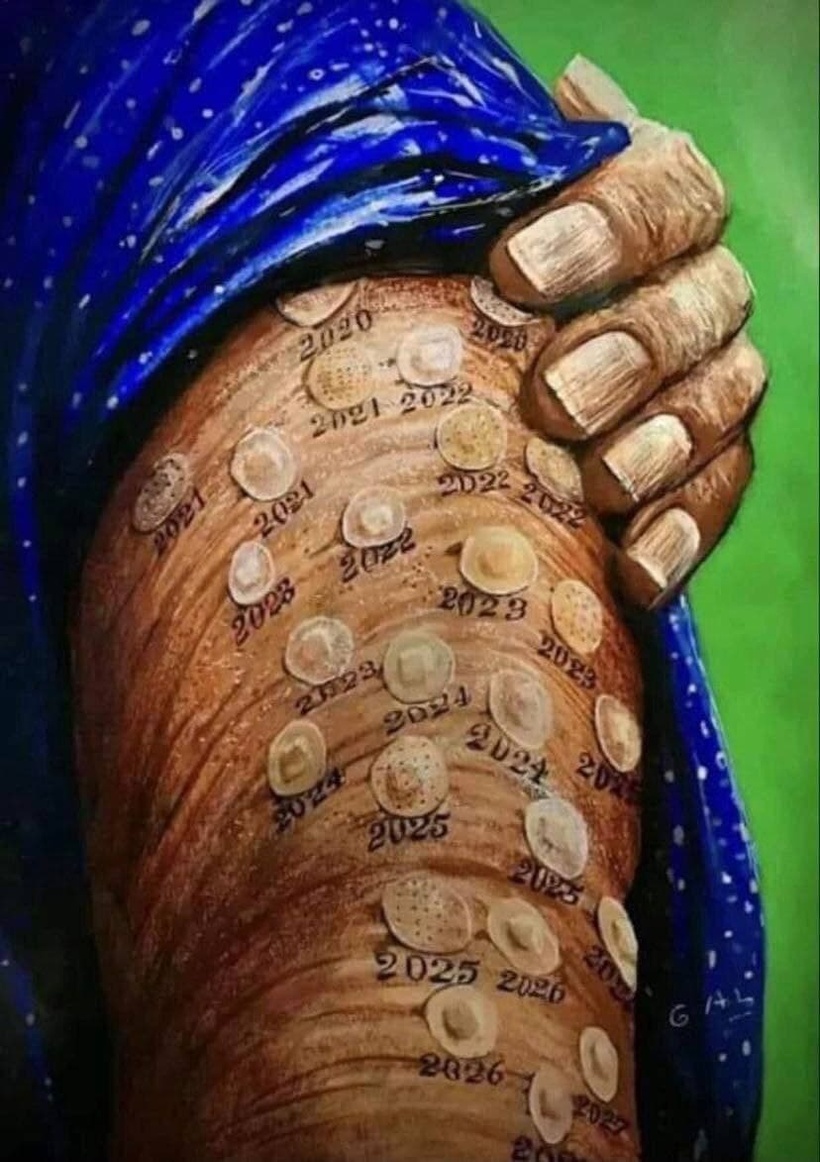

1. 2022 will be the year where COVID ends. I believe the appearance of Omicron is the biologic symbol that this pandemic is over. I still fully believe that politicians will try to extend it to usurp more power from people by enacting “Emergency Powers” in blue states as evidence of an economic capsize grows deep into 2022.

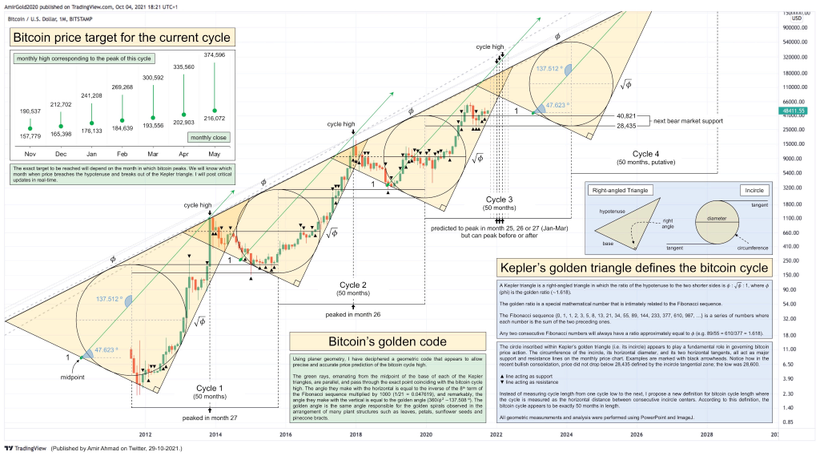

I believe 2022 will be ultimately remembered by next December as the year when the end of the debt cycle rears its ugly head for all to feel. With this caveat in place, limit your debt load and increase your conversion rate of fiat to Bitcoin. Make plans for navigating the economic reset immediately because I believe it begins in 2022.

Why?

In 2022, I believe we will experience the great monetary paradox which, I submit, is the chief secret of most, if not all, great depressions: The more the debtors pay, the more they will owe because of how deflation acts on debt. The more the economic boat tips in 2022, the more it will tend to tip further. It will not tending to right itself, because by the end of 2022 it will be obvious to most the economic ship that is the USA is capsizing.

Politics is a pendulum whose swings between anarchy and tyranny are fueled by perennially rejuvenated illusions they create. COVID was more about political science to hide the coming capsize than it was about biological science in 2021 about a virus Make sure you put COVID in your rearview mirror in 2022 irrespective of what emergency powers the government attempts to use to hinder you. If it becomes oppressive change your zip code where the cost of living is cheap and you have little to no debt.

Physicians, you get a special shout out: Censorship of doctors through intimidation of the medical community is imperative to keeping the false narrative going in 2022. Reject it if you honor your Oath. “You can check-in, but you can never leave” is becoming the slogan of US hospitals treating COVID-19. We as a group need to actively do things to change the incentives for hospitals.

Balance is a misnomer in life. What we can achieve is solid integration. Your hand opens and closes. If it were always a fist or always stretched open, you would be paralyzed. Your design is found in contracting and expanding like two beautifully balanced and coordinated birds’ wings. Many people seek balance when they should seek anti fragility.

Adaptability is an anti-fragile design and it not based on equilibrium or balance. It reads and reacts to the task at hand. When we integrate life, work, rest, and play it allows us to accept the dynamics life deals. To help with our integration consider who matters most and what matters most, your values, passion, and purpose. Base your decisions using those as markers. Do this consistently and you begin to enjoy an fully integrated life. Find what works for you and your key stakeholders and live, lead and work to attain and maintain that as best you can.

2. Avoid unit cost bias when it comes to Bitcoin price:

2013 “too expensive”

2014 “too expensive”

2015 “too expensive”

2016 “too expensive”

2017 “too expensive”

2018 “too expensive”

2019 “too expensive”

2020 “too expensive”

2021 “too expensive”

Bitcoin is always “too expensive” for those who don’t understand where we are in this set cycle. You don’t believe because your have not spent enough time to understand how the price links to the macro story unfolding. Be patient, keep learning It might take your time. But time is costing you a lot of money now so you better start thinking faster and acting on what it tells you. Your goal should be to get to 25 Bitcoins as soon as you can. With what may happen in 2022 you might be able to do it. when the chance shows up, do not hesitate to load up.

What’s the most important lesson Bitcoin taught me in 2021? I always knew earth needed education in the basics of Money but Bitcoin taught me, you need a solution first at the end of a debt cycle, not education first, so most people can see, feel and touch. Most people are not used to believing initially.

When you accumulate BTC, you are tangibly “getting ahead” because own a larger percentage of a fixed supply monetary network.

When you save fiat, on the other hand, there’s a good chance you’re actually falling behind.

When you accumulate BTC you are scooping water from a swimming pool and dumping it into your bucket.

When you save fiat:

• you’re essentially scooping from the ocean.

• your bucket has a hole in it.

^^^^this trend is unlikely to reverse in 2022.

3. History is repeated because modern people make the same old mistakes. It is happening in the world everywhere you look. 2021 has become 1931 in Germany. Resign yourself to not do this. When an institution in your life says, “We’ve always done it that way” this is an institution your should be ridding yourself of. People struggle with change because they have a hard time imagining a world which doesn’t yet exist. They wait until change becomes obvious to adapt. People who do that usually fade to black. Avoid this in 2022.

Modern supply chains are generally built for financial and operational reasons on the Japanese idea of “just in time”. Most of the time it’s OK and any problems are tiny. However when the problems come, even small ones, the problems magnify and become huge = the bill will come due in 2022 for decades of outsourcing our economic sovereignty.

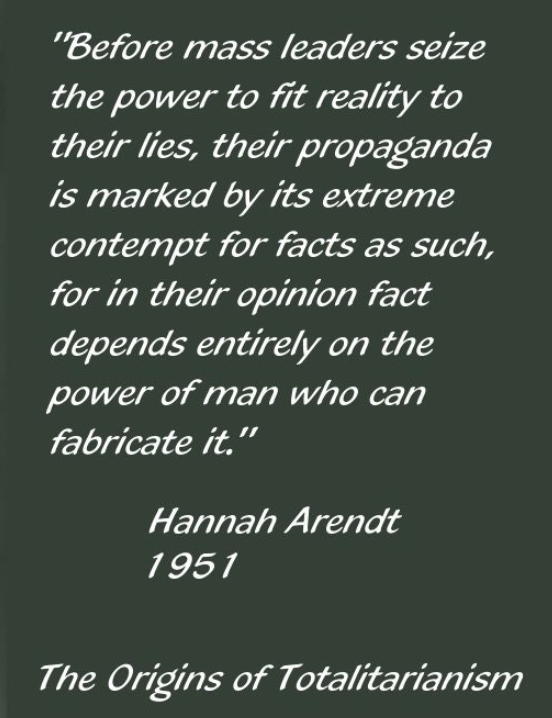

Fifty years from now history books will be written on how the tyranny of 2021 could spread. Moreover, books will be written about people who welcomed it with open arms because they fell prey to media propaganda.

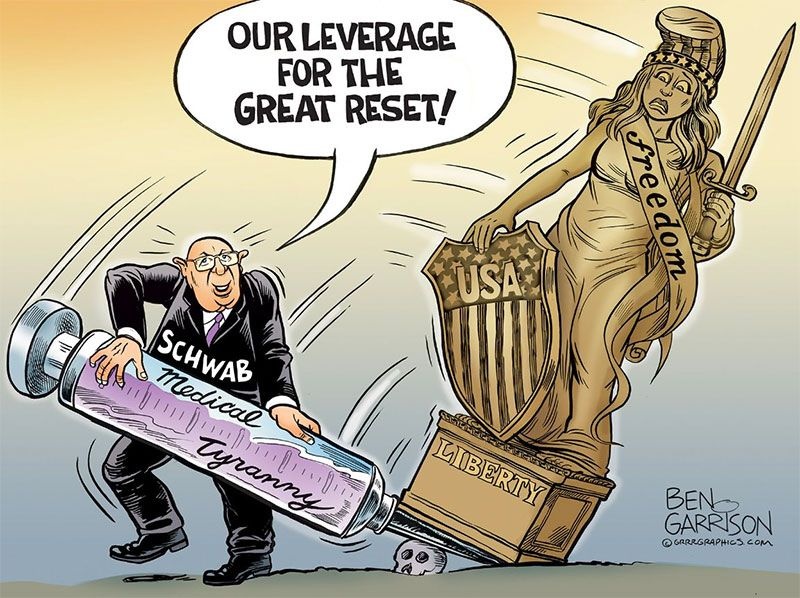

The global elites in government and the WEF/BIS thought COVID could be used to reset economies like Keynes tried to do Versailles after World War 1.

Instead, the COVID response at the genesis of 2022 is operating on the Federal Reserve like the Reichstag Fire did in Nazi Germany in the 1930s. This will likely lead to a BTC standard world sooner than most predict. I think we will see the sea change in November of 2022.

The midterms variant will be the best virus of them all. Testing and dry runs are over. It’s primetime for “We The People”

4. Have you been to your edge yet? If not, make 2022 the year you get to that edge. I believe the environment is going to help you get there because I am expecting maximum chaos to happen in 2022. Beyond the “edge” of our observed world in your mind there’s a space where emptiness and substance neatly overlap, where past and future form a continuous, endless loop. And, hovering about there, there are symbols no one has ever read, chords no one has ever heard. This is where your Rosetta stone resides for 2022. Where imagination meets vision and ideas. Go to your edge often this year. You will always be too much of something for someone: too big, too loud, too soft, too edgy. If you round out your edges, you lose your edge. Do your own thing in 2022.

5. Circumstances are the rulers of the weak; but they are the tools of the wise. Do not forget this mantra as 2022 rolls out. The happiest people are not those who have no problems, but are those who have encountered difficulties and even tragedies and have overcome them. A challenge only becomes an obstacle when you bow to it.

6. 2020 and 2021 where years when your government and institutions tried to screw you. In 2022, begin to realize how many great things could happen to you by simply confronting the things that scare you most. There are 2 types of people in the world. Those who make things happen and those who asked what just happened? Which type are you now? In 2022, change that person if the answer was wrong in 2021. To overcome anything in life you must get off the “What happened” page to the “make it happen” page.

7. Before the year closes begin to forgive those who wronged you in 2021. I have a sense many families and friends are going to face massive economic stressors. Stop keeping score. Harboring grudges is a poison to our body, mind, and soul. Today, deal with it, and remove it. Begin to forgive quickly and freely with no conditions attached. When we choose to forgive, we gain a personal freedom in how we think. Once you forget what you are worth, you forget what you deserve….However difficult we may find it to let go, there is never a wrong time to do the right thing. Remember as humans we are designed to face the very same defects and failings as others do. This reality allows us to keep things in their proper perspective. When you are able to forgive, you get back into alignment with your purpose and plan and are able to more freely share your talents with the world.

8. In 2022, become the shaft of lightning or the glowing candle that illuminates your world. Be fast, furious, bold, and strong. Arrive quickly and depart just as fast, leaving behind a brighter mind or soul or heart in all you touch. Your gifts lie not in what change brings to you, but rather in casting light on what you can bring to the world. In your work be legendary……..in your life make history.

9. This coming year make your life a show. It’s up to you how to make your own story. Do your own unique show and how to live your show you are on. You choose who you need to meet, where you should have your scenes, or which scenes you want to do. How awesome your mind can do right? Get to it in 2022.

10. Begin to explore new lands because you might need to go there to protect your freedoms soon. Use the precaution principle. It is better to be prepared than not. Every person needs to take a few days away to sharpen the blade. To go out with the setting sun on an empty beach is to truly embrace your solitude. A beach is not only a sweep of sand, but shells of sea creatures, the sea glass, the seaweed, the incongruous objects washed up by the ocean. A simple life filled with liberty is good with me.

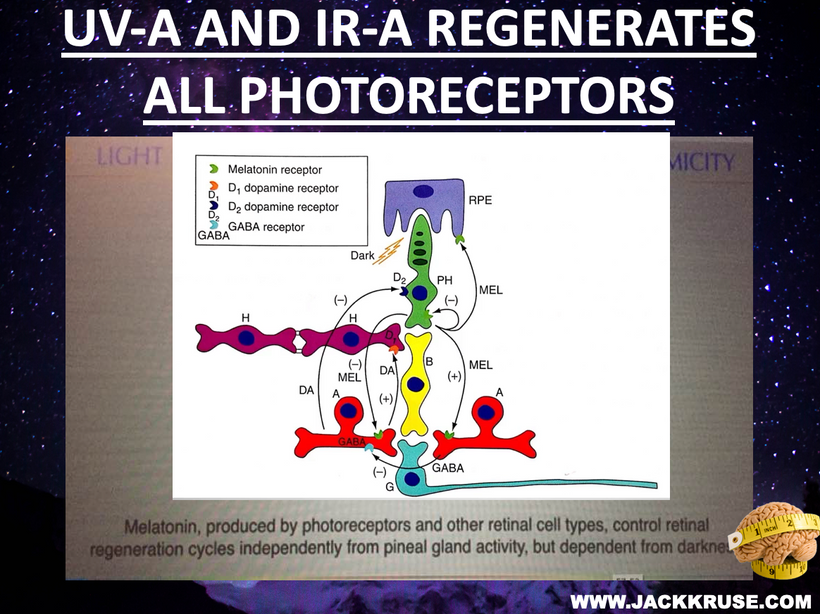

I don’t need a whole lot to rest there. Light doesn’t simply create probabilities, It guides them. Nature will naturally select the most probable, but we can let the most improbable become actual by our ‘light choices’.

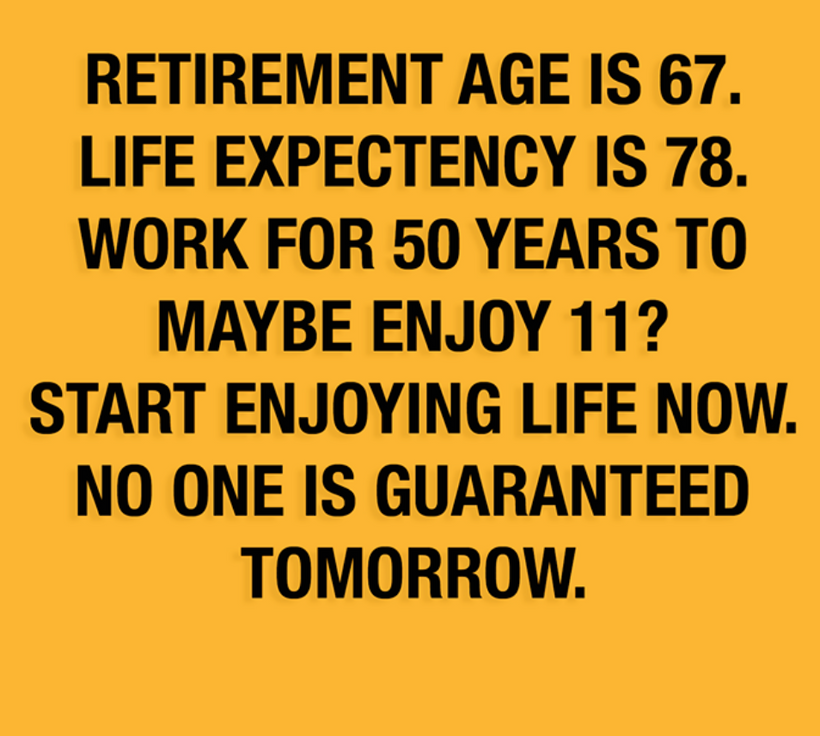

11. How are health and wealth linked fundamentally? They use time and value in much the same way. The best time to plant a tree is 10 years ago. The second best time is today.

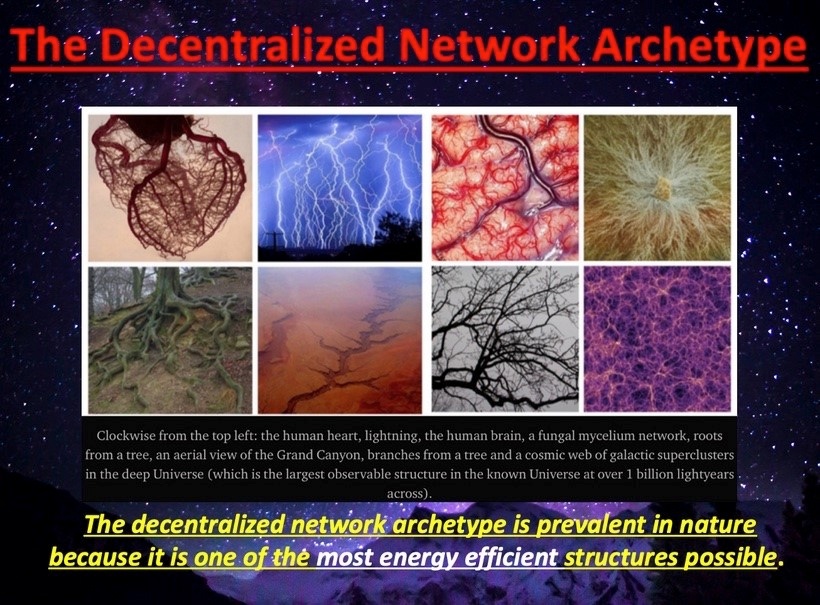

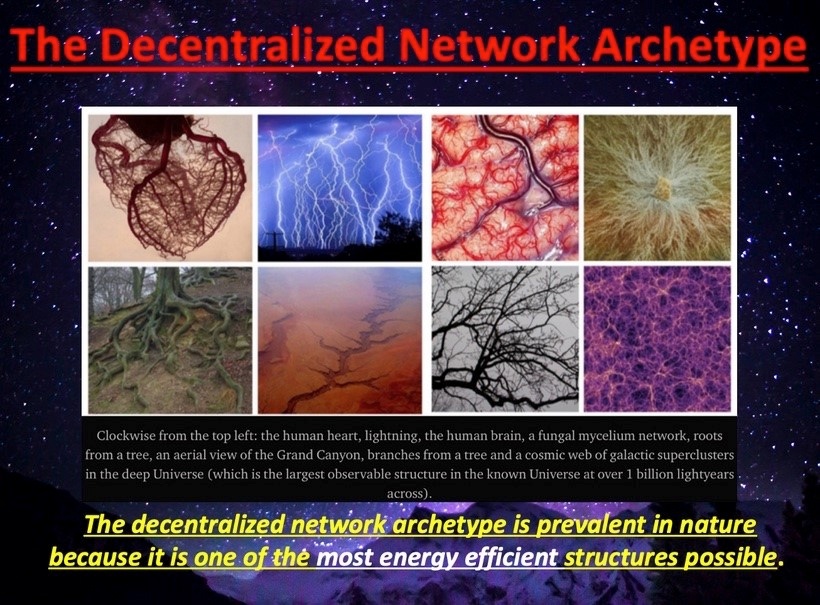

The best time to buy Bitcoin was ten years ago, the second-best time is right now. Big trees and large fortunes are built by decentralized networks that control energy/information.

12. History is just new people making old mistakes. If this is obvious to you at the end of 2021, make sure those people are not part of your 2022. We tend to judge others by their actions and ourselves by our intentions. Think for yourself and let others enjoy the privilege of doing so as well. As a leader, I cannot help people according to my temperament. I have to lead people according to theirs.

13. Where there is risk, there must be informed choice. If the choice is limited you must become fully unmanageable.

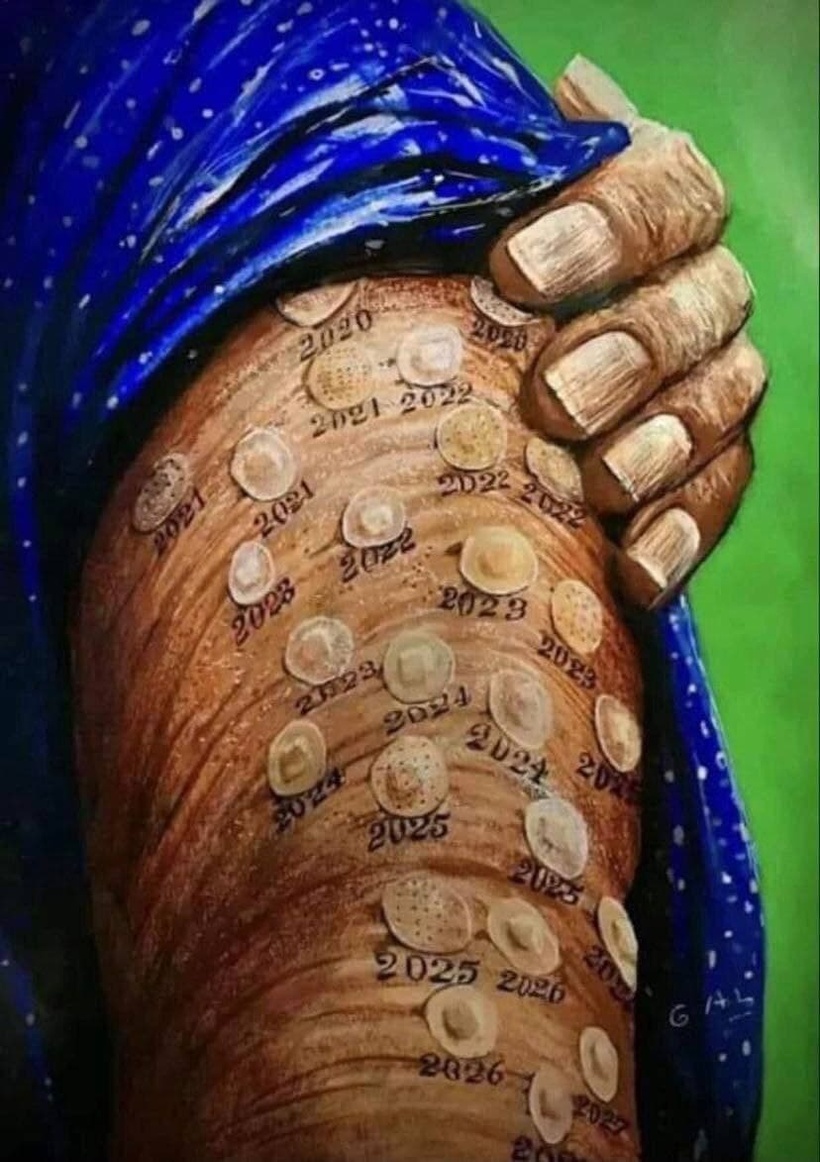

It turns out you cannot live in a free society when the majority of people within the society do not want to be free. Any COVID compliance in 2021 will be turned into a big-pharma subscription service in 2022. You cancel the subscription with disobedience to tyranny.

Freedom is not worth having if it does not include the freedom to make mistakes. The most courageous act is still to think for yourself. Aloud. Freedom is an intention resulting in a decision that leads to action. Freedom is a result of being and doing what it takes to gain it. Freedom is the release from that which holds us back from being released into who we are meant to be. Freedom is a reward that when received is prized above all others and never gathers dust on a shelf. Today’s irony is that people demand freedom of speech as a compensation for the freedom of thought which they seldom use. Freedom lies in being bold, so use it now.

Do not be forced to prove your health to participate in society. Do not accept exclusion of people based on their medical status. Voting with your feet is 100x more effective than voting with your hands. Make corporations pay for being complicit with tyranny in 2021.

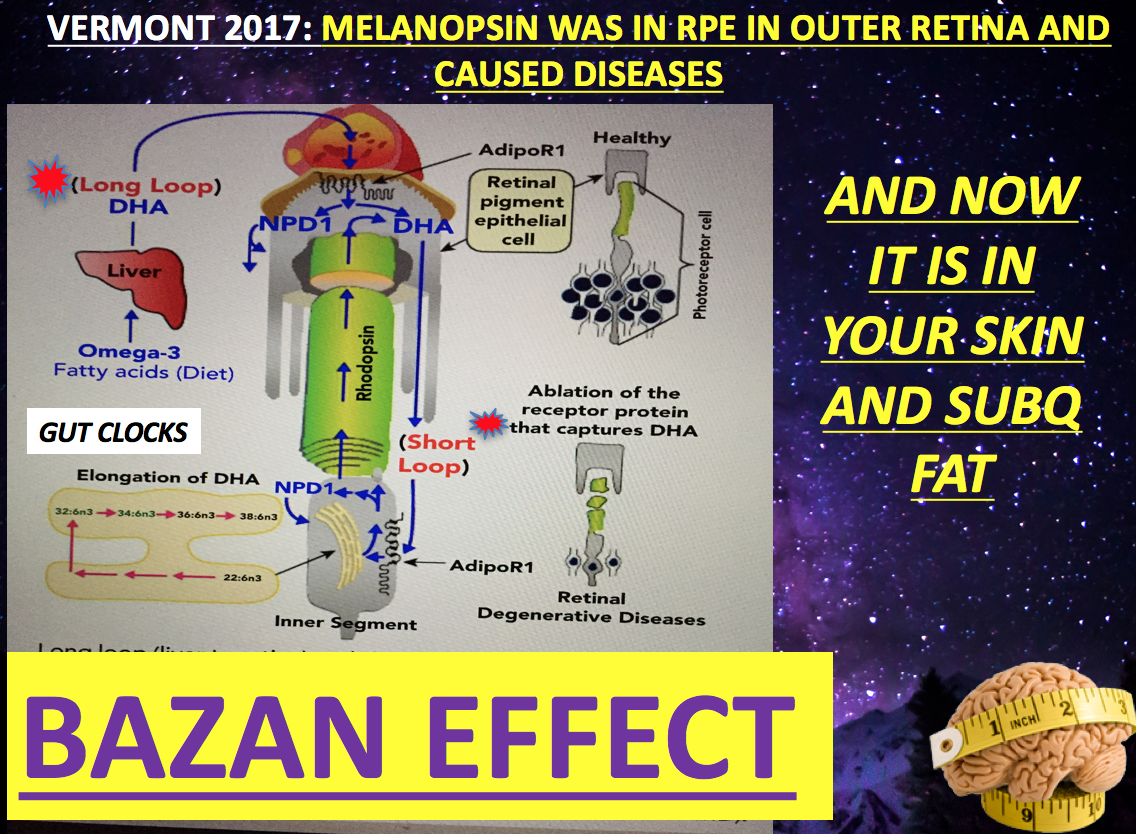

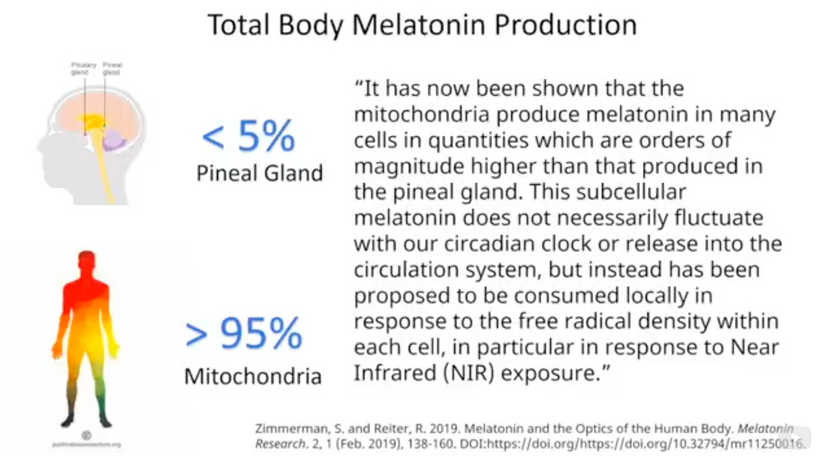

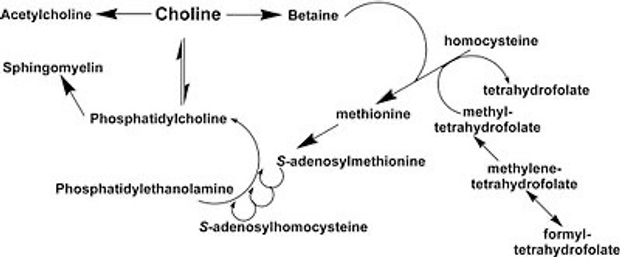

14. Remind yourself daily in 2022 what the Black Swan mitochondriac credo is all about. Can you distill what biology is for your tribe? Biology is the organization of the interplay of opposing forces that allows for the conversion of mass into high magnitude energy release in mitochondrion.

In 2022, become interested in the natural health patterns in you, and the beautiful decentralized form that only nature can create. Examine how energy that flows through you and how you get in its way at times. Begin to understand how that can create a situation that robs you of that gorgeous natural form. How all that occurs is what I’m trying to uncover and understand now.

15. The press and media have no legal right to dictate the practice of medicine. No right to intimidate or coerce physicians or patients. No right to employ propaganda to advance economic interests of the pharmaceutical industry. We all must insist that this stop immediately. Remember you have the same medical degree as Bill Gates and CNN. Good critical thinking is the foundation of science and democratic republic. Science requires the critical use of reason in experimentation and theory confirmation. The proper functioning of a liberal democracy requires citizens who can think critically about social issues to inform their judgments about proper governance and to overcome biases and prejudice.

The information system in media has gone in a direction that is no longer one that is the basis for journalism. The first amendment no longer works in the USA. There is less free journalism and more superfluous information… more is controlled from one or two sources, so propaganda is spread that suits the elite. Disconnect from this in 2022.

For example, the mainstream narrative should be reversed as it was crafted in 2021: the stock market did not collapse (in March 2020) because lockdowns had to be imposed; rather, lockdowns had to be imposed because financial markets were collapsing. COVID was used a a compliance test for the coming economic reset of 2022.

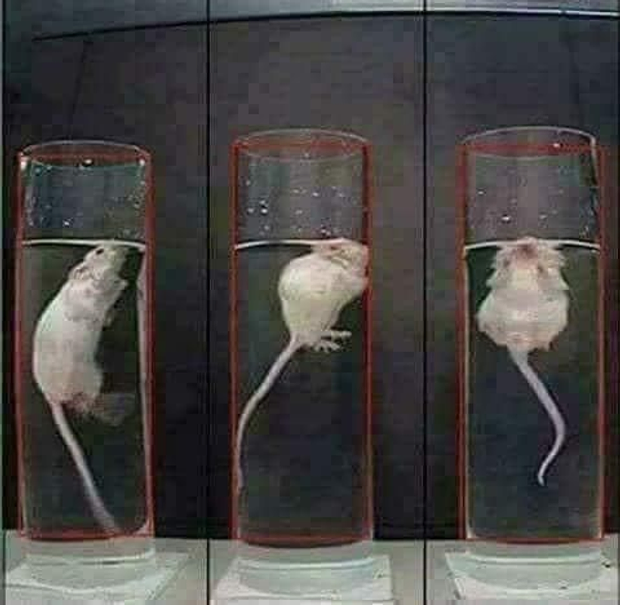

16. In 2022, you must gain the ability to use reason to move beyond the acquisition of facts to uncover deep meaning. In 2020 I was not afraid of any virus that had over a 99% survival rate and no amount of media-coverage, data manipulation or forced testing among asymptomatic people in 2021 changed my mind. Lions should not understand the mentality of sheep. The data is now crystal clear: The longer one remains in the control group in 2022, the more evidence will manifests that supports the decision to avoid the experimental group outcomes.

17. Embrace the chaos and uncertainty that 2022 is likely to usher in. Teachers need to be openly and comfortably uncertain, for the tribe to get the payoff. Why? The highest form of critical thinking can be modeled for our tribe when you learn how to destroy your own Dunning Kruger moments. A person disagreeing with her/himself always questions their own biases when changes happen rapidly around them. In the face of chaos using self-doubt improves our ability to model critical thinking.

It has often been said that the greatest enemy of knowledge is not ignorance; it is the illusion of knowledge. Do you believe this? If not, why not? How do you know you’re afflicted with this viral infection. Why does a Black Swan mentor tell his tribe constantly a half-truth always leads to a full lie? Knowing a concept wrongly is more dangerous than skipping a concept when you are searching for wisdom. The illusion of knowledge is just like drinking too much wine with your beliefs. Never get drunk with your own dogma. This idea is simply stating that ignoring something completely may not harm you as much as partial or incomplete knowledge may harm you. This is especially true in times of chaos.

18. Critical thinking will be very important in the new first turning that will begin in 2022. The new economy will be driven by information and technology. One has to be able to deal with changes quickly and effectively. The new economy will place increasing demands on flexible intellectual skills, and the ability to analyze information and integrate diverse sources of knowledge in solving problems. Good critical thinking promotes such thinking skills, and will be very important in the fast-changing world. LOL at your critics. The time of this reset is upon us now. “It’s going to be difficult. And the longer you wait the more painful it will end up being.” HYPERLINK

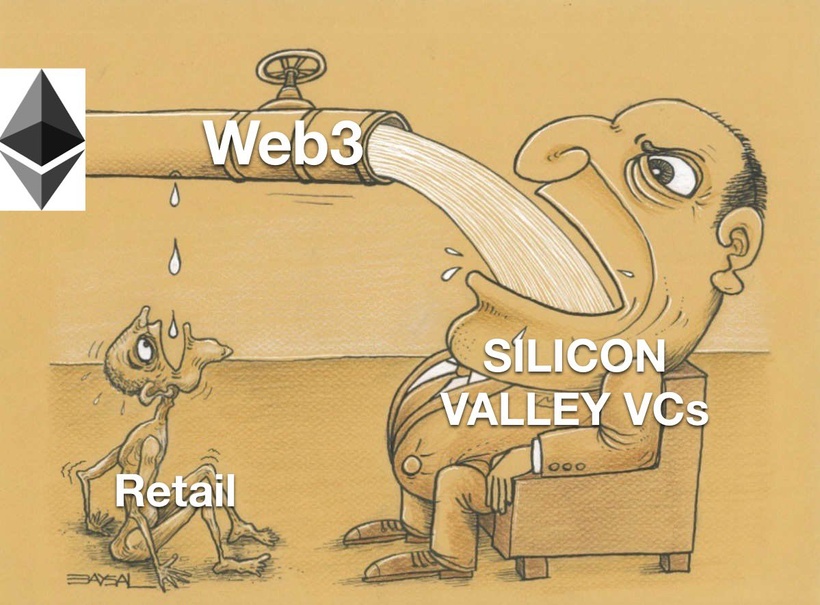

19. In 2022, if you don’t pay attention to web 3.0 you are uninformed. If you pay attention to web 3.0, you are misinformed. Web 3.0 = metaverse.

The metaverse is the ultimate safe space for tyrants who favor centralized control because of its Cantillon effect.

It will be the biggest scam of the year for those who embrace it.

Never underestimate the power of wealth people in Silicon valley taking advantage of ignorant people on Main St. They pull this off in large groups who gather on Web 2.0 products and spread their ideology on social media to build markets for Web3 businesses. It is how the virus replicates in 2022.

Web 2.0 = you are the product

Web 3.0 = you are the exit liquidity for the pre-mine

20. What lesson have I learned about my profession in 2021? The COVID experience has taught me that there is an inverse relationship between education and common sense. The higher you go in academia the less common sense can be found.

The American dream is alive and well in healthcare. The hustle is sold separately to patients individually in a package called evidence based medicine. Corporations force mandates down our throats that the government cannot due to illegality. And its funded by the guys making money on both sides of the equation.

Science must always be “pressure tested” to distill the truth. That’s the only way forward. Science isn’t ‘what experts think.’ It’s a method that corrects what experts think. In 2021, Fauci claimed he was science. In 2022, the scientific method should remove him from power.

I believe you will learn why alternative therapies and natural immunity were removed from the lexicon of medical science by bureaucrats in 2021. The jabs cost them a lot of money to develop and they needed to protect themselves from legal challenges to the EUA’s if any alternative therapy worked because this would have made their EUA’s ILLEGAL.

A curious principle of epidemiology, which only the public seems to get and the elites act like it is conspiracy theory is what happens if you give drugs that work too late int eh course of a disease?

When we find out in 2022 that ‘scientific authorities’ just published assumptive baloney which conforms to a narrative that suited the centralized elite, with no medical evidence behind it whatsoever……Then why would any sane person contend, ‘Trust the Science’?

If you don’t treat someone, until they are almost dead – your treatments aren’t going to appear very effective when studies are done. This is how methodology can be used to skew the truth. This creates an opportunity for the political ruling class. Then you can use that data, to cite that treatments are ineffective – so there are none. This can be used to create legal means to create a solution via patent that has legal protection. This is how the EUA idea was born by Big Pharma during Operation Warp Speed. This is why HCQ nd IVM were villified in 2021.

In fact, I will take this idea further. I now believe they all believe that natural immunity is viewed as an illegal theft of pharmaceutical intellectual property by people in power. They believe COVID was a flu accidentally blew into your lungs or gut. Your immune system then attempted to usurp Big Pharma IP. Your thieving-ass immune system was and remains their enemy. This is how centralized medical systems think. It is also how the people who sit next to its money printer think. This is how the Cantillon effect operates in medicine now. This is why most physicians follow the mandates of those who pay them. Physicians no longer work for themselves. They work for centralized healthcare systems. If you take money blowing downwind of a bank robbery, you’ll see another centralized system that will force you to pay it back.

The moment you allow the government to break the law for an emergency, you will live in a daisy chain of emergency from that day forward.

21. If privacy is outlawed only outlaws will have privacy in 2022. Vote carefully in November 2022. We don’t control what happens, we control how we respond to what they allowed.

In chess, a gambit is when a player sacrifices a piece, usually a pawn, early in a game to obtain some larger competitive advantage. We saw that this year in Washington DC. The Build Back Better bill was the queen of Biden’s domestic agenda. It was a bill so far-reaching that it threatened to encroach upon every corner of the economic chess board of American life. How did the opposition topple Biden’s queen? They allowed some to vote for the infrastructure bill only of there was a decoupling the infrastructure bill from Build Back Better. This maneuver was straight out of Sun Zhu’s Art of War chapter on the nine situations. When infrastructure passed with some opposition party votes the House leftist progressives leverage evaporated in an instant. The opposition seemed to know that inflation was a growing problem that Biden ignored in the process. You need to understand how COVID and Build Back Better were coupled by WEF policy. Biden was bringing the global elite agenda to the American taxpayer.

It’s hard to overstate what a bullet was just dodged by the nation in 2021 with the downfall of Build Back Better. Democratic Senator Manchin voted against this bill because inflationary concerns alone were a reason to kill it. But let’s be clear, had infrastructure and the social spending leviathan remained coupled, there is every reason to believe that major parts of Build Back Better would have survived and created a pathway to socialism and a CBDC in 2022 under Biden and Yellen.

The chess game is not over in 2022. In fact, I believe the game is now restarting. Looking at the chessboard right now, less than a year out from the midterm, opposition leadership now has enough material to compete almost everywhere in House and Senate races. I believe this is why House Minority Leader McCarthy, is already running ads for a oppositionCongress in the deep blue New York City media market. He knows what Biden’s COVID policies did to New Yorkers lives.

Any power taken by government without constraint leads to abuse. Remember when ‘two more weeks’ and ‘flatten the curve’ was a thing?

It was only 50 political narrative shifts ago in 2021.

COVID was a crisis that was used to make way for the most extreme and widespread suspension of constitutional freedoms in American history, despite being based on myths and lies. The goal of these maneuvers was to replace the US constitution with the UN Charter. This would remove your inalienable rights and put the government’s interest infront of your own. That is why the global elites have infiltrated the USA and what they have been doing since World War 2.

From the beginning of the Coronavirus crisis, the media and politicians engaged in myths, half-truths, and even flat-out lies to bring about obedience from the populace.

COVID was built as a crisis by politicians to create a cultural war to divide us so they could conquer us. It allowed a deep dive into how those in power used the emergency to consolidate power and change the very concept of American freedoms. Government, media, advertisers, and scientists all sought to set an agenda to strip Americans of their rights. From church attendance to running a business, right down to how many people can be in a private home, few rights were left wholly unchecked. What’s worse is that any challenge to the holy laws of lockdowns were criticized and censored as dangerous and deadly speech. The question that remains is whether Americans will ever allow this to happen again.

Now the lies of 2021 have been revealed. No, Americans weren’t all in the ruse together. It was not as simple as “trust the science.” Donald Trump was not a sole villain, Andrew Cuomo was not a hero, and lockdowns did vastly more harm than good to the people. But COVID did give the bankers “cover” over a collapsing dollar system system they created. As America awakens from the nightmare of the COVID, will they learn the lessons from it? I believe 2022 will bring the initial honest accounting of all the rank dishonesty.

22. Price is what you pay, value is what you get when your money is hard. when it is not hard, inflation will eat your value and it will steal your time. You will have more value and time stolen from you in 2022 than ever before if you are not prepared. Remember the more you sweat in peacetime, the less you bleed in economic war. Inflation is robbing ‘money’ of its intrinsic design. Inflation is theft of time. It was programed to operate like this by its hackers at the Federal Reserve.

23. The jab is the only product in the history of medicine whose failure is blamed on those who didn’t use it. Society and health sciences have become so synthetic and artificial that the truth now offends people. That truth will be suppressed on social media. Somehow we’ve forgotten that individual rights is the organizing principle of a civilized society. We need a separation of Science and State for the same reason we have had a separation of Church and State.

Time is only valuable when you have health. Wealth is only valuable when you have time. Clock management in 2022 will be an IQ test on risk management. You don’t lose the game, you just run out of time.

24. Your response to previous failure in past years will determine the height of your success in 2022.

25. Learn a new task in 2022. Learn how to actively non-conform.

SUMMARY

The Funnel to Nonconformity leads to:

+Become a funnel for ideas

+Let ideas fight based on merit, not emotion

+Find courage to act in nonconformity

= Opportunities others never see, or are too scared to act upon

An uncrowded market leads to outsized returns in life, and wealth.

Anger is useful in physical fights but a killer of logic. It’s a trick of the mind pushing you into a fight or flight. Let me tell you what you can’t do well when you’re fighting or flighting… think critically. Remove your anger. This is why politicians used fear to control many of us. They knew our ability to think well would be stifled.

There is a spectrum where controversies and conformity sit on two ends of the line. More conformity = less controversial

And yet, most of the wins in life land on the edge of controversy. Choose your controversy wisely in 2022, but choose it very quickly this new year.

Be careful what you read, it becomes the way you think. Words are heard, then internalized, then repeated, and then habituated. Curate what you let into your brain as you do with your body. The words you read simulate the diet you eat.

Having a strong opinion is the mark of intellect but having the ability to change it is the mark of true intelligence. Only politicians hold one stance forever for fear of flip-flopping, we mortals do better to constantly experiment. In 2022, state your ideas strongly but makes sure they are loosely held.

Every time you produce a product or idea, more come back ten-fold. So don’t make it perfect, make it happen. Then let your tribe decide for themselves.

Focus on thinking clearly, intently, and strategically before you pull any triggers.

The best ideas need breathing room. They’re a flower stretching for the sun. Clutter them with meetings or emails, and watch them die. Instead, clear your schedule every morning when sun rises and allow for no calls prior to 10am.

Anytime something is common practice, check if it’s common sense. Return to the very first principle there is: 1+1 = 2. Numbers are often terrible liars in decentralized networks. Scientists and physicists make this error all the time. Numbers are used in math and math creates statistics. Statistics are shadow casts of the truth. They do not reveal the truth. They most often rhyme with the truth. Facts are very stubborn things, but statistics are pliable. They are shadows of what might be true. This is why numbers often lie to us and undermine our ability to think.

Take that shiny new idea in your head and go explain it to a boomer. Can you take the complex and make it simple? If not, you don’t know enough about the topic. Strong beliefs paired with little knowledge is a dangerous spot to operate in 2022.

Your skin regenerates itself every 72 days completely. Your gut does the same in 48 hours if you are healthy. Your ideas need an equal level of velocity and regeneration. Challenge the old ideas and let them be reborn into something better in 2022. New learning Is a little like embracing a daily death. Do not be afraid to let ideas or people die in your life to grow.

What if your intellect is measured by how much truth you can tolerate? Can you be told you’re wrong, and that dress makes you look fat, and you’re getting older, and he’s smarter than you, and take them all in stride? If not change that in 2022.

Shortcuts and get-rich-quick schemes will get you lost. Forget the outcome, focus on the process and watch your destination appear. Avoid “shitcoinery” in crypto or fiat worlds. Really avoid the people who push these ideas on you.

Every piece of art I buy in my life is motivated by a failure I have made in my life. I never tell anyone about the failure. I keep my collection of old failures on a wall for all to see. Most people hang medals, I remind myself of scars gotten and mistakes mishandled. It keeps me honest in the new year.

Sycophants (yes men) will kill you faster than dissent. I see that everyday in Bitcoin rooms on Clubhouse. Instead of trying to fit into their “deck of cards”, be the joker in the deck. Surround yourself with unruly individuals who make you stand your ground or berate you for not.

You don’t really hold an idea in your head until you can say it with your lips. Idea, Word, Action. Speak the truth to the tribe and they will feel the oscillation. If they do not, they likely were not part of your tribe to begin with.

Fluid intelligence is the capacity to reason, make connections, solve problems, and consider abstract concepts. The fastest way to grow it? Read widely, voraciously and continuously. I hope you read here the words I craft for you and I hope you share the ideas here you find useful with others you care about in 2022.

As we come into the New Year, as personal sovereignty becomes more important… we have to realize, it starts with us It is not the tactics of money making that matter most. The most important thing you can do is train your brain to seek the ideas that stand on their own 2 feet.

A contrarian isn’t one who always objects — that’s a conformist of a different sort. A contrarian reasons independently, from the ground up, and resists pressure to conform.

The government derives their consent to govern from “We The People”. We are owed transparency by our government as it is our taxpayer dollars that fund it. There is nothing controversial about demanding answers from your government in 2022.

Why are you not getting the most out life now? You must stop doing what you always done to get to where you have not been. You can’t get the most out of life unless you give life more than you have in the past. Your life is at risk if you are not taking risks. You must give up the past to go up in the future. You have to let go off something, to get something better. Avoiding danger is no safer in the long run than outright exposure. Life is either a daring adventure or nothing at all…….time for you to chose and act at the dawn of 2022. Time is not promised to anyone by Nature.

Thanks for your continued support here in 2021. You have my gratitude. Please help me expand our tribe here by sharing this with people who need to hear the messages. Gift it to them. Show them a new way to see a changing world.