Why should you own Bitcoin right now? In this midterm election year I expect Biden to freeze prices, institute informal yield control because of currency instability (FX market), and forgive student loan debt all in advance of November. This will be bullish for Bitcoin as inflation goes into hyperinflation range and Bitcoin begins its ascent in Europe, Asia and the US

Social unrest will rise as inflation rises. Credit is the future tense of what money is today. Credit is how we borrow time from tomorrow today. When we borrow time it comes with a toll. That toll is the leverage of inflation. When we rely on credit, we need to pay more in the future money for the time we steal today from the future. Inflation is time theft. Credit to an excess always leads to inflation because of how credit links to time.

Hod do I see things breaking now?

The shortage of gas/diesel supplies in Europe is going to explode the price of hydrocarbons very soon = target $120 = DXY going higher = Fx risk rising = credit crisis probability increases. What happens on May 4th or May 11th will be additive to the motion of inflation in this broken economy.

The effects of inflation bad currency FX trades and High Yield bond losses for banks have cause the bank stocks to drop 25% in the last month. The Swiss franc is one of the strongest rmeaining currencies in the world, but even the Swiss banks got hit with this risk. The Swiss Central Bank got hit with a 35 billion loss.

Why would a strong bank with a strong currency get hit with this loss? To answer this you have to understand how the global economy is connected and how it works. The Japanese yen is dying. The last 7 weeks it is the second worse currency in the WORLD in terms of its strength. It has been getting weaker because of rising US interest rates and higher oil prices in Europe. Here is the recent chart of the Yen plotted against the USD.

As Yen gets debased, so do South Korean Won, the Chinese Yuan, and Euro. These currencies weakening makes the global economic system react to these stimuli via the butterfly effect. A small currency change in Asia is capable of taking down the global financial system, defines a butterfly effect. The symptoms of this currency flu is now being seen in the US bond market yields and in equity instability. US bond market has an inverted curve and the pressure on the ten year bond continues to go higher as inflation risks go higher. The pulse of inflation in the US is not what it is in Europe.

What is driving US inflation?

The zero COVID policies in China. This has totally shut down all manufacturing in the top three ports in China which means supply chains disruptions in the US will be down for the next 12-24 months causing US inflation and a serious drop in US GDP. GDP was just announce as negative yesterday for the current quarter in the US.

Proof that GDP is headed lower and recession is here already?

We are getting additional data/signs of economic slowdown from forward looking indicators The 6-months forecast for new orders in the Philly survey today printed at the lowest level in 10 years, and similar metrics in Europe look bad too Plus China in lockdown

Credit markets are sniffing some issues here, with junk credit spreads in the US on their way to convincingly break the 400 bps mark.

GDPNow estimate from Atlanta Fed has moved lower for 1Q22; now at +0.4% (q/q ann.) … nowcast for real PCE has declined from +3.8% to +2.4

The PCE came out today at 5.2%. So inflation is here to stay in US. The patient is in the ICU now. The symptoms are present.

Where can we see the symptoms of all this inflation in the US? American bank stocks. If you own bank stocks think about dumping them because banks are slowly catching the High Yield bond flu now. These stocks are down 25% from their recent highs.

Interest rates in the US have risen dramatically in the US and this make the dollar stronger compared to all other currencies. That is not good for them. At home a strong dollar and higher interest rates are toxic for real estate. The US private sector sits on more than $35 trillion of debt and you think mortgage rates and corporate bond yields above 5% will have no impact on the system? Think again.

Why do people really think the FED will hike aggressively in 2022 with VIX over 30?

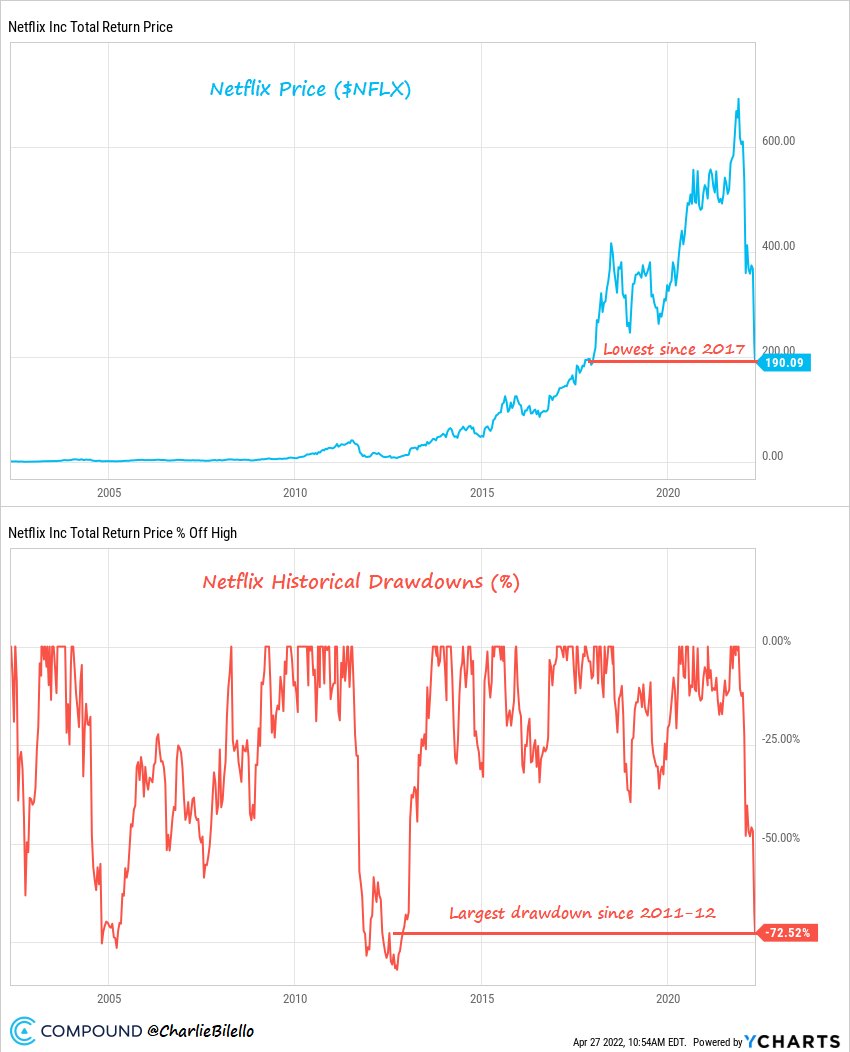

The equity markets are getting crushed in April. See Netflix and Amazon as proof. Netflix is back to 2017 levels, down 73% from its high

Banks are not leveraged to loans like they are in usual past financial crashes. This time they are bag holding junk bonds in massive numbers. When the powder keg blows bag holders get covered in shit.

the CB in Germany, Deutsche Bank is now calling for 5-6% Fed Funds rate needed to tame inflation. I can tell you at those rates you not only tamed but literally killed inflation, growth, the housing and the stock market, the bond market, and Cathie Wood’s joie de vivre. It would create a stong US dollar which would destroy everything.

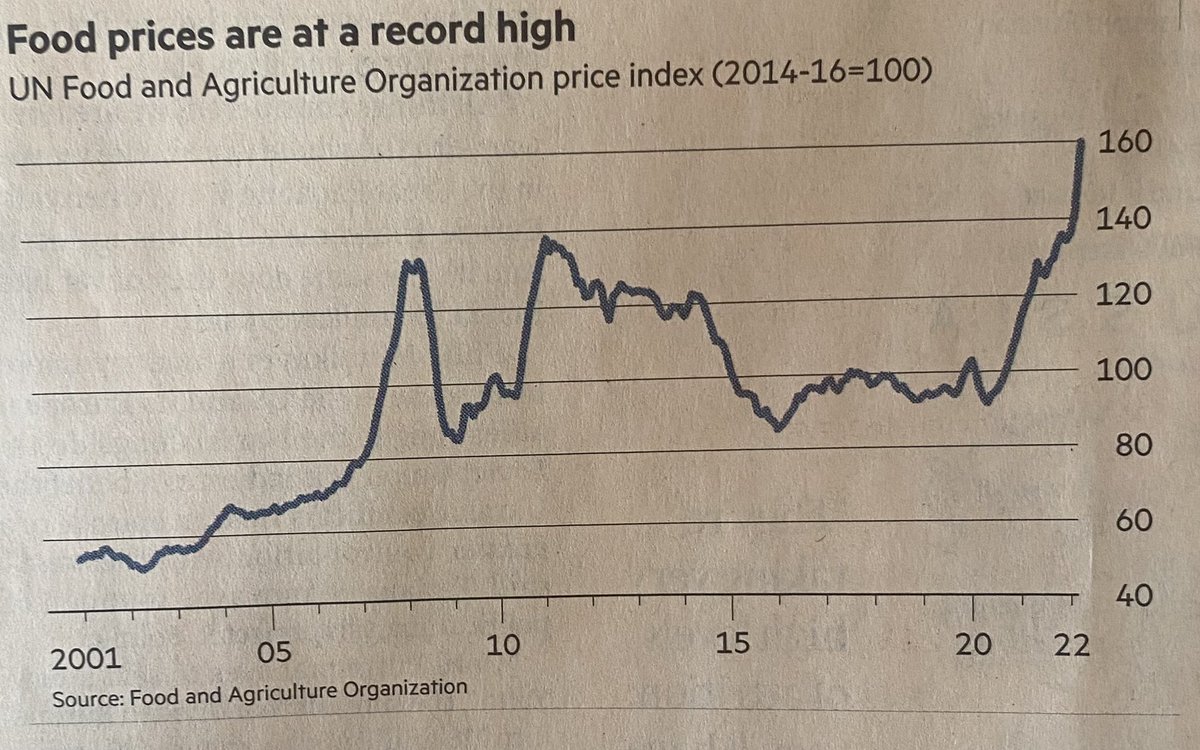

Germany’s consumer confidence has broken the 2020 lows, and food prices are skyrocketing. Probably nothing. LOL

I believe risk assets (stocks/bonds) are not correctly priced for the macrocycle ahead. Either long-end real yields are going to rise enough until something breaks, or we get a growth slowdown of larger magnitude than currently priced in. This is why the big cap stocks are getting killed in April.

The month’s not over, but April is thus far the worst month ever for most popular growth/FANG-like names relative to S&P 500.

With the Ukrainian War raging, Russian hydrocarbon costs for Europe is increasing dramatically. This also weakens the Yen/USD couple. As the USD get stronger, the euro falls in strenght to the USD. We can see this via the DXY. The lower the euro falls relative to the dollar, the more inflation will stay elevated in the EU. The Russian actions with hydrocarbons sales to Europe implies WTI is going much higher than most expect & this will drive EU inflation way higher. Zero COVID will drive US inflation higher. Soon both with be additive and the effect will be seen in global currency FX trades, causing widening CDS spreads, and High Yield bond implosions on banks’ balance sheet = PERFECT STORM for the global economy.

In April, Gemrany PPI was at 30.8%, Spain at 46.6%, and Italy Italy PPI 37% YoY at same time GDP -0.2%. This shit is hitting the fan folks.

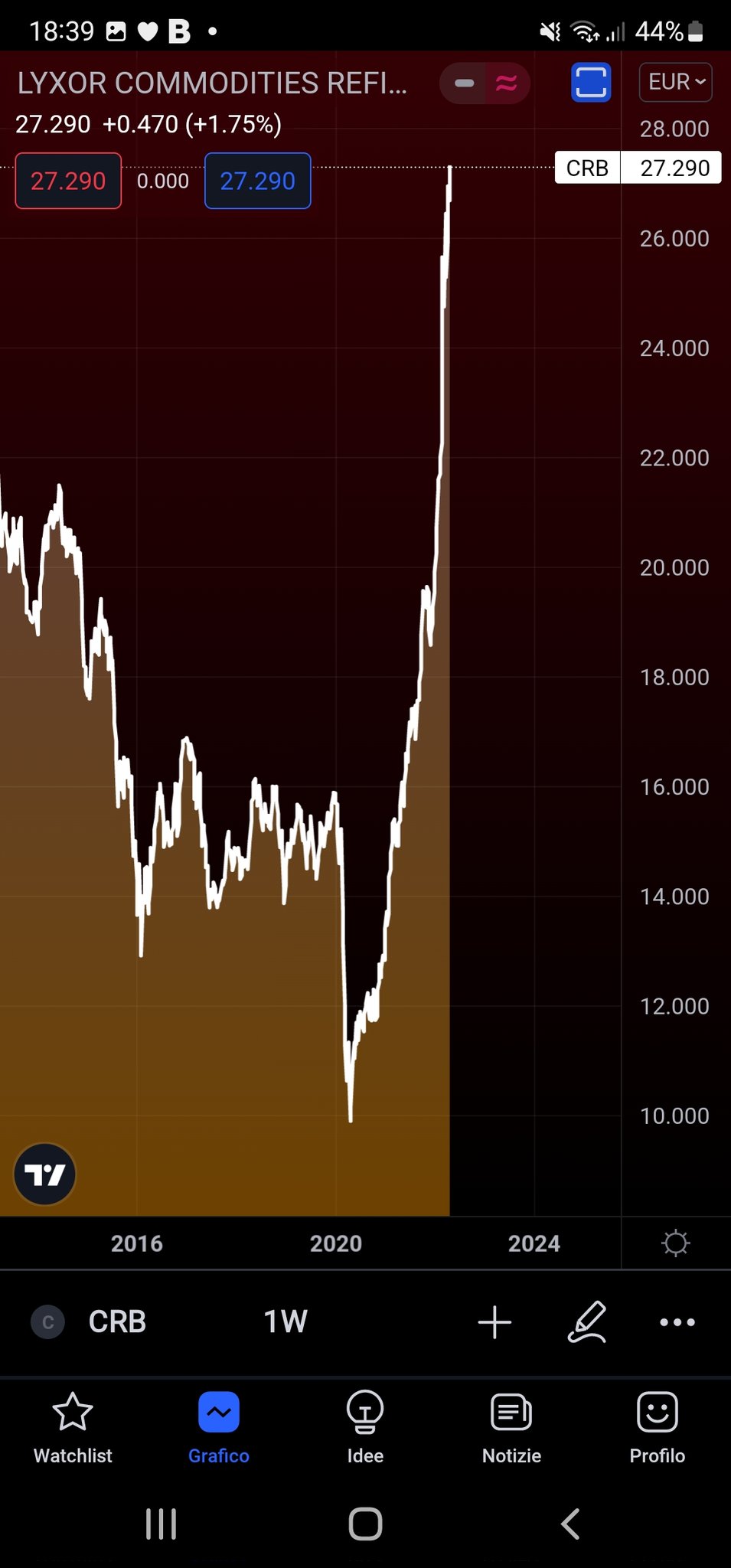

Putin’s effect on EU inflation undeniable. The ETF of commodities in euro currency has just hit a new high. Inflation will remain elevated in the EU.

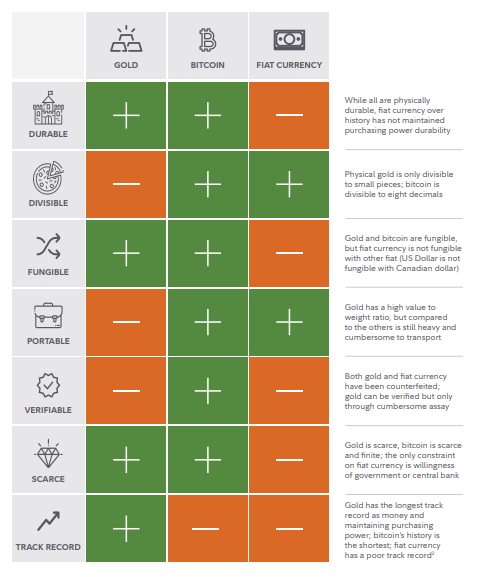

How do I know Putin is winning his war over Brandon? The ruble is up and the dollar is down. Seems like this should be a bigger media story. More proof Putin is winning this economic war? Check what Italy is doing right now: ITALY’S ENI is preparing to open a new ruble account to purchase hydrocarbons. Ya’ can’t make this shit up. The Russian currency is now stronger than it was before the war broke out because Russia back their currency with gold//Bitcoin to force the rest of the world to buy their hydrocarbons with something other than the dollar.

SUMMARY:

Inflation is going to harm the bottom 90% of the population who has little to no Bitcoin.

A new NBC poll: 20% of Americans and *40%* of Black Americans own / have owned cryptocurrency Likely on the high side, but a clear trend Bitcoin will be increasingly popular in America and politicians that oppose it will pay the price at the ballot box in November.

The leverage of the US consumer is the ONLY real data to look at in a fiat world based on credit and debt instruments. Inflation is a negative entropy to the leverage the US consumer has. Eventually, their ice cube melts under the furnace of inflation.

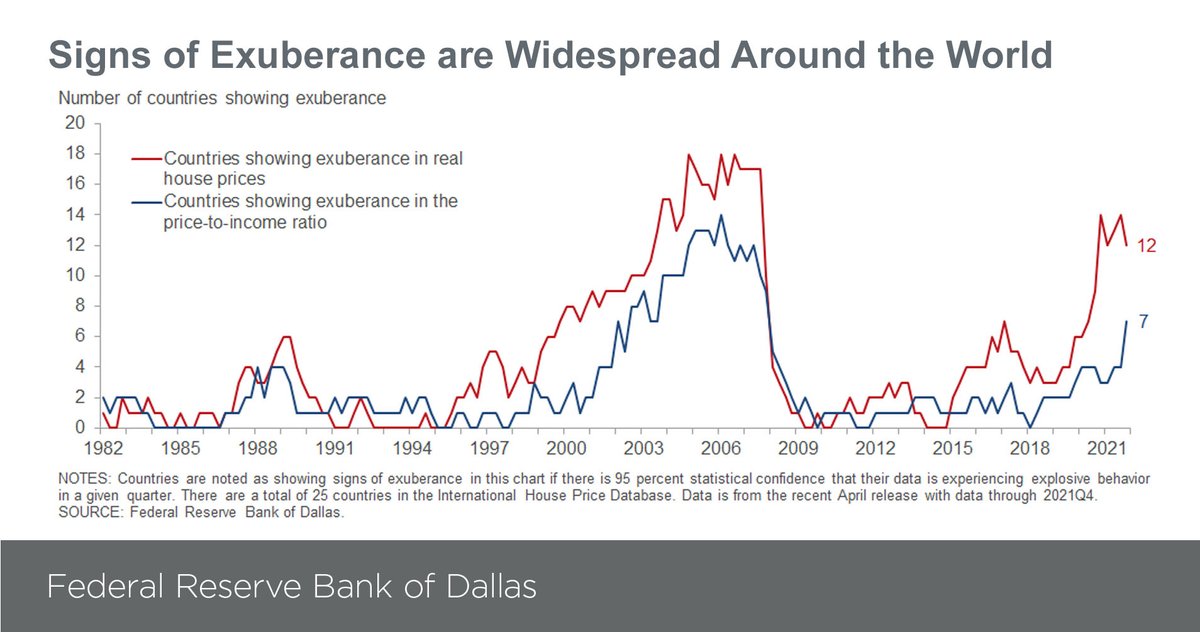

US wage inflation skyrocketing in US now at 32 yr high but wages still do not offset the loss of value from the 8.5% inflation rate. As for the United States real estate market, home prices are 30% overvalued with respect to incomes, rents, and consumer inflation.

We now have Fidelity offering BTC in 401K plans. We have several more countries making Bitcoin legal tender.

Nation-states, cities, and autonomous regions are adopting Bitcoin

El Salvador

Lugano

Prospera

Madeira

Central African Republic

Panama

Folks think the price of crude oil will collapse with the lockdown in China: Think again! Lower lows being made on OECD commercial oil inventories which means supplies are going down and prices have to rise when this happens. Moreover, things in China are getting WORSE with zero COVID lockdowns = EU in deeper while global Fx risk rising.

This is the 2nd time since 1996 that equity mutual funds and ETFs saw outflows of more than $20 billion in back-to-back weeks. The other was October 2008.

JAPAN Minister Of Finance OFFICIAL said this week: EXCESS FX VOLATILITY is undesirable for Japan and the global economy. Xi seconded that opinion. His currency is also failing. Neither of them seem to comprehend that Asian monetary policy is driving the currency debasements. The recent moves are concerning, but Japan keeps buying bonds… the Bank Of Japan is trapped and the Yen keeps being debased as a result. As it get weaker, the USD gets stronger on a relative basis. The stronger the USD gets (DXY) the larger the wrecking ball gets for the global economy.

The blog take home? Dollar strength > global deflation = DXY is a global wrecking ball = massive credit crisis = global depression Caveat emptor.