Strong network effects are at the core of every platform technology business. All of them employ algorithms to drive their success or failure. 70% of enterprise value is locked up in these network effects. A network effect increases the value of the company or currency as new people join the platform and it expands its influence. For example, in the game Monopoly, once enough properties are owned by a single player, renters can’t afford to pay rents and are therefore forced into bankruptcy – and the game ends.

For those who have played, you will notice how systems work. ie – Once you have an early advantage, the game becomes easier (because you have the rents) to acquire more properties, add more houses/hotels. A “positive feedback loop” is created – concentrating wealth. This idea built into the fabric of the game explains to you why TIMING matters most in economic It turns out in a technocracy platform 42% of enterprise value comes from having good timing. Bill Gross of Idealab did a TED talk on this in 2015. Listen to what he said about timing.

In the Monopoly board game, you might also notice that the wealth in the game “might” be due to luck – landing on the right squares early in the game gives you a massive advantage. Right place right time really matters.

Conversely, missing out on acquiring those assets early creates a “negative feedback loop” which also reinforces on itself. The poor become poorer until they become insolvent as they move around the board paying higher and higher rents. The result become inevitable as they bleed all their cash reserves.

Fortunately – it is just a game. The game ends! Someone gets bragging rights – and all are given a fresh chance to “win” when the game begins anew with everyone being equal.

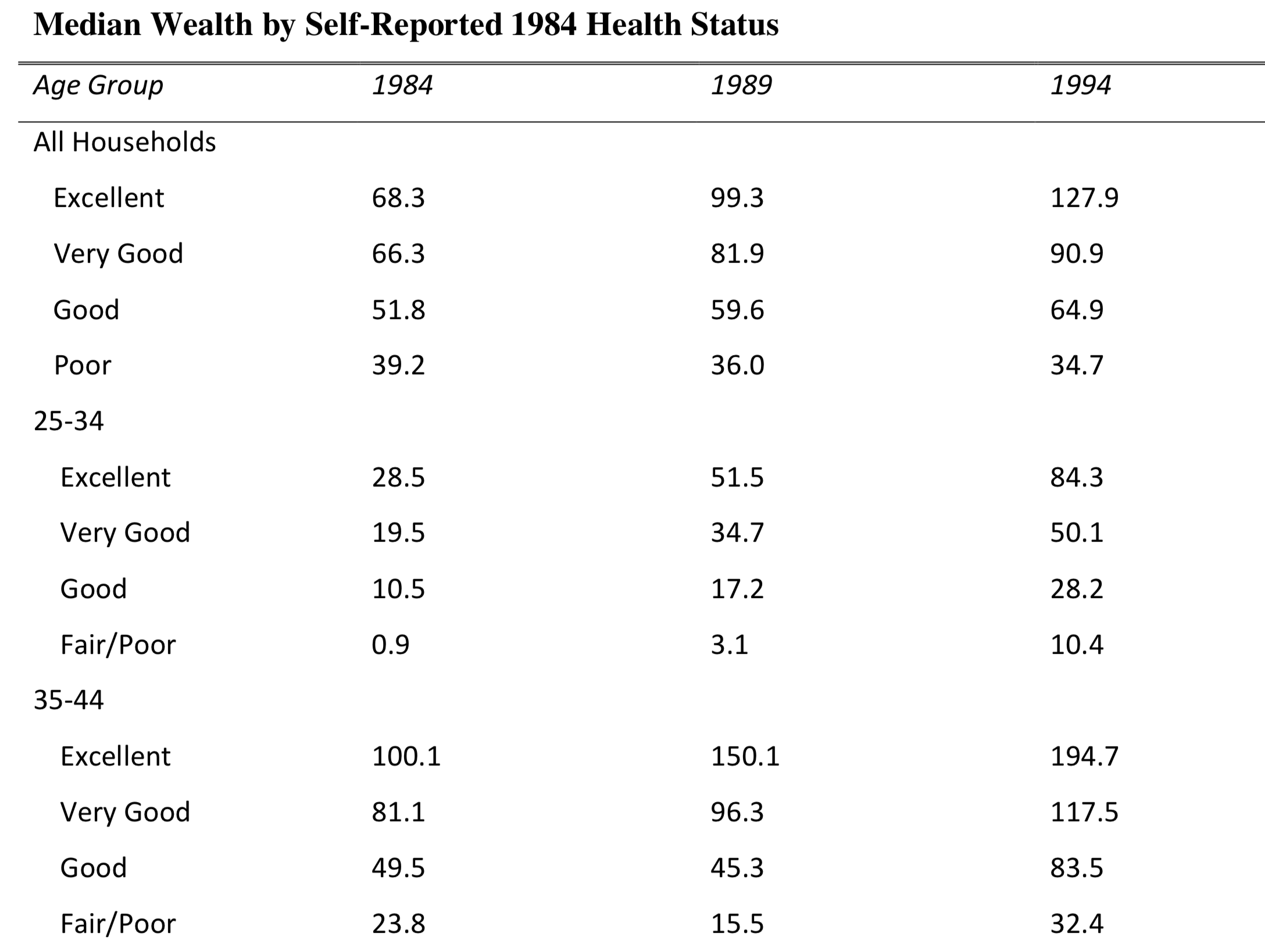

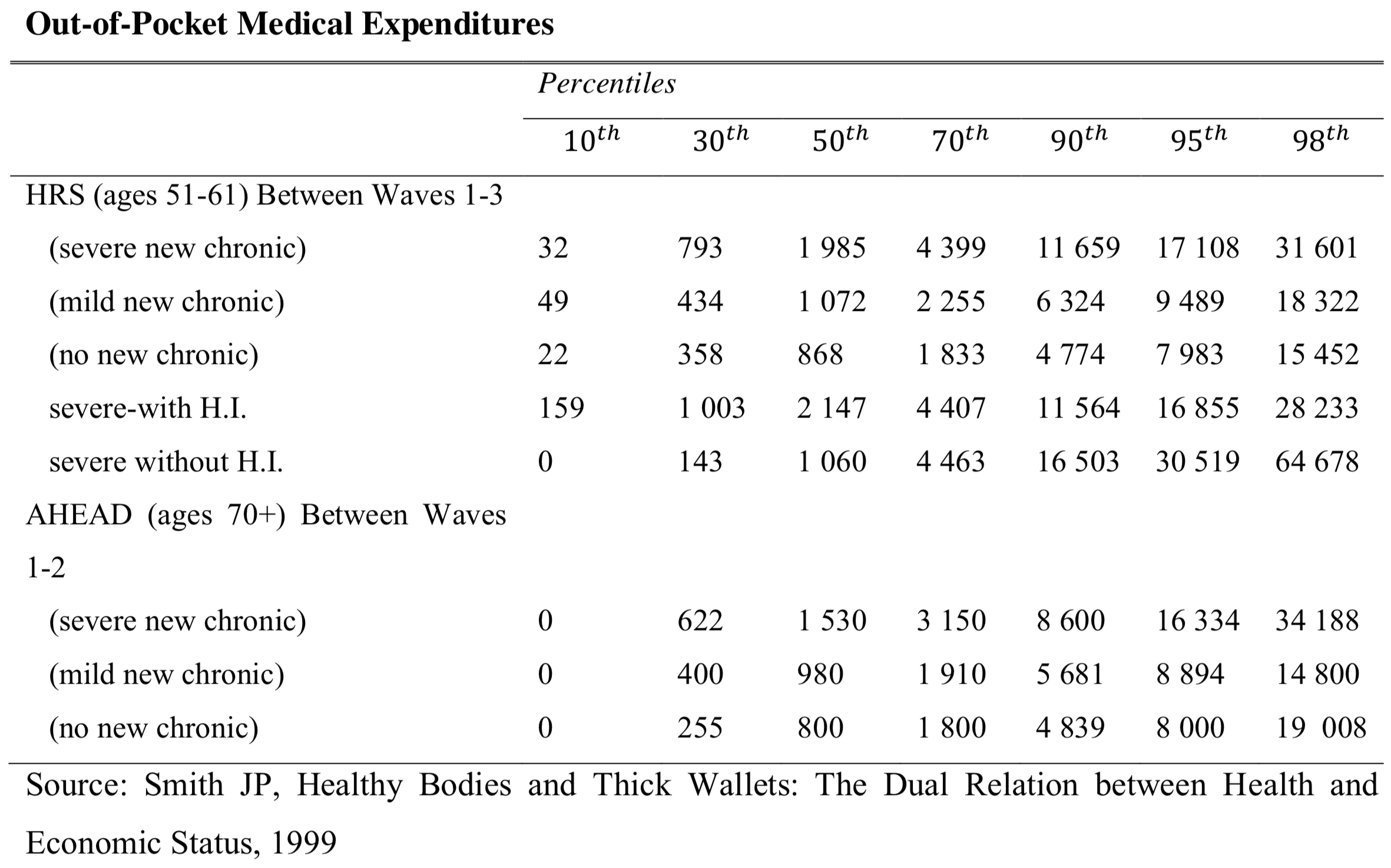

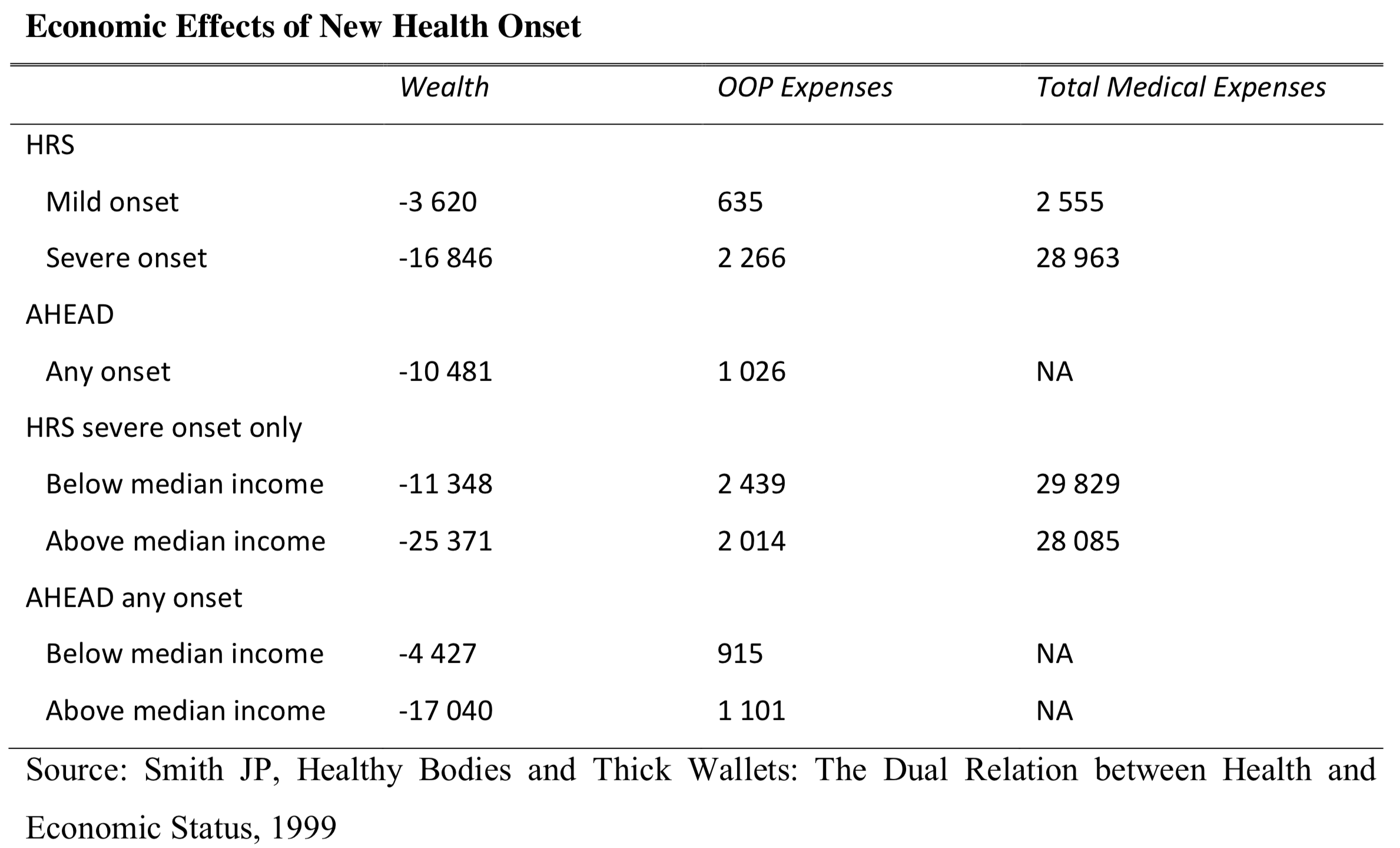

BUT- What would happen if the same positive and negative feedback loops happened in real life? With the “winners” acquiring ever more because they had the assets first- concentrating their wealth, and enjoying privileged access to the best education, medical, and other services.

This brings us to the topic of the blog, is BTC the vaccine for COVID? What if I told you COVID narrative is just political cover for a coming economic disaster. This is why the government wants control of the education system to keep us financially illiterate.

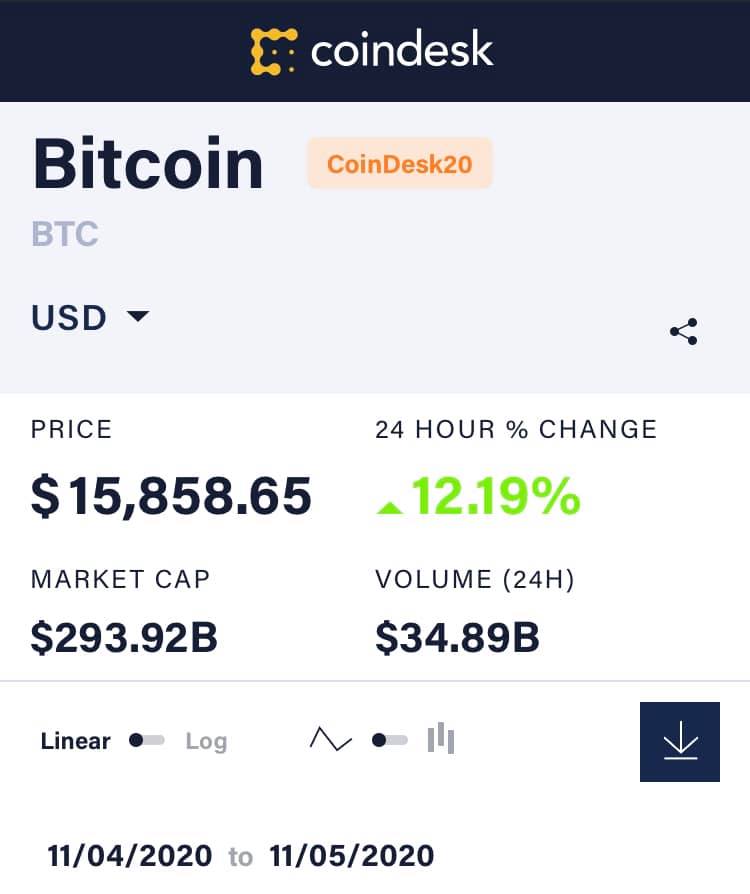

Timing is of the essence right now with BTC to help yourself before you are drowning. What is the time to get into BTC? You want to have a colonial position before all the network effects I mentioned to you above occur fully. Right now three things are the wind in the sails of BTC timing. Politics, COVID 19, and the coming economic storm. Right now most of the public and investing world are sleeping on the enterprise value of BTC as a a new currency as these macro effects are occurring in our lives. Are consumers ready for a currency that holds its value while jobs are lost to technology platforms? No, I don’t believe they understand its real value because the events of economic destruction are not obvious to 99% of the public yet. Does our current money system allow us to be prepared for what is the collateral effects? No, it was built for another world and different form of government.

The exact same playbook is now occurring to the US Federal reserve. I want you to think of the US Fed as Blockbuster in this example. It has been the only money game in town since WW2 because of the Bretton Woods agreement I mentioned earlier in this series. The American government feels omnipotent when it comes to its currency, because in 1971, its own president decided to break the agreement unilaterally and move our currency off the gold standard. Nixon did this to stimulate the economy to get him a second term in 1972. That single action actually exploded into the financial crisis of 2008 under the regimes of Bush and Obama.

The key to their success is their business plan and the algorithms they use to remain stealth. New companies are always underestimates the older companies because the older companies have spent decades at perfecting their own blue print to gain market share. They develop a business myopia. Sometimes, the old companies know what the deal is but their business model does not offer them the ability to compete as the market shifts. This is how Blockbuster lost out to Netflix over night when I was a resident in the late 1990s

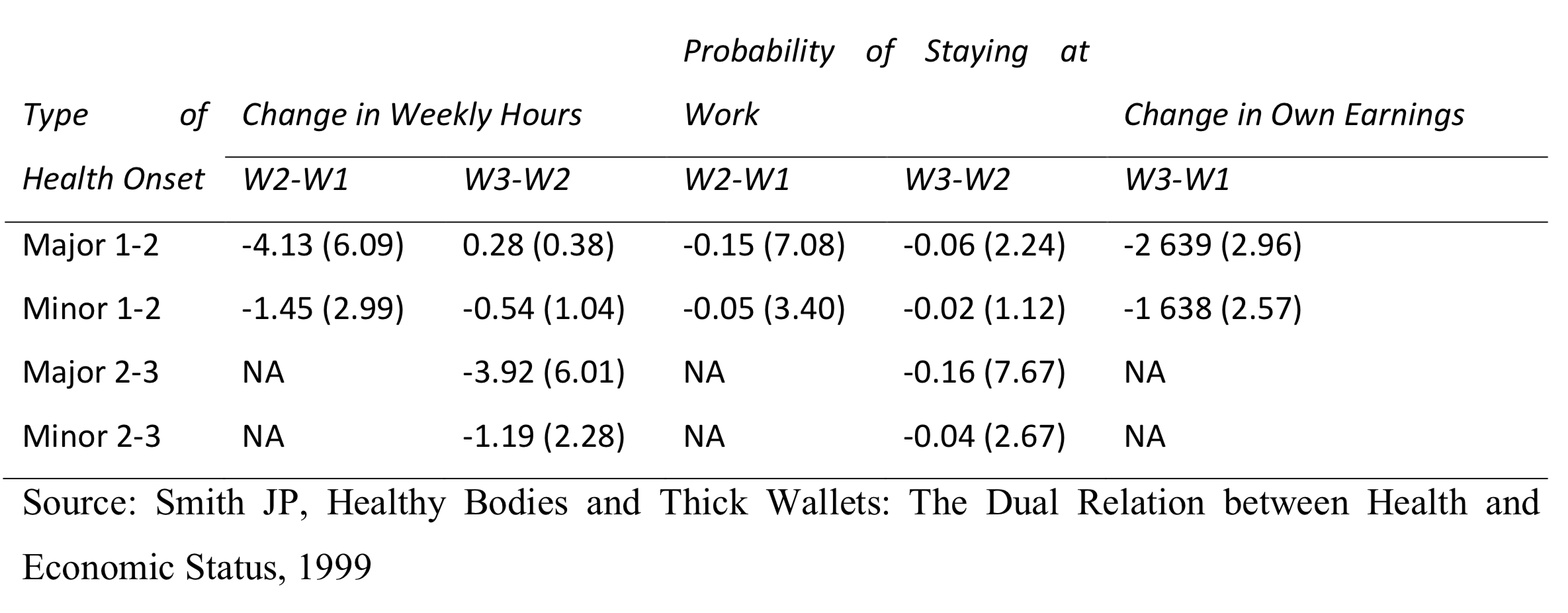

Nixon’s decision was fueled by economists who convinced him that easy credit and debt would help stimulate a faltering economy that occurred during the late 60s and early 1970s when food and gas prices spiked very quickly. This threatened his re-election. In an interconnected economy driven by credit and debt there are some longer range macroeconomic pitfalls. In 2008, Bush and Obama had to decide what was more important, banks or the people? They both chose to bail the banks out. When you bail out the banks and risk takers in this economic model the collateral effect is that you create a moral hazard by eliminating trust from the public. All paper money is a trust agreement between its people and its government. Since 2008, that trust is worse because it has created the greatest wealth disparitiy the US has ever faced. This includes the era of the “robber barons” of Rockefeller, Carnegie, and JP Morgan that Teddy Roosevelt broke up in his presidency. The reason the two leaders chose banks over the public was because if they did not act this way, they risked a world wide depression that likely would have dwarfed the 1929 Great Depression. This is why they did what they did. Why do I rehash it for you here? Because it sets the stage for optimal timing now with respect to BTC and when you should buy it.

When someone asks me the Question now: “Should I buy BITCOIN now?

My answer is now: “Is it under $100k per coin?” – If so, the answer is yes you should be a buyer. If it is not you need to do more homework because the network effects mentioned above are likely taken effect.

Negative interest rates is a death sentence for all macroeconomic trends and it will destroy the economy quickly because it is the thing that will cause central bank death quickly. Why? You will have to pay the bank money to keep your money in the bank and banks will struggle to find dollars in this situation. Study the slide below to understand these implications.

The quick death of prolonged negative interest rates will allow new ideas to take over even faster than anyone imagines. The printing of money is a sign the patient is critically ill and we all need to become prepared for the inevitable at some time. This gives us time to make ready how we will respond. It also gives new technology companies and public entrepreneurs the time to create a new options to run an economic system. That is what BTC fundamentally is for us all. The US Federal reserve has no idea this is what it is but CEOs of at least 16 companies now see the handwriting on the wall. All of their corporate money is now being stored in Bitcoin. The charge is being lead by Micheal Saylor the CEO of Microstrategy. I believe that when macroecononmics dies a slow or fast death, equities, countries, and people who put BTC in their treasuries into BTC will be able to force the US Federal Reserve to use Bitcoin as its new currency to avoid a revolutionary war.

It took Bitcoin 12 years to build an impenetrable store of value and in this scenario the Federal Researve will have no time to build their own to control it because the economic storm the lockdowns of COVID have caused cannot be solved with old tools. Moreover, no one will ever trust the Federal Reserve again after this event. I see the change will be lead by CEOs who had the foresight to see this tsunami coming. The US Fed and Gold market have no idea what to make of BTC. In this analogy, the US Federal Reserve is Blockbuster and they are staring at Netflix just shrugging it off. Do not let their mistake be your mistake. You might survive but you won’t thrive.

BTC is a lot like Facebook and Amazon in their early days. They bring immense value to the user via their platform. Network effects are at the core of what creates their value. The same is true for BTC. the issue is the network effects of BTC have not yet taken hold. Why do I think now is the time for BTC?

The financial crisis of 2007–2008 was a symptom to the Black Swan that the Central Banks all over the world had a viral illness. The doctors who should have regulated the system by treating the central banks as a dying breed put off the inevitable. The political choices made in 2008 have allowed central banks to hallow out the global economy and financial markets until someone figures out how to replace the system. This is what made the election of 2020 such a big deal in Washington DC. This should explain to you why 100% of Wall Street was supporting a Biden tocket and not a Trump victory. Biden has promised them a Treasury secretary that allow them to continue to print money until they can solve the problem they created. Do you trust them to get it right for you or your family?

The government knows a financial reset is coming (cite one) and both sides of the aisle want a say in what the new system will look like. Trump’s idea was outside of the mainstream of both parties. He offered a different view point that mimic what Henry Wallace offered the American public as FDR longtime VP. In 1944 the DNC decided they could not afford Wallace’s view point to take over the democratic party. That is why he was removed politically in 1944 in 9 minutes while party bosses gave the nod for Vice President to worthless politician named Henry Truman. They knew FDR was dying of polio and wanted to make sure they had a yes man in charge to control the terms of the end of WW2. This is where Bretton Woods came from. My recent Farm members have been taught how he came to power during their visits with old videos I have found to explain how he came to power. Truman was the banker’s choice of Wall Street just as Biden is today. Like FDR, Biden brain health is not good. This is why a progessive leftist was installed as his VP. She will push hard for huge wealth distribution and the banks won’t get blamed but Kamala will. Biden was selected because he could be controlled by the real power brokers in the US. The industrial military complex. The same game plan that was in operation with FDR and Wallace is going on today in my opinion with regards to the recent election.

For starters, in the older macro economic models created by every president of the Federal Reserve since the Nixon administration, the US economy can ONLY grow with constant monetary support. This is why Nixon got rid of the gold standard in 1971 when it no longer suited his purposes of reelection.

TIMING MATTERS IN BIOLOGY AND IN POLITICS

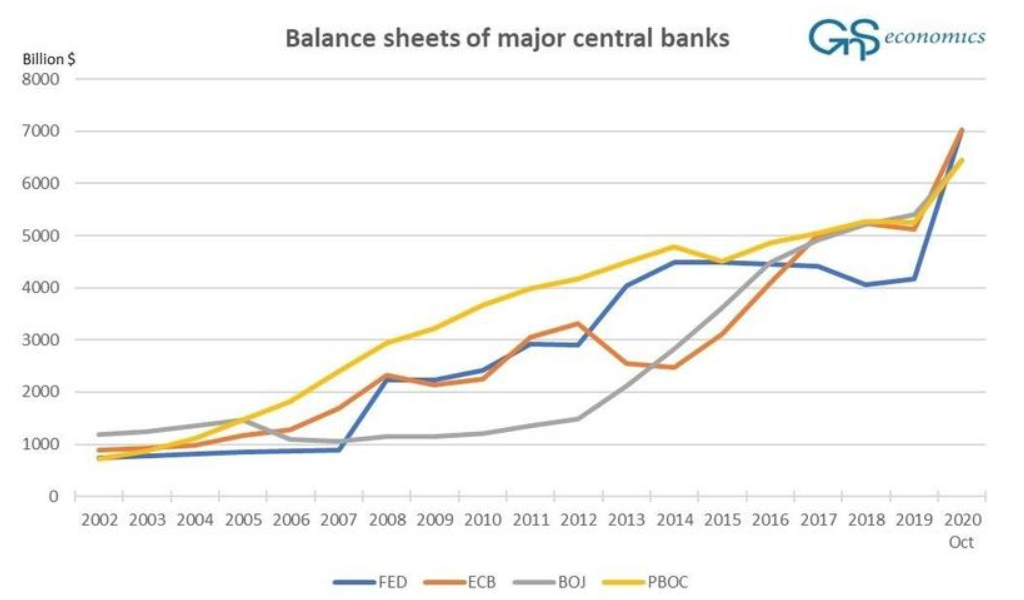

The global central bank crisis started at the turn of the year from 2018 to 2019. It was clear to any economic doctor (bank Regulator) that the patient was terminal when one looked at their balance sheets.

When I looked at these charts in 2019, I understood what C19, the “Chinese flu” real purpose might be. It is all a dog and pony show to hide the real truth. Our government has been stealing value from us for decades and has no out card to get out of the mess without us finding out about it. Then I realized immediately that with a devaluation, any asset with value had to be removed into something that had value the central bank could not touch. The pandemic current events of 2019 was going decrease the slope of the line FOR TIMING of the “great reset” so that it would happen faster than anyone thought. It was going to give bankers political cover to blow up a dying economic system using a made up pandemic.

Right now there’s no institution on earth that I despise more than the World Economic Forum. I don’t trust a word they say! If the Illuminati really exists, they are it. Opt out. Unbank yourself and buy BTC before it gets to its network effects. The Chinese flu was designed to bring politcal and economic change faster than the American public can stomach it without stimulating a revolutionary war. They want to hide their banking blunders in the facade of a global plandemic built by a a faulty PCR test to create a casedemic.

How do you appease the public when you are robbing them blind since 1971? With cheap money. The Fed has provided massive stimulative monetary policies since 2008 to avoid civil unrest. This was done by the quantitative easing algorithms the Fed put in place since the global banking crisis of 2008. Just as a dying trauma patient needs a constant source of blood while it bleeds on the operating table, the US economy has an incessant need to chronic currency stimulation to remain alive. This operation has been going on globally since 2008 way below your ability to perceive it. That was by design so we did not take up arms and remove the government ourselves. The latter led to ballooning balance sheets among major central banks as the picture above shows. This is not my opinion. This is what the data the banks have shown us. The problem is few people a financial literate to know what is really going on, so this gave them the chance to fool us with a planned event. This also explains why they want our guns so badly. They hope you have no tools to decipher what is really going on. This is why the political events around C19 make no scientific sense to anyone who can think.

This technique is working for them. No one seems to see their game plan yet. But they are no longer hiding it as you can see here. You need to see it clearly now. The coronavirus pandemic is fuel to the fire that will lead to much more rapid change economically. A Biden presidency makes the adoption of BTC as a new option much more rapidly than any of the central bankers anticipates. Moreover, when the public sees generational value destroyed in weeks to months civil unrest will dominate. A revolutionary war between us citizens and its government is a distinct possibility in the next 5 years. That is why COVID was created to block people from the real truth.

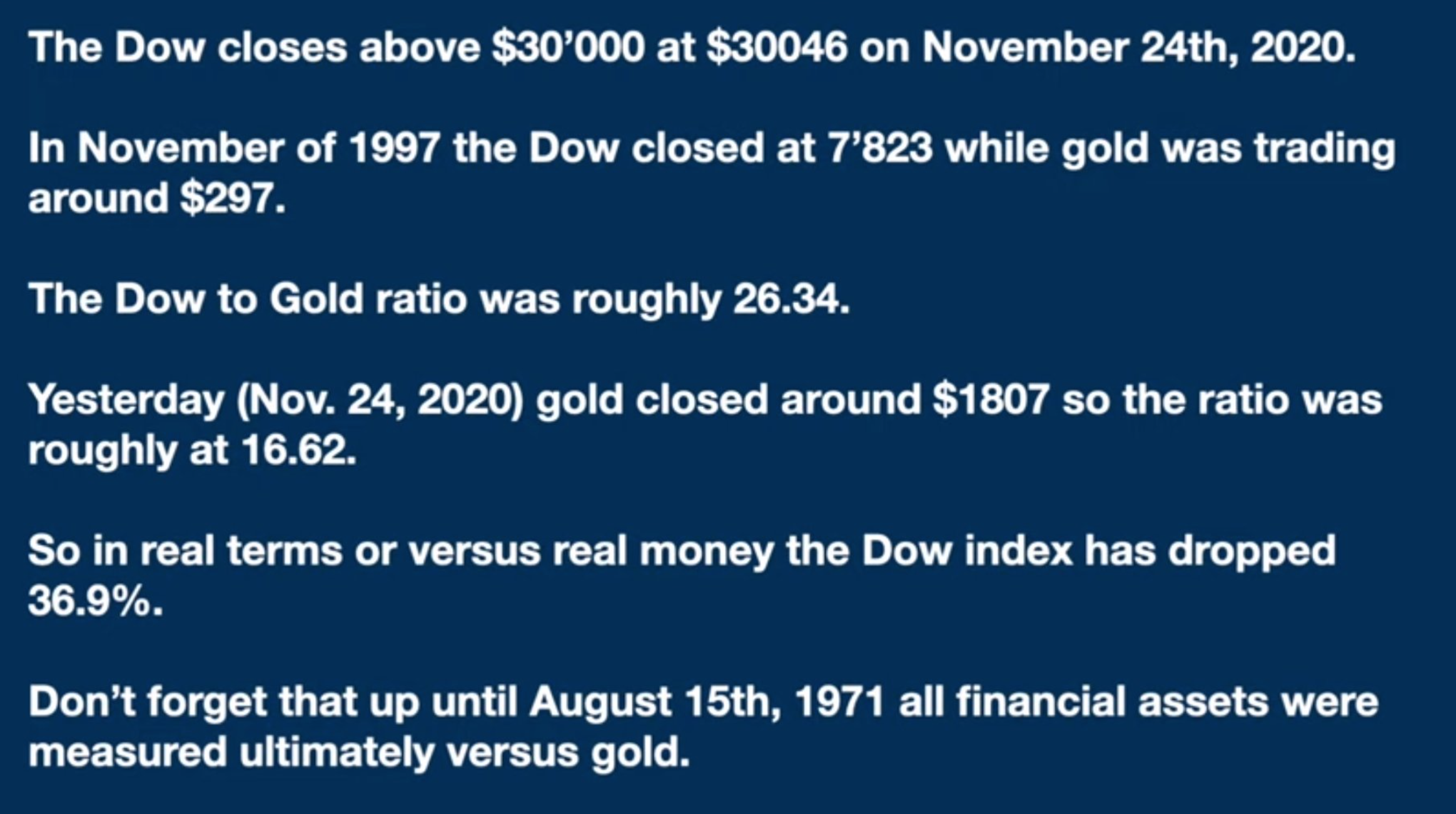

The economy is imploding and the patient is now actively dying in front of us. This pandemic is a huge signal for the Black Swan to pay attention too. It has turned many of our coming economic events into obvious forecastable significant events against the public. Now, it’s only the question of where to look to go to understand what the new world order is all about. It is about protecting your tribe for the economic tsunami headed our way. To see how much value has already been taken from us examine the next slide for some simple math that compares the Dow Jones Index from 1997 and 2020. You’ll notice it appears many people have made money with this Index………..but is it all an illusion? The illusion was done because few people understand how to calculate value over time using the proper comparisons. Let us go back to the gold standard that Nixon took away from us in 1971 as our benchmark.

Wall Street and the public think we have had an epic run of equity profits, but when you break it down you see that we’ve lost almost 40% of our value because our currency has been devalued.

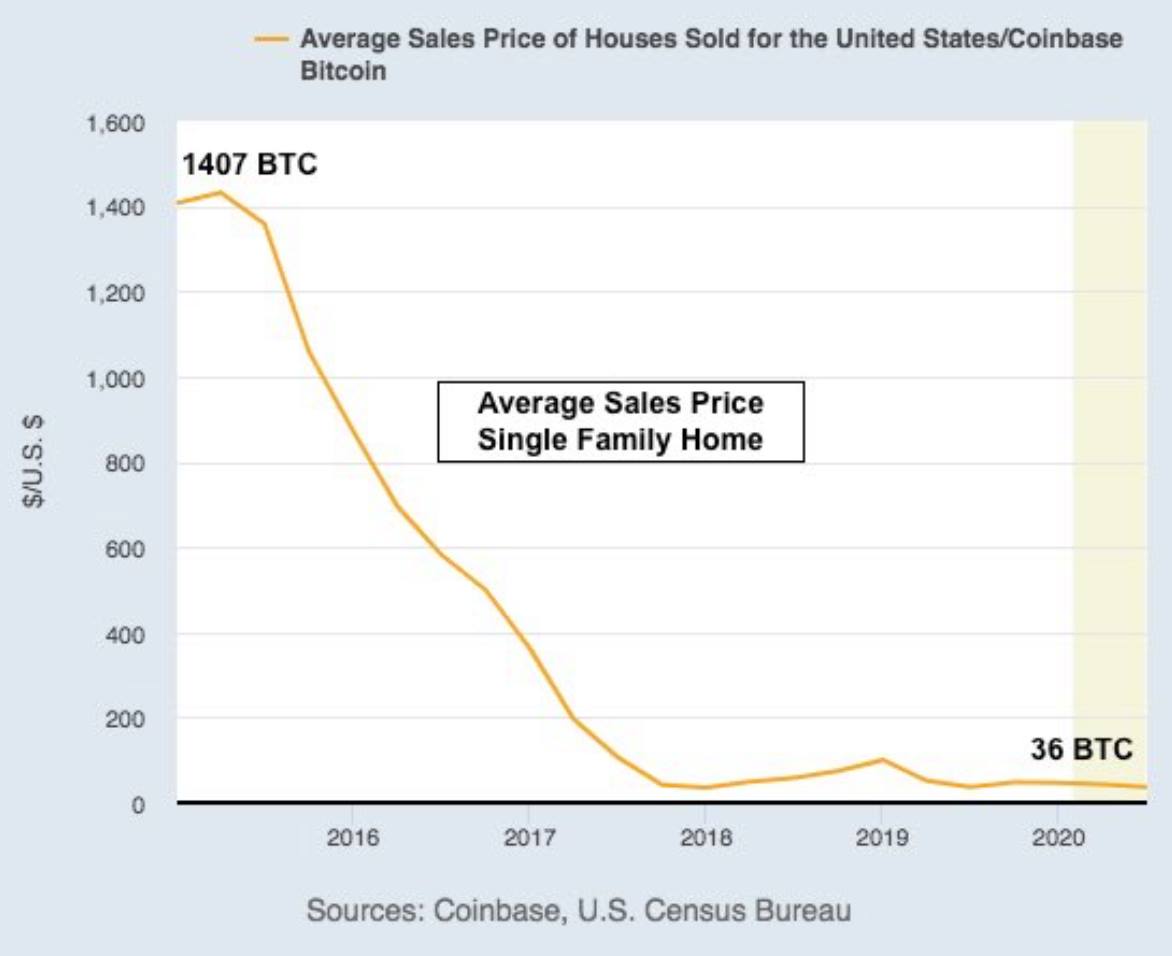

If you do not like this example how about we use your house as an example and not gold.

Housing prices have collapsed by nearly 98% as the graph below shows. The average price of a US single-family home fell from 1407 BTC in 2015 to 36 BTC today. Current market conditions point to an additional 10 times drop in price.

SAT analogy time: If “Bitcoin is too volatile.” then “Fire is too hot.” The Wisdom: Learn to use new technology like BTC real quick folks.

Now you can see that the price of your house matters little when you are buying and selling homes with money that is not worth what the government said it was. Still feel good about Washington DC?

The central bank-run economic governance model has reached the end of its lifespan my friends. We desperately need a more open and free economy and less intervention and continuous “rescues”. This path will not be easy, but the current end-point, global economic dystopia shrouded in a pandemic veil, courtesy of global central banks, is much worse.

First we humans put our communications, advertisements, inquiries, opinions, resumes, relationships, photos, music, and movies on the network. Now we are going to put our money on the network. It sounds bizarre until you understand the reason why it must happen. That is the story of this blog. If you missed Microsoft, Apple, Amazon, Google and Facebook, you might want to catch Bitcoin. I believe its market cap will be higher than all of them combined shortly.

More than anything, we need true political leadership—the statesmanship, courage, and wisdom to see through the scare-mongering and distorted economic information. We need a politician like henry Wallace who will stand up for the common man and do what is right and not what is easy. We must confront dominant elitist economic shibboleths relentlessly to move past what is first and foremost an intellectual dead-end. Sadly, I don’t see that politician on the horizon who can do this, so you need a life raft until that person emerges. That life raft is BTC. It is now your job to inflate your raft by buying the raft yourself. The money you put into BTC will be the air in that life raft. The more you add the better your ride into this uncertain future will be so you can create an optimal environment for your biologic problems. Read the paper below to understand why you action at this moment is critical to your future success

Many people thought the radio wouldn’t be important. Many people thought the TV wouldn’t be important. Many people thought the internet wouldn’t be important recently.

All were wrong, as we all found out.

Many people think Bitcoin won’t be important. Do not be like them. Use your critical thinking skills to win at life. It is and always be about the survival of the wisest from here on out. Drop me a comment below. I am interested to hear your thoughts about this topic.

CITES: