Red, itchy eczema patches may look contagious, but they’re not. Eczema is basically an altered immunologic disease in the skin that starts out as an itch that turns into a red rash. The itch of eczema can be hard for others to understand. Patients with this disorder say it can feel like poison ivy, chickenpox, and a sunburn rolled into one skin condition.

The skin can also get rough and scaly, with sores that ooze and crust over. To manage the symptoms, some alternate between taking Epsom salt baths and showers. That is what most physicians tell their patients because that is what is taught in medical school. Those answers do nothing to get rid of the disease. They only treat the symptoms on a short term basis.

The answer to reversing the disease is getting solar exposure more frequently to properly program the T cells in your skin to raise the melatonin levels in your skin. No one learned this in medical school.

Reality alert = Is eczema an allergy to nnEMF or blue light toxicity?

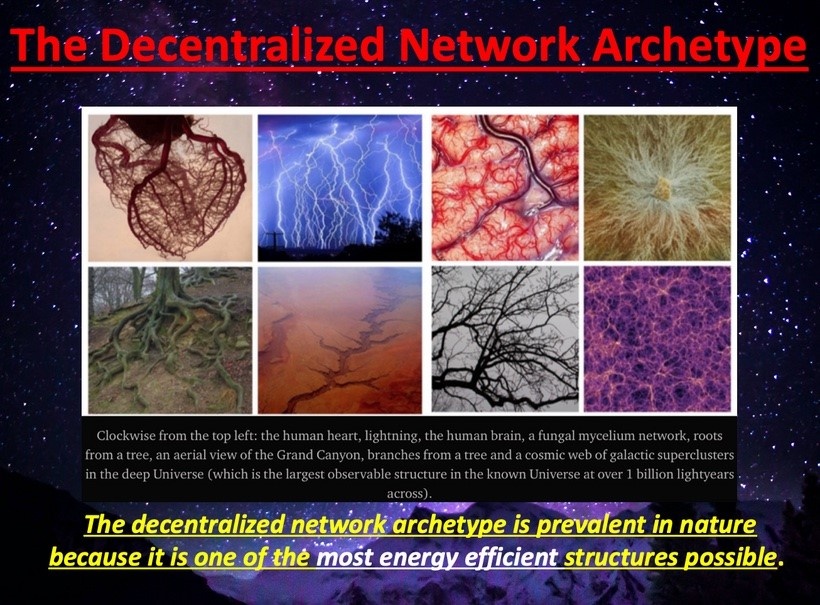

It might be. Read the below carefully. Is sunlight a wireless vaccine that can help this condition? It might be. Sunlight has so many benefits I might have written volumes about its effect. There are so many hidden benefits people don’t just get because people are taught these days to bury the sun by my profession. This is an example of how a centralized curriculum in medical school is really an analogue algorithm of a by gone era.

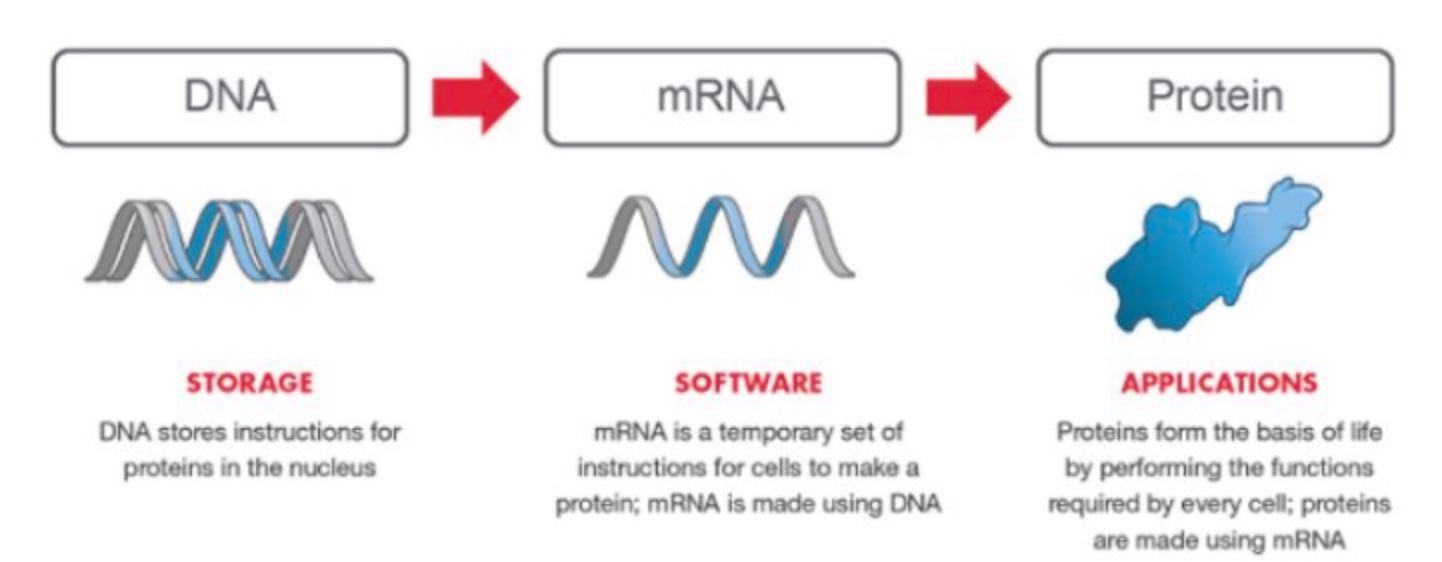

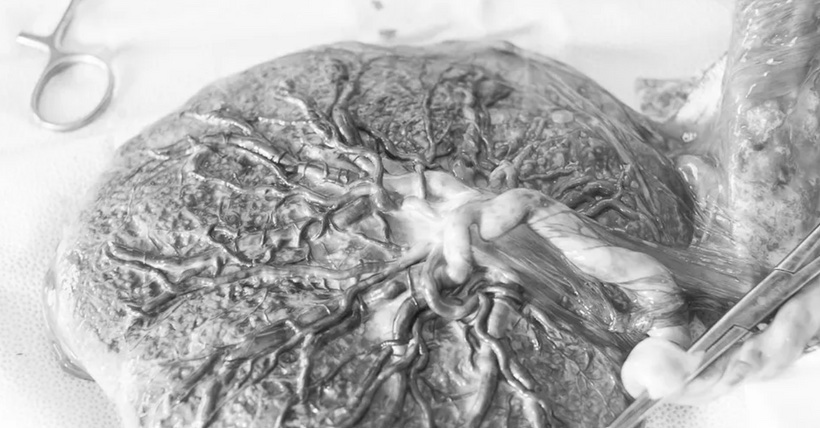

We, like trees, need physiologic solar exposure. For me, I use it to reduce my overall nnEMF/blue exposure I get in surgery and in my life; in addition, it has massive effects on dopamine, serotonin, histamine, melatonin, sulfation, methylation, and Vitamin D3, gut biome populations, charging my exclusion zones up by raising my DC electric current to lower the work my mitochondria needs to do. No area is difficult to get sun on if you just expose your skin to the problem region. The results of that “wireless vaccine” of light might shock you!!! That is why eczema remains a large problem today. People cover up far too much. If you child has eczema it maybe that pre-pregnancy and during pregnancy your body did not get enough sun and this altered your T cell cells in your skin. We have more T cells in our skin than in any other organ. When this occurs this information can be epigenetically transferred to your child via mRNA signaling to change the childs’ skin physiology. This condition might be a baseline acute immune reaction of a de-programming of T-regulator and helper cells from a lack of sunlight!!!!!

STATIC SHOCKS AND ECZEMA

Most people are familiar with electrostatic forces that are weak. Examples of weak electrostatic force is when humans rub a balloon and the hair on their body stand up on ends or what that some materials, such as amber, attract lightweight particles after rubbing.

Usually insulators, e.g., substances that do not conduct electricity, are good at both generating, and holding, a surface charge. Some examples of these substances are rubber, plastic, glass, and pith. Conductive objects only rarely generate charge imbalance except, for example, when a metal surface is impacted by solid or liquid nonconductors. The charge that is transferred during contact electrification is stored on the surface of each object.

Skin is actually a very good insulator as well so, relative to metal, humans aren’t very good conductors. Because the skin is a good insulator it means Nature engineered it to hold electric charges from sunlight for some reason. What might those reasons be?

Sunlight create electric fields in our atmosphere every day and that sunlight creates a Coulomb force. Coulomb force is an electrostatic force. Electrostatic phenomena arise from the forces that electric charges exert on each other. Such forces are described by Coulomb’s law. Even though electrostatically induced forces seem to be rather weak because of how we experience them in life, when the scale shrinks, as it does in a cell, the electrostatic force increases tremendously in its power. For example, some electrostatic forces such as the one between an electron and a proton, that together make up a hydrogen atom, is about 36 orders of magnitude stronger than the gravitational force acting between them. The electrostatic force generated in your skin is another example of a strong electrostatic force because the skin, as an insulator can hold large amounts of charge.

People are unaware that this force involved with the biology of melatonin and the function of mitochondria where electrons and protons are the target of this force because they are charged particles. The same thing is true of T-Regulator cells in the skin.

Although charge exchange happens whenever any two surfaces contact and separate, the effects of charge exchange are usually only noticed when at least one of the surfaces has a high resistance to electrical flow. An alteration in the electrical charge in your skin is one of the major reasons why many people cannot convert cholesterol containing semiconductors in their skin to 25-D-OH Vitamin D. Tattoos also alter the charge state of the skin because of the atoms in the ink.

This is because the charges that transfer are trapped there for a time long enough for their effects to be observed. These charges then remain on the object until they either bleed off to ground or are quickly neutralized by a discharge: e.g., the familiar phenomenon of a static “shock” is caused by the neutralization of charge built up in the body from contact with insulated surfaces. With melatonin, T Cell functioning, and skin physiology the charge are rarely seen because charges are transferred to electrons and protons in the chemicals of cells.

Coulomb force, also called electrostatic force or Coulomb interaction, is the attraction or repulsion of particles or objects because of their electric charge. When people get skin outbreaks the charge within the epidermis is a manifestation of charge discharge in the skin. This is analogous to the static discharge mentioned above. The redden plaque is the manifestation of a charge transfer problem in the skin. When electrostatic force cannot be discharged properly it can effect Gauss law in our body. Gauss’ law states that “the total electric flux through any closed surface in free space of any shape drawn in an electric field is proportional to the total electric charge enclosed by the surface. Since a mitochondria is a close organelle that contains massive amounts of electrons and protons at a small scale any altered discharge of an electrostatic field causes a change in Gauss’s law with respect to the mitochondria. What is this a big deal?

Mitochondria make water, CO2, and melatonin. Melatonin, doc? Yep. We now have very new data that shows that mitochondria make the chemical that regulates its ability to transform energy in tissues locally.

This recent paper describes this finding. We now know mitochondria synthesize and release melatonin. This occurs via their selective G protein-coupled receptor (GPCR) in the outer membrane of the mitochondria. The paper demonstrated that mitochondrial melatonin type 1 receptors respond to melatonin by activating circadian coupled G proteins located in the intermembrane mitochondrial space. These proteins, once powered up by the redox potential created in the power plant than become able to inhibit stress-mediated cytochrome c release. Cytochrome C controls water production in the mitochondrial matrix from metabolism and it control autophagy and apoptosis programs in mitochondria which link it to redox power. Nature’s use of this unique wiring mechanism gives mitochondrial educators insight to how we need to changes our thinking about how humans operate. The classical understanding of biological GPCR function, taught in a centralized medical curriculum is OUTDATED badly. This has huge implications for how we should be treating diseases. The new data is telegraphing us that the powerplant of a cell has the ability to synthesize and act as a signaling receptor for a specific ligand. This ligand is likely tied to the circadian mechanism of the peripheral clock genes present in tissues. This means the wiring diagram shows mitochondria come built in with a automitocrine signal which creates melatonin locally to prevent degeneration and disease by limiting the downstream effect of cyctochrome C release on caspase activation. Caspases are a family of protease enzymes playing essential roles in programmed cell death.

Why is this a big deal? We know that melatonin deficient tissues are more likely to develop cancers. We also know that caspase deficiency has been identified as a cause of tumour development. This paper now makes the link between these two concepts and explains why skin diseases are harbingers of future cancer risk.

Early mitochondrial damage shows up in people with Hay Fever & Asthma

People with loss of redox power in their immune systems tend to get mitochondrial diseases earlier in life. This is why there is a connection between those two conditions and rosacea and atopic dermatitis. If a parent has hay fever or asthma, their children are more likely to have the skin condition. And many children with atopic dermatitis will go on to get hay fever and/or asthma.

Most often the cause of these disorders are due to a change in the semiconductive properties of the skin and the reason is often tied to our light environment. When light hits a semiconductor a DC electric current result in tissue. We can measure with with surface electrodes and an oscilloscope. Electric charges cause electromagnetic force fields around them. This causes things to do the things they do = physiology of the tissue in question. When the semiconductor in the system is defected the phenotype of the disease manifests. That is what causes eczema plaques.

Phototherapy:

UV light affects the immune system. In some people, it can improve moderate to severe cases of eczema from atopic dermatitis, rosacea, or contact dermatitis. Usually, these treatments use UVB light. “PUVA” is a UV treatment combined with a drug called psoralen. I do not like the drug, so I replace it with photobiomodulation and this improves clinical efficiency in therapy. Skin docs use UV light in an artificial manner by itself. UV is never present from sunlight without the other frequencies of visible light. This is why I balance the huge Coulomb force created by UV light with red light.

Coulomb forces must be balanced after daytime and this occurs at night when light is absent. This is why light at night is so bad for us, and why a centralized doc has no ability to figure out why this occurs. It is also why your dermatologist has no clue to the cause of eczema. You have to understand how Coulomb’s force becomes unbalanced to alter how mitochondria can transform energy. That break in the pathway is the charge on melatonin in the skin which affects the mitochondria in the skin to give a person eczema. Melatonin in mitochondria of tissues are created by the Coulomb forces in AM sunlight. Melatonin levels vary within tissues because of how much light tissues get. As a result, it appears melatonin is a guardian of the Mitochondrial genome (37 genes). Out of the 37 genes, 13 of them are specific to energy-transforming mitochondrial genes. Those 13 genes only code for the proteins that tunnel electrons and spit protons out of the mouth of cytochrome proteins. The mitochondrial genome undergoes 3 times as many genomic mutations as the nuclear genome by design. Melatonin levels are critical in monitoring mitochondrial behavior and light energy transformation by controlling how energy is being transformed from light to create physiologic power.

The major function that melatonin helps smooth-out in mitochondria are

Energy metabolism and flux via control of electron and proton tunneling.

Redox balance within the mitochondria = GSSH (glutathione)

Ion homeostasis = electrostatic controls via Coulomb forces that vary via light

The signaling of cell death and mitophagy = % heteroplasmy in a mitochondrion = the amount of melatonin your skin makes from its mitochondria = the amount of light energy transformed to physiologic power in the skins component semiconductors.

How Light Treats Acne

Acne forms in pores — the tiny holes in your skin. Each pore contains an oil-producing gland. The oil keeps your skin healthy.

But sometimes the oil, dirt, and dead skin cells can get trapped inside pores and clog them up. Bacteria called Propionibacterium acnes (P. acnes) that live on your skin can also get inside these blocked pores. P. acnes make the clogged pores swell up into bumps called acne.

One way to kill bacteria and clear up pimples is with light. The bacteria in your skin are sensitive to certain types of light. When you shine these lights on your skin, toxic substances form and kill the bacteria. Light therapy also shrinks the oil glands in your skin, so your skin makes less pore-clogging oil.

Doctors used to treat acne with ultraviolet (UV) light. The smart play is to use full spectrum sunlight to help acne or cystic acne because sunlight has red light in it that help resolve the inflammation in the follicles.

You may get special medicine before your treatment to make your skin more sensitive to the UV light. Doctors call these medicines “photosensitizers.” They include aminolevulinic acid (ALA) and methyl aminolevulinate (MAL). The smarter play is to use red light therapy to precondition the skin to absorb more UV light and you won’t need the drugs to deal with the acne.

This is why docs cannot solve many skin diseases, but sunlight can and does. A lack of sunlight or excessive blue or nnEMF causes many skin diseases.

CITES

1. https://www.eurekalert.org/pub_releases/2016-12/gumc-sos121616.php